Best Loans Options: Financial Freedom

- Understanding the Best Loans

- Key Features of Best Loans

- Benefits of Choosing the Best Loans

- How to Qualify for the Best Loans

- Comparing Different Loan Options

- Steps to Apply for the Best Loans

- Common Pitfalls to Avoid

- Finding the Right Lender for Your Financial Goals

- Tips for Applying Successfully

- Benefits and Drawbacks of Personal Loans

Finding the right personal loans with a suitable tenure, appropriate loan amount, and favorable loan terms can be overwhelming.

It's true that choosing the best loans for one’s specific needs is crucial to financial growth and stability. With a plethora of options available, individuals must align their choices with their unique financial goals, including considering the convenience of autopay features and appropriate loan amounts. So, whether it’s for home improvement, business expansion, or personal endeavors, securing the right personal loans is a step toward unlocking potential and achieving dreams.

Understanding the Best Loans

Navigating personal loans, especially for debt consolidation, requires informed decisions on APR, loan terms, autopay options, and loan amounts. With numerous loan amount options available, understanding APR is crucial. From home loans for aspiring homeowners to business loans for entrepreneurs, each loan type serves specific purposes.

For those aiming to realize their dreams, personal loans with fast funding can be transformative. By evaluating loan terms and conditions, individuals can find options that align with their goals.

Securing the best personal loan amount requires knowledge, foresight, and strategic planning. Exploring diverse financial products confidently can unlock new opportunities, bringing individuals closer to their aspirations and a secure financial future.

Key Features of Best Loans

Best loans provide flexible terms, competitive interest rates, and borrower-friendly repayment options. These features, including competitive APR, cater to diverse financial goals, enabling individuals and businesses to achieve their dreams.

To ensure these benefits, the best loans often include transparent fee structures, lower APR, and accessibility to additional financial resources. This combination empowers borrowers to make confident decisions with a clear understanding of their financial commitments, including the specific loan amount they are comfortable with.

Keywords like “low-interest” and “easy-to-approve” loans become synonymous with the 'best loans'.

Flexible Repayment Terms

Flexible repayment terms, especially when combined with autopay options, offer borrowers the freedom to manage their financial obligations without undue stress. These terms often vary, accommodating different financial situations and making repayments more manageable.

Many lenders provide options such as "payment holidays" and "grace periods." This ensures that in times of financial strain, borrowers have the necessary support to stay afloat without penalty.

Flexible repayment terms reduce financial strain and promote long-term financial well-being.

Customized payment plans: Borrowers can tailor their loan repayment schedules to fit their income cycles and financial responsibilities, ensuring a balanced approach to managing debt and other expenses effectively. This fosters confidence.

Low-Interest Rates

Low interest rates and a competitive APR lower monthly payments, making loan amount repayment easier and more affordable for borrowers.

Such rates offer significant advantages to a borrower's financial health, ensuring that more of their hard-earned money stays in their pockets, especially when dealing with substantial loan amounts. Reduced interest payments free up funds for other essential expenses, allowing borrowers to enhance their financial stability and achieve their goals more swiftly.

Moreover, low-interest loans can lead to substantial savings over time. By minimizing the amount paid in interest, they allow individuals to expedite their journey toward financial independence and prosperity.

Ultimately, opting for low-interest personal loans with a competitive APR can provide considerable financial relief and long-term benefits. They not only lighten the immediate financial burden but also contribute to the overall economic well-being of borrowers, fostering a sense of financial empowerment and confidence in achieving their financial aspirations.

Benefits of Choosing the Best Loans

Opting for the best loans fosters financial empowerment, a catalyst for achieving personal milestones. Thoughtfully selected loans with favorable terms can significantly enhance a borrower's financial stability, enabling them to allocate resources more efficiently and accomplish their aspirations, fostering a solid foundation for long-term success.

Financial Freedom

Attaining financial freedom is within everyone's reach with the best loans available.

By selecting the best personal loans, individuals can carve out a path to financial stability and independence. These loans offer favorable terms, low-interest rates, and flexible repayment options designed to meet diverse needs.

Whether it's for consolidating debt, funding education, or becoming a homeowner, the best loans provide a gateway to achieving one's financial dreams. The right loan facilitates the freedom to invest in personal growth and long-term goals, providing peace of mind.

