Guide to Getting a Personal Loan Philippines

Navigating financial challenges and seizing opportunities often require immediate access to funds. For middle-income Filipinos, personal loans offer a practical and accessible solution, particularly when considering the interest rate. Whether you're facing unexpected medical expenses, planning a home renovation, or looking to consolidate debt, understanding the ins and outs of personal loans in the Philippines can help you make informed financial decisions. This article delves into the essentials of personal loans, from eligibility criteria to application tips, including specific requirements, ensuring you have the knowledge needed to secure the best loan for your needs.

What is a Personal Loan?

A personal loan is an unsecured loan that individuals can borrow from banks, credit unions, or online lenders. Unlike secured loans, personal loans do not require collateral, making them accessible to a broader range of borrowers. The loan amount, interest rates, and repayment terms vary depending on the lender and the borrower's creditworthiness.

Benefits of Personal Loans

- Flexibility: Personal loans can be used for various purposes, such as medical emergencies, home renovations, education, or even debt consolidation.

- No Collateral Required: Since personal loans are unsecured, you don't need to pledge any assets, reducing the risk of losing valuable property.

- Fixed Interest Rates: Most personal loans come with fixed interest rates, ensuring predictable monthly payments and structured installments throughout the loan term.

- Quick Approval: Many lenders offer fast approval processes, allowing you to access funds swiftly when needed.

Eligibility Criteria

To qualify for a personal loan in the Philippines and improve your loan application, you typically need to meet the following criteria:

- Age: Usually between 21 and 65 years old.

- Income: A stable source of income, often with a minimum monthly salary requirement.

- Credit Score: A good credit history increases your chances of approval and may result in better interest rates.

- Employment Status: Regular employment or a stable business for self-employed individuals.

How to Apply for a Personal Loan

- Research Lenders: Compare different lenders to find the best terms and interest rates. Consider both traditional banks and online lenders.

- Check Eligibility: Ensure you meet the lender's eligibility criteria before applying.

- Prepare Documents: Gather necessary documents such as valid ID, proof of income, and employment certificate.

- Submit Application: Fill out the application form and submit it along with the required documents.

- Wait for Approval: The lender will review your application and notify you of the decision. If approved, the funds will be disbursed to your account.

Popular Loan Apps Offering Personal Loans in the Philippines

In recent years, the rise of fintech has made accessing personal loans more convenient than ever. Several loan apps in the Philippines provide quick and easy personal loans, catering to the needs of middle-income Filipinos. Here are some of the most popular loan apps you can consider:

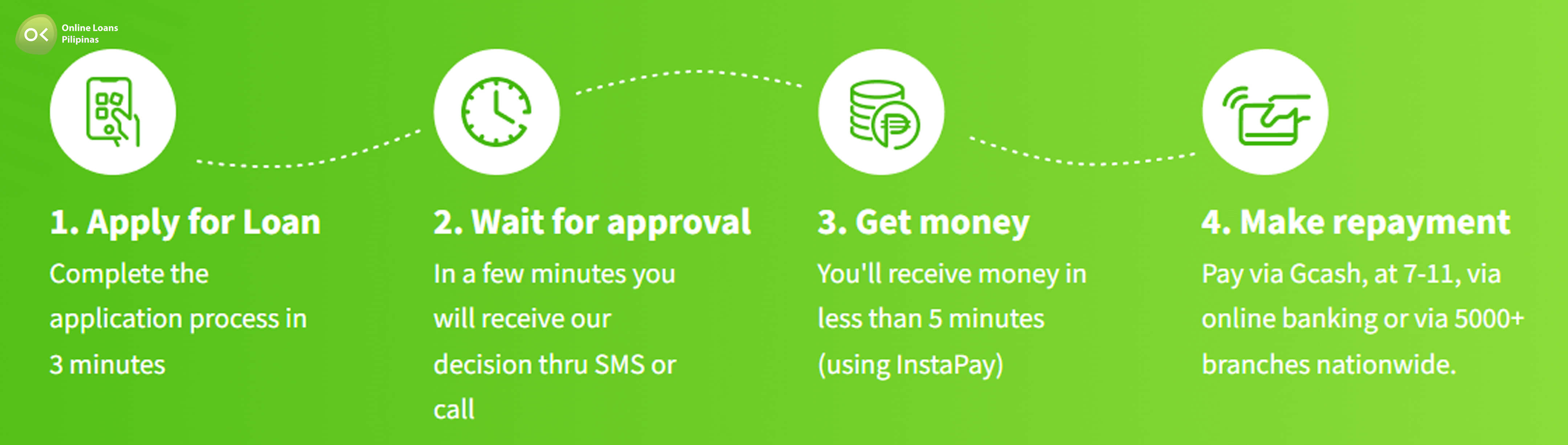

1. Online Loans Pilipinas

Online Loans Pilipinas offers fast and flexible personal loans with minimal requirements. The app provides a user-friendly interface and quick approval process, making it a popular choice for many Filipinos.

2. Cashalo

Cashalo is known for its straightforward application process and quick disbursement of funds. The app uses alternative data to assess creditworthiness, making it accessible even to those with limited credit history.

3. Home Credit

Home Credit provides personal loans with competitive interest rates and flexible repayment terms. The app is widely recognized for its transparent terms and efficient customer service.

4. MoneyCat

MoneyCat offers short-term personal loans with a simple application process. The app is designed for quick approvals and disbursements, making it ideal for urgent financial needs.

5. Tala

Tala provides fast personal loans with minimal documentation. The app is known for its quick processing times and user-friendly interface, making it a convenient option for many borrowers.

6. UnaCash

UnaCash offers personal loans with flexible terms and competitive interest rates. The app is designed to provide quick access to funds with a hassle-free application process.

7. LoanChamp

LoanChamp provides personal loans with a focus on transparency and customer satisfaction. The app offers quick approvals and flexible repayment options, catering to various financial needs.

8. JuanHand

JuanHand offers personal loans with a simple and fast application process. The app is designed to provide quick access to funds, making it a popular choice for those in need of immediate financial assistance.

Conclusion

Personal loans in the Philippines offer a practical solution for middle-income Filipinos seeking financial flexibility. By understanding the benefits, eligibility criteria, and application process, you can make informed decisions and manage your finances responsibly. Whether you need funds for an emergency, a significant purchase, or debt consolidation, a personal loan can provide the financial support you need.

Evaluating personal loan options in the Philippines requires meticulous attention to detail and a clear understanding of individual financial needs. Each financial institution offers unique benefits, so it is crucial to compare interest rates, loan terms, and additional fees.

Assessing the interest rate is paramount. It directly affects the overall cost of the loan.

Loan terms vary significantly among lenders, ranging from a few months to several years. Shorter terms might have higher monthly payments but lower total interest.

One should thoroughly examine any additional charges, such as processing fees, prepayment penalties, or late payment fees. Additionally, researching customer reviews and lender reputations can provide valuable insights into the reliability and quality of service. By carefully comparing these aspects, they will be well-equipped to choose the best personal loan for their needs.