Get Quick Loans Online with No Hassle

In the Philippines, financial emergencies can strike without warning, leaving individuals scrambling for immediate funds. Whether it's an unexpected medical bill, urgent home repairs, or a sudden need for travel, quick loans online have become a go-to solution for many Filipinos. These personal loans offer a fast, convenient, and hassle-free way to access the money you need, right when you need it most.

Understanding Quick Loans Online

Quick loans online are short-term loans that can be applied for and processed entirely over the internet. These loans are designed to provide fast financial relief, often with minimal documentation and quick approval times. Unlike traditional bank loans, which can take days or even weeks to process, quick loans online can be approved and disbursed within hours.

How fast are online loans approved?

Many Filipinos wonder about the speed of approval for online loans, especially when facing urgent financial needs.

Typically, online lending platforms in the Philippines have streamlined their processes to ensure swift turnaround times. These platforms often require minimal documentation, which expedites the entire application process significantly, with some even offering instant pre-approval features.

Once the necessary information is submitted, applicants can expect feedback within a few hours. In some cases, loans can be approved and disbursed on the same day, providing much-needed financial relief quickly and efficiently.

To maximize the chances of fast approval, applicants should ensure that all required information and documents are complete and accurate. Being transparent and thorough can help avoid delays, enabling the loan to be processed without unnecessary setbacks, thereby addressing urgent financial needs promptly.

Are online quick loans safe?

Online quick loans have emerged as a popular financing solution for many in the Philippines, offering convenience and speed.

They offer an easy application process through various digital platforms accessible anytime.

With stringent regulations in place, numerous reputable lenders ensure borrowers' data is kept secure and private.

Individuals are encouraged to look for licensed lenders with positive reviews and clear guidelines on fees and interest rates. Doing so ensures that they can access the funds they need without falling prey to unscrupulous entities. Additionally, it's crucial to read the terms and understand the obligations before proceeding to maintain financial stability and confidence.

How to apply for quick loans online?

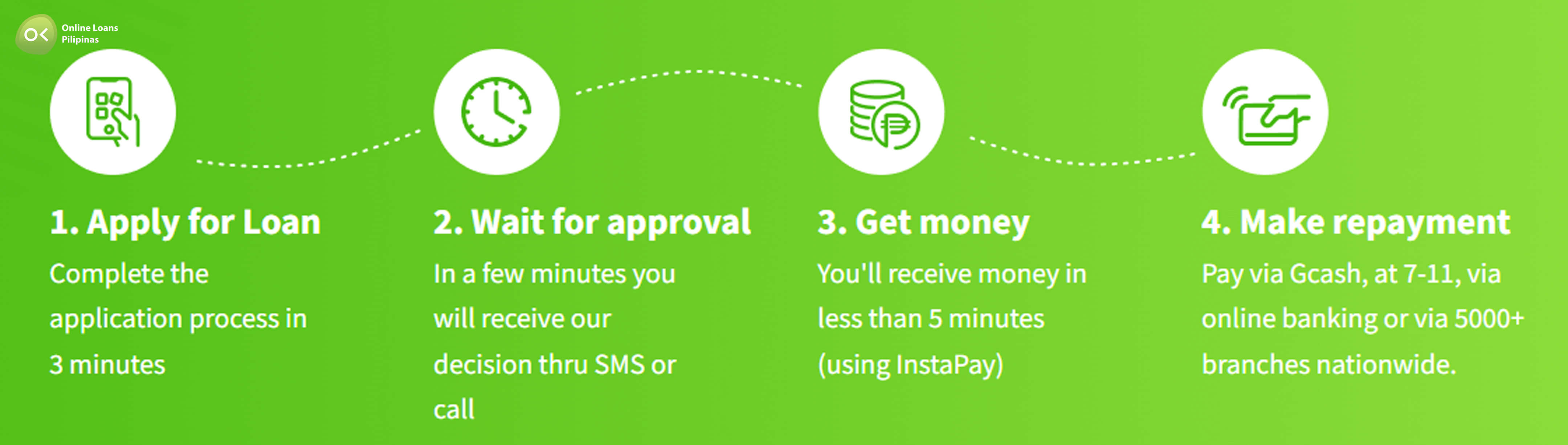

Securing a quick loan online is straightforward.

First, one must identify a reputable lender. They should review various lenders’ terms and conditions, interest rates, and repayment options to find one that suits their needs. Additionally, verifying the accreditation of the lender ensures reliability. Once a suitable lender is chosen, they can proceed with the application process.

They gather the required documents.

Typically, this includes a valid ID, proof of income, and bank statements. These documents help the lender assess the applicant's creditworthiness and expedite the approval process.

They then fill out an online application form with accurate details. Most online platforms are user-friendly and prompt applicants through each step. Submitting the form initiates the review process, and if approved, funds are disbursed swiftly, often within the same day.

By following these steps, individuals can efficiently access quick loans online, helping them manage urgent financial needs with confidence and ease.

Which online platforms offer quick loans?

Several platforms cater to urgent loan needs.

Online Loans Pilipinas stands out as a leading provider. With a user-friendly interface, they have streamlined the application process for quick loan approval. Their commitment to fast disbursement ensures that applicants can address their urgent financial concerns promptly. In addition, Online Loans Pilipinas' transparent terms instill confidence in their service.

Another reliable option exists. Tala Philippines, known for its flexible loan offerings and swift approval times.

Furthermore, Atome Credit offers impressive features. Their platform is designed for ease of use, making it accessible to a broader audience.

These platforms have fine-tuned their processes to address the immediate financial needs of Filipinos. They leverage advanced technology to provide fast, secure, and convenient loan services. This ensures individuals can manage unexpected expenses with confidence and professionalism.

Key Takeaways

Quick loans online in the Philippines offer a fast and convenient solution for urgent financial needs. These loans can be accessed through various online platforms, providing quick approval and disbursement processes. They are ideal for emergencies, unexpected expenses, or bridging financial gaps, ensuring that Filipinos can manage their finances efficiently without the lengthy procedures of traditional banking.