Moreover, financial freedom through best loans enables more strategic financial planning. It ensures that individuals can save more, invest wisely, and create opportunities for financial growth, laying the groundwork for a prosperous future.

By focusing on the best loans, people can transform their financial landscape, driving them closer to their ultimate aspirations.

Improved Credit Score

To improve one’s credit score, optimizing loan repayment terms can be highly effective.

Selecting the best loans based on one's financial situation can enhance credit profiles. Timely payments demonstrate financial reliability, improving credit scores and unlocking better loan options, creating a cycle of financial improvement.

Choosing loan amount with favorable interest rates reduces financial strain, allowing more money to pay off the principal and efficiently reducing overall debt. Such prudent decisions positively impact credit history.

Strategic selection and disciplined repayment are key. Utilizing loans tailored to specific needs ensures manageable commitments, fostering a robust financial future. Improved credit scores open doors to greater opportunities, supporting significant life goals and long-term financial well-being.

How to Qualify for the Best Loans

Qualifying for the best loans requires strategic planning, a good credit score, and thorough preparation.

Applicants should ensure their credit history is clean and accurate, and they should make timely payments on all financial obligations to demonstrate fiscal responsibility. Additionally, having a stable income will bolster their chances of approval.

Remember, “clean” and “stable” are the key attributes lenders look for in the 'ideal borrower'.

