7 reasons say no to Loan Sharks 🦈

What is a loan shark

Loan sharks are the ones who exercise illegal lending practices in our country. They are unlawful cash moneylenders that typically focus on urgent and poor people. They're known to draw and break you into a suspicion that all is well and good by being benevolent and supportive at first, offering you money related assistance when the banks would not acknowledge your application – because of poor credit rating or no ownership can be utilized as a guarantee. However, the cash that you get will come at an extremely high interest and payable in a brief time frame, also the danger of this plan.

So, how do loan sharks work and why you should not take a loan from loan sharks:

How loan sharks work?

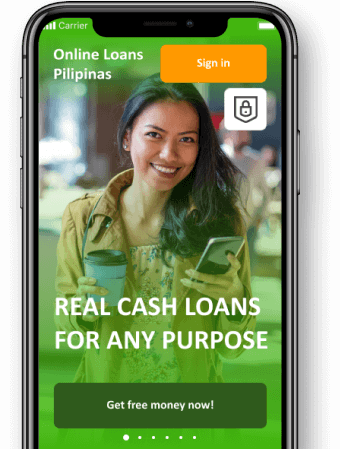

Extremely High-Interest Rate

Going after an individual's franticness, loan sharks’ rate is incredibly high that can go over 100%. Credits from them must be reimbursed in a brief span. Borrowers are normally pulled into the straightforwardness and effortlessness of the credit application process, and the way that they don't need to go to the advance sharks to make their everyday installments. The credit sharks utilize 'gatherers' who make day by day adjusts to gather the day by day reimbursement, and whether you have the cash to make the installment is another story.

ID or ATM card as Collateral

Or most famously known as "Sangla ATM". Since credit sharks don't require ownership as security, they will request your ID or ATM card. This unlawful cash loaning framework works by expecting borrowers to turn over their ATM cards and offer their PIN and other private financial balance data with a credit shark. Other advance sharks may take a borrower's identification, driver's permit, or any ID as security for the credit.

Sangla ATM is risky on the grounds that credit sharks could pull back higher sums than what they loan. It likewise opens the unfortunate casualty to wholesale fraud, unapproved exchanges, and other financial tricks on their ATM accounts.

Loan sharks do not require a background check

The majority of the advance sharks, or most regularly known as 5-6, they don't have to check your experience, yet they realize where to discover you. In contrast to, legitimate lenders, they will in general check the foundation of the borrower or even request contact references to tie down the qualification of the borrower to make the installment.

No Formal Loan Contracts

For loan sharks, this sort of plan is typically verbal, if not, just the moneylender has the reports of the exchange. A genuine loaning organization would give a printed copy or delicate duplicate of the agreement expressing every one of the terms and condition that has been settled upon.

No Record of Payments

Besides the absence of a composed credit understanding, advance sharks additionally don't give a record of their borrowers' reimbursements. This enables unlawful moneylenders to build the obligation since borrowers may not be monitoring the amount despite everything they owe.

Requires an Advance Fee

Most credit sharks will request an advance payment before they can discharge the guaranteed advance sum. Afterward, you can't get in touch with them any longer. What's more, you won't almost certainly track them, since they're not an enrolled organization.

Violence and Harassment

This is the most alarming part after you got the cash from private loan sharks. In the event that you can't most likely pay your obligation on schedule, they will irritate and undermine you, even your family, and most exceedingly terrible, they may hurt you. For this situation, they will weight you to pay, because of this, you will be compelled to get an advance from another organization or individual. What's more, those instances will bury you into a spiral of debts.

How to deal with loan sharks

Suppose you are truly needing a payday loan for business or emergency purposes and loan sharks are your best alternative right then and there. Here are tips on the best way to manage them:

- Attempt your best to reimburse them when you can. It is as yet your duty to pay what you owe and, in the meantime, spare you from their provocation and dangers.

- Know your rights as a customer as well as an individual – and ensure you let them realize that you know about such rights.

- Look for assistance from experts in the event that you or your family's prosperity is being influenced.

How to Avoid Loan Sharks in the Philippines

Since you realize how to find a loan shark, it's simpler to abstain from falling snare to any unlawful and damaging loaning plan. Remember these tips when acquiring cash to abstain from managing an advance shark:

- Quit executing with a lender that hints at being a loan shark.

- Be careful with loan specialists who connect with you. Informal lenders regularly utilize open records to get the contact subtleties of their potential exploited people. On the off chance that you get an email or instant message you a strange credit, simply disregard it. Authentic moneylenders don't do that.

- Check if the lender is authorized. Utilize the Securities and Exchange Commission (SEC) site to check if the moneylender is approved to work in the Philippines.

- Investigate different approaches to obtain cash. In case you're declined for a personal loan from a bank or government office, attempt other authorized private moneylenders who may consider favoring you for a loan regardless of whether you have a low financial assessment or low salary.

Given these facts, would you still consider patronizing illegal lending practices? We hope not. Nowadays, there’s always a way to come up in getting extra money or stick to old man’s saying, “Spend your money wisely”.

Loan sharks’ penalties could be distortion, prevarication, and infringement of the Lending Company Regulation Act. As per the SEC, no loaning organization will direct business except if it has an expert to work. The expert is conceded by the SEC.

If there are bound cases that we tend to can’t avoid borrowing cash, perpetually opt for the legit ones. The path of least resistance dependably accompanies an outcome. In some cases, it is smarter to get past the repetitive individual credits application process and be guaranteed not to stray into the red devices. Advance sharks, 5-6, or Sangla-ATM are unreasonable and hazardous alternatives that will not improve your line of credit or credit history in the future.

Personal loans are not only a practical choice for getting out of debts. These financial tools could also help you manage your finances for as long as you apply from legitimate lenders.

These days, in time of modernity, Online lending companies are the most widely used way to borrow money. It is a more convenient yet safe way rather than borrowing money to loan sharks, or visits office or banks. In times of necessity, Online Loan Pilipinas is ready to help without a risk. You can always login into our website or download our app to apply for a loan. You are just a few clicks away to get extra cash.