Best Platforms for Loan Online Pilipinas in 2024

In this digital age, individuals can now access a multitude of services with just a few clicks.

Gone are the days of tedious applications; now, you can secure your loan amount online Pilipinas efficiently and seamlessly. This modern convenience caters to our fast-paced lives.

Benefits of a Loan Online Pilipinas

Online loans offer unparalleled convenience, allowing access to funds anytime and anywhere in the Philippines. The digital application process is user-friendly, eliminating the complexities of traditional financial institutions, resulting in fewer forms and faster approvals—crucial during urgent financial situations.

Additionally, online loan platforms promote transparency, providing instant feedback on application status, which helps in effective financial planning. The financial flexibility offered by these loans can significantly contribute to personal and professional growth, empowering individuals with immediate and reliable support to achieve their aspirations and goals, fostering a brighter, more secure future.

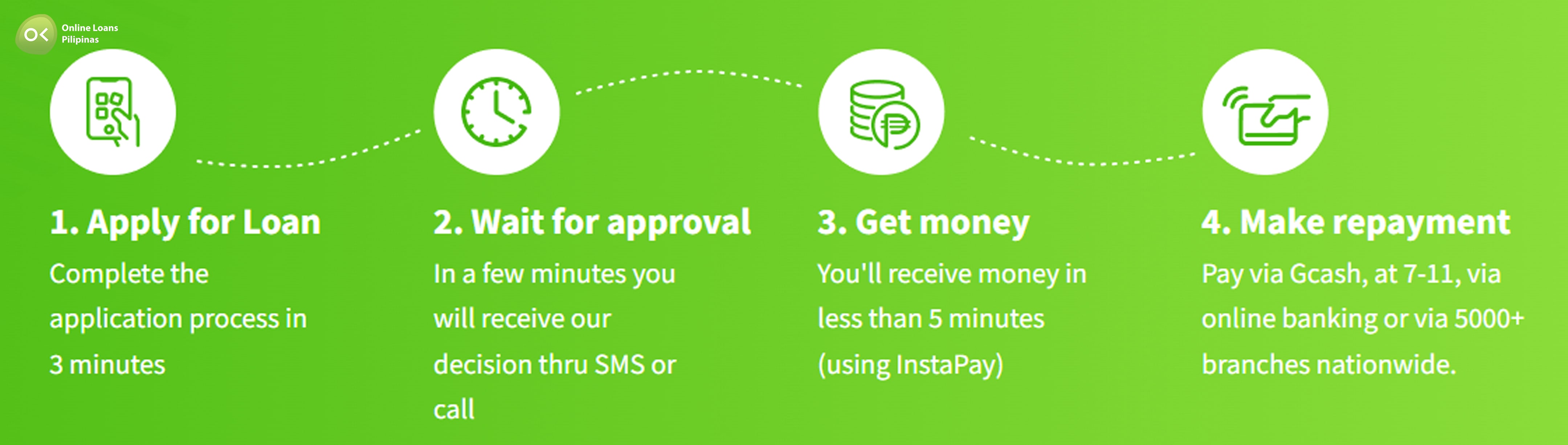

How to Apply for a Loan Online

Applying for a loan online in the Philippines is a modern, convenient solution to your financial needs. Start by gathering necessary documents like valid ID and proof of income. Ensure all documents are legible to avoid delays and confirm your eligibility.

Choose a reputable online lending platform by comparing interest rates, terms, APR, and reviews. Trustworthy lenders offer clear guidelines and user-friendly interfaces.

Complete the online loan application form with accurate information, double-checking details before submission. Most platforms provide instant feedback once reviewed.

Await the lender's prompt response. Upon approval, funds will be swiftly disbursed to your designated account, ready to support your financial needs.

Tips for Faster Approval

Prioritize accurate information from the outset. Ensure your personal and financial details are complete and correct to boost your chances of quick approval. Double-check for missing fields or discrepancies to avoid delays. Well-prepared documentation and precise details demonstrate reliability and readiness, helping lenders process your application swiftly.

Choose licensed and reputed lenders with a proven track record of efficiency. Organize your financial documents in advance—pay slips, tax returns, bank statements—to facilitate continuous application processing for unsecured lending without delays.

Maintain a healthy credit score by managing debts responsibly and making timely payments. A strong credit score can expedite your approval process, affirming your creditworthiness to potential lenders.

What are the Best Platforms for Loan Online Pilipinas in 2024

In 2024, several platforms stand out for offering the best online loans in the Philippines. These platforms combine convenience, transparency, and reliability, ensuring that borrowers have access to the financial support they need.

- Online Loans Pilipinas: Renowned for its user-friendly interface and quick approval process, Online Loans Pilipinas offers competitive interest rates and flexible repayment terms, making it a top choice for many Filipinos.

- GCash: Known for its seamless integration with everyday transactions, GCash offers quick and easy loan applications directly through its app. With competitive interest rates and flexible repayment terms, it’s a top choice for many Filipinos.

- Tala Philippines: Tala provides a straightforward application process with minimal requirements, making it accessible to a wide range of borrowers. Their quick disbursement of funds and transparent fee structure make them a reliable option.

- Cashalo: Cashalo offers a variety of loan products tailored to different needs, from personal loans to business financing. Their user-friendly app and fast approval times make borrowing hassle-free.

- Home Credit: Home Credit is well-regarded for its flexible loan options and easy application process. They offer both short-term and long-term loans, catering to various financial needs.

- Loan Ranger: Loan Ranger specializes in short-term loans with quick approval and disbursement. Their transparent terms and conditions ensure borrowers are well-informed throughout the process.

- CIMB Bank: CIMB Bank’s digital banking platform offers personal loans with competitive rates and flexible repayment options. Their efficient online application process makes borrowing straightforward and convenient.

These platforms exemplify the best in online lending, including trusted options like Online Loans Pilipinas, providing Filipinos with the financial tools needed to achieve their goals and secure their futures.

The approval process is remarkably swift - you can often receive approval within just a few hours of your application. This rapid turnaround underscores our commitment to providing efficient and dependable service.

Yes, self-employed individuals are welcome to apply. We understand the diverse needs of borrowers and offer tailored solutions to cater to various employment statuses. Each application is evaluated on its merits, cutting through the red tape.

Choosing a loan online Pilipinas offers unparalleled convenience, competitive interest rates, and flexible repayment options. By leveraging technology, we streamline each step, delivering an exceptional borrowing experience. Join thousands of Filipinos who have successfully secured their financial needs through our trusted platform.