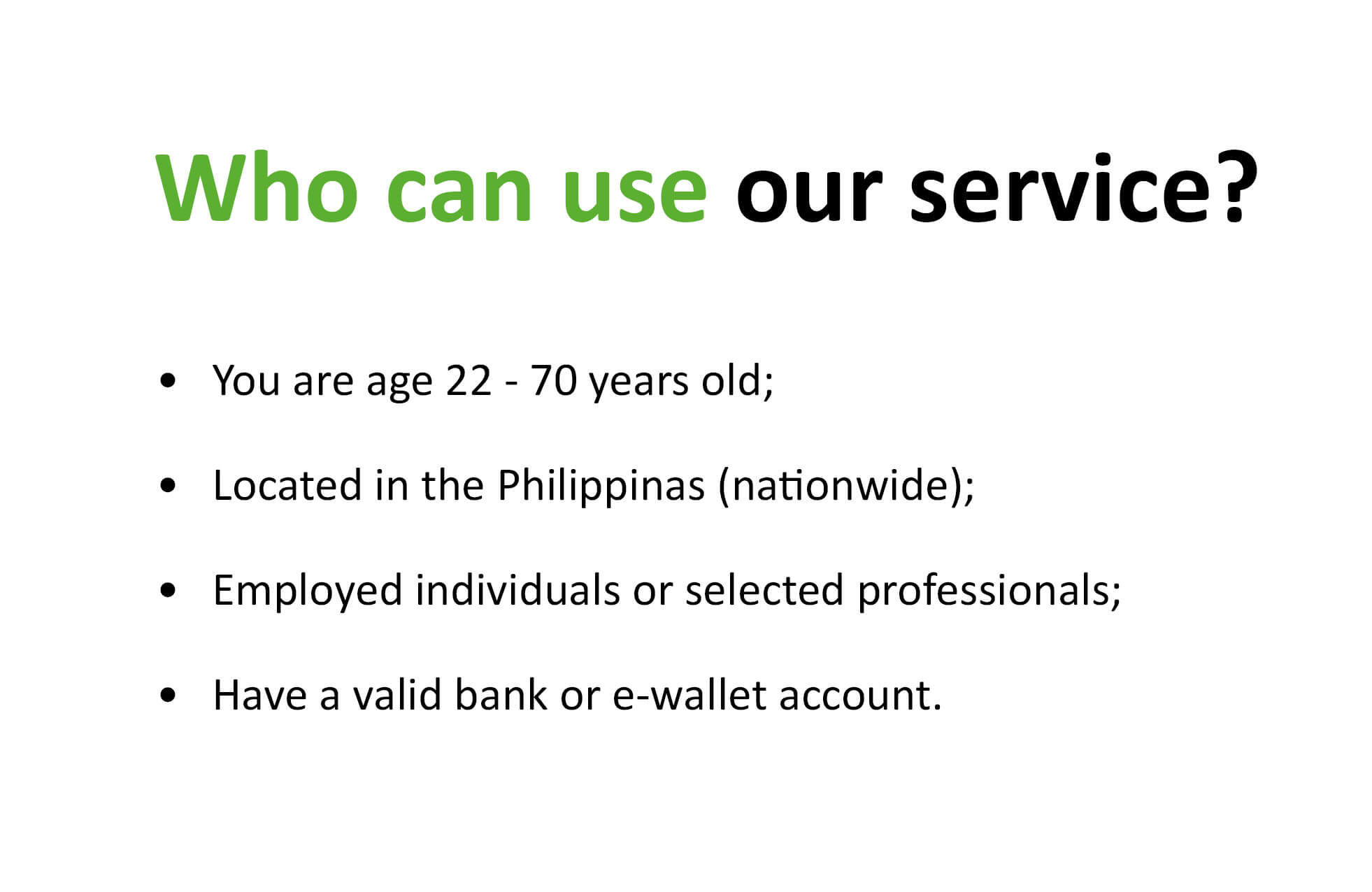

Eligibility Criteria

Understanding the eligibility criteria for a loan, including the APR and autopay discounts, is crucial to securing the best loans suited to one’s financial needs.

- Age Requirement: Typically, applicants must be at least 21 years old.

- Income Stability: Proof of stable income through payslips or bank statements is essential.

- Credit Score: A good credit score, often 650 and above, is favorable.

- Employment History: Continuous employment for at least 6-12 months is preferred.

Proper documentation and adherence to these requirements bolster the applicant's credibility, showcasing their reliability to potential lenders.

Required Documentation

Gathering the essential documents ahead of time can greatly simplify the loan application process.

- Valid ID: Passport, Driver's License, or Government-issued ID

- Proof of Income: Recent payslips, employment certificate, or bank statements

- Credit Report: Latest credit score and report from a recognized bureau

- Proof of Address: Utility bills, lease agreements, or official correspondence

- Bank Statements: Detailed statements from the past three to six months

- Tax Returns: Most recent income tax return documents

Well-prepared documents reflect favorably on the applicant’s reliability and organizational skills.

Comparing Different Loan Options

When exploring various loan options, a detailed comparison can yield significant advantages. Evaluating factors such as interest rates, repayment terms, and associated fees is crucial to identifying the best loans tailored to one's unique financial requirements.

In analyzing these aspects of a loan offer, individuals gain a comprehensive understanding of its true cost. This not only aids in making informed decisions but also ensures alignment with their financial goals. By doing so, they position themselves to effectively manage debt and potentially save money in the long run.

Personal Loans vs. Business Loans

Understanding the differences between personal loans and business loans, especially when considering the loan amount, is crucial for making informed financial decisions.

Personal loans typically serve individual needs.

These loans can be used for various personal expenditures like home renovations, education, unexpected expenses, or managing APR effectively. Conversely, business loans are tailored specifically for entrepreneurial endeavors, such as startup funding, operational costs, and expanding a business.

Taking the time to identify the type of loan that best suits one's requirements is essential for achieving financial success. Whether it’s for personal growth or business expansion, selecting the right loan ensures a reliable and effective path to financial stability and future prosperity. This decision-making process, marked by clarity and foresight, can lead to meaningful and lasting outcomes.

Secured vs. Unsecured Loans

When navigating the world of loans, understanding secured and unsecured loans can greatly impact one's financial strategy.

Secured loans require collateral such as a house or car.

These assets serve as security to the lender in case of default, enabling the borrower to receive favorable interest rates. Often, secured loans are perfect for larger, long-term investments like home purchases, starting a business, or debt consolidation.

On the other hand, unsecured loans do not require any collateral, making them accessible to a broader range of people. While they may come with higher interest rates, their flexibility enables individuals to address immediate or short-term needs without risking their valuable assets. Consequently, both types of loans, when chosen wisely, can pave the way toward financial growth and stability.

Steps to Apply for the Best Loans

To begin, research multiple loan options and compare various lenders' rates, terms, and conditions.

By doing so, one ensures they are making an educated decision tailored to their specific needs and financial goals. It's essential to gather and organize all necessary documents, such as proof of income, identification, and credit history, to streamline the application process.

The terms “pre-qualification” and “pre-approval” are crucial to navigate in this journey to secure the best loan.

Application Process

The loan application process is designed to be both systematic and user-friendly, ensuring ease and efficiency for applicants.

- Research Lenders: Look for potential lenders that offer favorable terms and interest rates.

- Gather Documents: Collect essential documents like identification, proof of income, and credit history.

- Submit Application: Fill out the loan application form accurately and submit it to the chosen lender.

- Await Decision: The lender will review the application and provide a prompt decision.

Researching and comparing lenders is the first crucial step in securing the best loans for your needs.

Once the application is submitted, applicants should stay prepared for any follow-up queries from the lender.

A prompt response to such queries can significantly expedite the approval process.

Approval Timeline

Navigating the approval timeline is essential for any aspiring loan applicant.

In 2023, advanced technologies have streamlined processes, enabling faster and more efficient loan approvals than ever before.

Typically, it's a matter of days from the moment one's application is submitted to when a decision is reached, depending on the chosen lender and loan specifics.

For instance, while personal loans might get approved within a day, mortgage approvals may stretch to about 3, reflecting their intricate verification procedures and larger sums involved.

Applicants are encouraged to remain proactive and responsive to requests for additional information to hasten the timeline further.

Common Pitfalls to Avoid

Navigating the intricate landscape of loans poses potential obstacles, which can derail an aspirant's financial aspirations. One common challenge is underestimating the importance of comparing multiple lenders and their loan terms, as sticking with a single option might result in higher interest rates or unfavorable terms. Additionally, neglecting to closely examine the fine print of loan agreements can lead to unexpected fees or restrictive conditions down the road, underscoring the necessity of thorough diligence and a keen understanding of one's unique financial circumstances.

Hidden Fees

Understanding the APR alongside hidden fees is crucial when selecting the best loans for your needs. Often, these fees can significantly impact the total loan cost.

- Origination Fees: Charges for processing the loan application.

- Late Payment Fees: Penalties for missed or delayed payments.

- Prepayment Penalties: Fees for paying off the loan early.

- Annual Fees: Yearly charges for maintaining the loan.

- Administrative Fees: Costs tied to managing the loan over time.

By being aware of these potential costs, applicants can make more informed decisions. Hidden fees can sometimes be overlooked during the initial loan application process.

Always scrutinize the loan agreement documents to ensure there are no unwelcome financial surprises later on.

Over-borrowing

Over-borrowing can cause severe financial strain, hindering one's ability to meet obligations and achieve long-term goals. Often, it results from miscalculating repayment capacity or underestimating borrowing costs, leading to escalating debt and financial stress.

Borrowers should adopt a balanced approach by accurately assessing their financial situation to avoid over-borrowing. Pursuing loans that align with their repayment capabilities and objectives is crucial.

A responsible borrowing strategy, emphasizing mindful spending and informed decisions, can transform financial challenges into manageable endeavors. Understanding and respecting financial limitations helps protect creditworthiness and allows individuals to pursue their dreams confidently.

Finding the Right Lender for Your Financial Goals

Choosing the right lender is crucial to securing the best loans that align with your financial goals. Here are some steps to help you find the ideal lender:

- Identify Your Needs: Determine the purpose of the loan, whether it's for a home, car, education, or personal expenses. Knowing your specific needs will help narrow down potential lenders.

- Research Lenders: Look for lenders that specialize in the type of loan you need. Consider banks, credit unions, online lenders, and peer-to-peer lending platforms.

- Compare Interest Rates: Interest rates can vary significantly between lenders. Compare rates to ensure you get the best deal. Lower interest rates mean lower overall costs.

- Evaluate Repayment Terms: Different lenders offer various repayment terms. Choose a lender that provides flexible terms that fit your financial situation and repayment ability.

- Check Lender Reputation: Research the lender's reputation by reading customer reviews and checking ratings from financial watchdog organizations. A reputable lender will have positive feedback and a track record of good customer service.

- Assess Customer Service: Good customer service is essential for a smooth loan process. Contact potential lenders to gauge their responsiveness and willingness to answer your questions.

- Review Fees and Charges: Be aware of any additional fees or charges associated with the loan. These can include origination fees, prepayment penalties, and late payment fees.

- Seek Recommendations: Ask friends, family, or financial advisors for lender recommendations. Personal experiences can provide valuable insights into the lender's reliability and service quality.

By following these steps, you can find a lender that not only offers the best loans but also aligns with your financial goals, ensuring a positive borrowing experience.

Tips for Applying Successfully

|

Tip |

Description |

Action |

|---|---|---|

|

Understand Your Financial Situation |

Assess your income, expenses, and existing debts to determine borrowing capacity. |

Calculate your monthly budget and debt-to-income ratio. |

|

Research Loan Options |

Explore various loan products, comparing interest rates, repayment terms, and fees. |

Use online comparison tools and read reviews to find the best loans. |

|

Check Your Credit Score |

A good credit score improves approval chances and interest rates. Obtain and review your credit report. |

Address any discrepancies and work on improving your credit score if necessary. |

|

Gather Necessary Documentation |

Collect required documents such as proof of income, identification, and bank statements. |

Prepare and organize all necessary paperwork before applying. |

|

Consider Loan Terms Carefully |

Evaluate the repayment period and monthly installments to ensure they fit your financial capabilities. |

Review loan terms and calculate potential monthly payments. |

|

Seek Professional Advice |

Consult with a financial advisor for personalized loan recommendations based on your financial situation. |

Schedule a meeting with a financial advisor to discuss your options. |

|

Apply to Multiple Lenders |

Increase approval chances by applying to multiple lenders and comparing offers. |

Submit applications to several lenders and review their proposals. |

|

Read the Fine Print |

Thoroughly read the loan agreement's terms and conditions, including fees and penalties. |

Carefully review all documents before signing to understand your obligations and rights. |

Benefits and Drawbacks of Personal Loans

Personal loans can be a valuable financial tool, but it's essential to understand both their benefits and drawbacks before making a decision.

Benefits

- Flexibility: Personal loans can be used for various purposes, such as consolidating debt, funding home improvements, or covering emergency expenses.

- Fixed Interest Rates: Many personal loans come with fixed interest rates, providing predictable monthly payments and helping with budgeting.

- No Collateral Required: Unlike secured loans, personal loans are often unsecured, meaning you don't need to put up assets like your home or car as collateral.

- Quick Approval and Disbursement: Personal loans typically have a faster approval process compared to other types of loans, with funds often disbursed within a few days.

- Improving Credit Score: Timely repayment of a personal loan can help improve your credit score, demonstrating responsible borrowing behavior.

Drawbacks

- Higher Interest Rates: Personal loans generally have higher interest rates compared to secured loans, especially if you have a lower credit score.

- Fees and Charges: Some personal loans come with additional fees, such as origination fees, prepayment penalties, and late payment charges, which can increase the overall cost.

- Impact on Credit Score: Applying for multiple personal loans within a short period can negatively impact your credit score due to hard inquiries.

- Debt Accumulation: Taking out a personal loan without a clear repayment plan can lead to increased debt and financial strain.

- Limited Borrowing Amounts: Personal loans may have lower borrowing limits compared to secured loans, which might not be sufficient for large expenses.

Understanding these benefits and drawbacks can help you make an informed decision about whether a personal loan is the best option for your financial needs.

Securing financing can be daunting, but some loan options simplify the process, fostering financial stability and growth. Personal loans from banks and private lenders offer straightforward applications, flexible criteria, and quick disbursement for urgent needs. Payday loans, despite higher interest rates, provide short-term solutions for immediate financial crises. Credit cards, especially secured ones, offer revolving credit with easier approval. By choosing wisely, individuals can harness these financial tools to achieve their aspirations and build a resilient future.

When seeking the ideal loan deals in the Philippines, evaluating various financial institutions is crucial. Commercial banks offer competitive interest rates, flexible repayment terms, and a range of loan products like home, auto, and personal loans, ensuring a secure borrowing experience. Government-sponsored programs, such as Pag-IBIG Fund or SSS, provide favorable terms for first-time homebuyers and entrepreneurs, focusing on social responsibility and affordable options to reduce financial barriers. Careful research is essential to find the best match for your needs.

Online lenders are another viable option, offering convenience and speed. These platforms typically have streamlined application processes and faster approval times. However, one must exercise caution and validate the legitimacy of these lenders to avoid potential pitfalls.

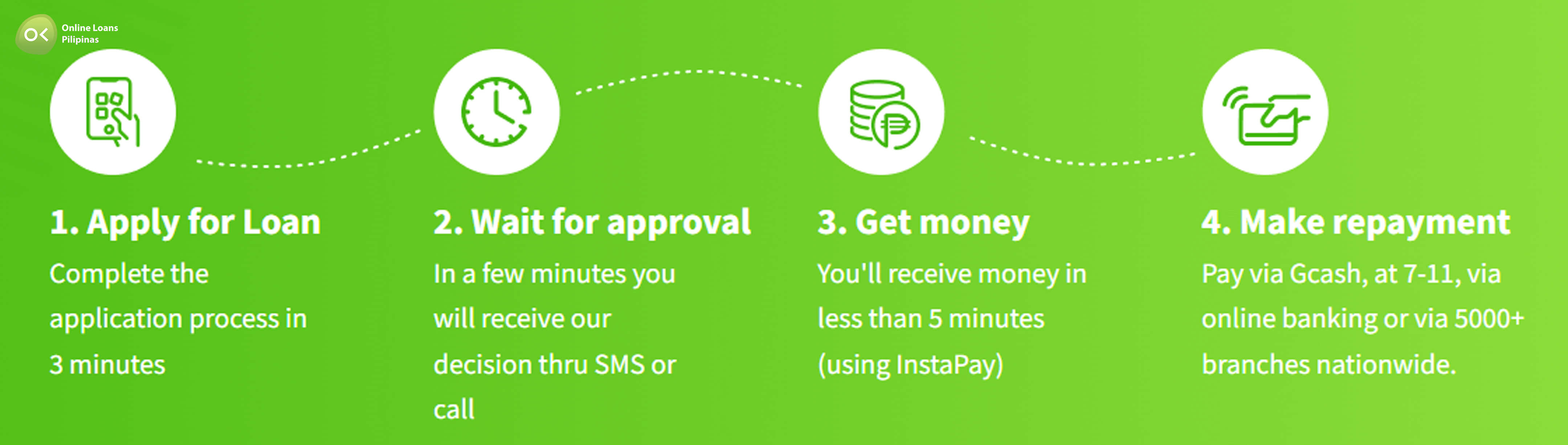

Online Loans Pilipinas stands out for its quick, hassle-free online application process, allowing borrowers to apply without lengthy paperwork or in-person visits. They offer same-day approval and disbursement, making it ideal for urgent financial needs. With flexible loan terms tailored to various financial situations, borrowers can find plans that suit their repayment capabilities. The company maintains transparency in fees and interest rates, ensuring borrowers understand the total cost without hidden charges. Additionally, their services are accessible to individuals with varying credit scores, providing financial solutions to a broader audience. Coupled with responsive customer service that guides borrowers through the process and addresses concerns promptly, Online Loans Pilipinas is a top choice for reliable and efficient loan solutions.

In choosing the best loan deal, it is crucial to consider the interest rate, repayment terms, and any additional fees. Comparing multiple offers will enable one to identify the most cost-effective solution.

Ultimately, thorough analysis and thoughtful consideration are key to successfully obtaining the best loans for one's needs. Staying informed and proactive can transform financial challenges into opportunities for growth and stability.

Seek trusted recommendations from friends.

Peers and family can often offer invaluable advice. Their firsthand experiences with specific lenders provide crucial insights, paving the way for safer decisions. Additionally, browsing online reviews and customer testimonials can serve as a rich resource. These narratives reveal consistent patterns of reliability and trustworthiness in financial dealings.

Opt for financial institutions.

Banks and credit unions are highly regulated.

Explore their loan offerings meticulously, and compare interest rates and terms. Established institutions often provide more transparent and straightforward loan processes. Assess their customer service quality, as this can foster a supportive and responsive lending experience.

Verify credentials and affiliations through government and industry bodies.