Online Loan Benefits: Easy Money Access Today!

For many, obtaining a loan swiftly to handle unforeseen expenses can be a daunting task. The traditional loan application process is often cumbersome, fraught with delays and extensive paperwork, creating significant stress.

But worry not, today’s digital age offers a streamlined solution: online loan approval. By leveraging technology, one can secure the necessary funds with minimal hassle, making financial hurdles easier to overcome.

Understanding Online Loans

Online loans have revolutionized the financial sector, simplifying access to funds for countless individuals across various walks of life.

Now, it's as easy as logging onto a lending institution's website to start an application from the comfort of one’s home. In the Philippines, Pinoys can obtain personal loans, business loans, or even emergency funds swiftly without physical meetings or lengthy requirements.

The beauty of the online loan system is its inherent efficiency. Applicants can receive approval in as little as 24 hours, thanks to real-time data processing and automated credit assessments. This reduces both waiting time and anxiety.

How to Apply for an Online Loan

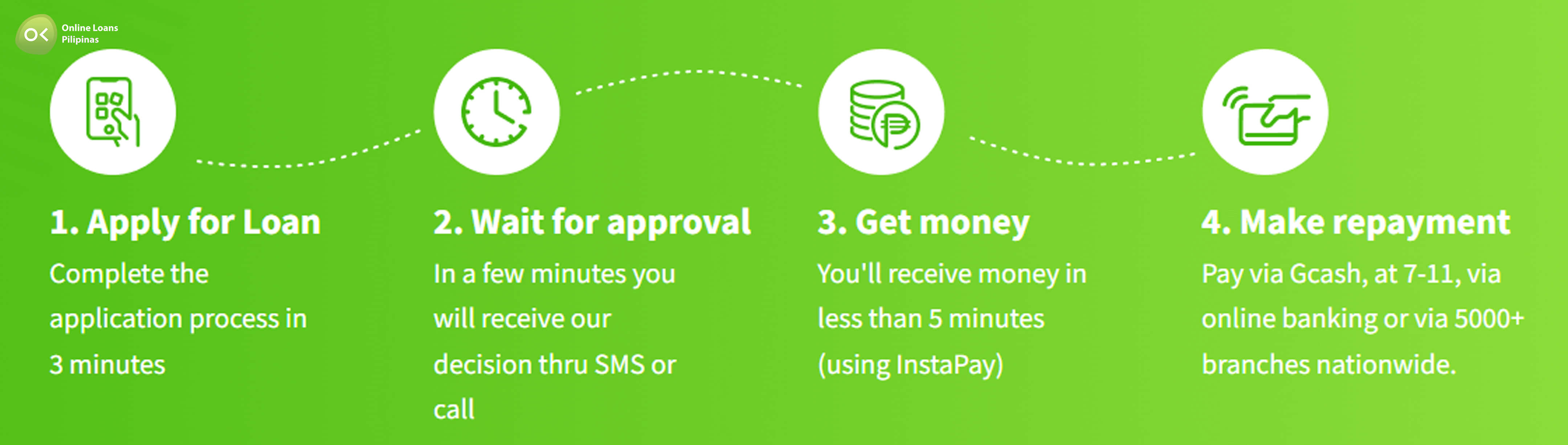

Applying for an online loan is straightforward and efficient.

First, applicants should research various lenders to find the best match for their needs, considering interest rates, repayment terms, and credibility. Next, they complete a short application, providing personal and financial details. Double-checking for accuracy is essential.

Once submitted, applicants can expect swift processing times, with many lenders offering approval notifications within minutes to a few hours. An approved application brings them closer to achieving their financial goals.

Types of Online Loans

Various online loans cater to different financial needs, simplifying the process to borrow funds. Personal loans, business loans, and payday loans are highly accessible, offering unique advantages and quick approval.

Personal Loans

Personal loans provide flexible, unsecured financing for diverse purposes, from significant life events to debt consolidation. With minimal scrutiny and quick disbursement, they enable individuals to achieve their goals efficiently.

Business Loans

Business loans offer essential capital for growth, cash flow management, and new investments. Rapid online applications and competitive terms make them ideal for businesses seeking financial agility and sustainability.

Payday Loans

Payday loans offer fast relief for unexpected expenses with minimal requirements, making them a quick finance solution. Designed for short-term needs, they provide quick access to funds but require responsible borrowing due to high interest rates.

Common Mistakes to Avoid

Applying for an online loan through a website can be efficient and straightforward, but common mistakes can hinder the process.

Firstly, not reading the terms and conditions thoroughly can lead to unexpected fees and unfavorable repayment terms. Secondly, failing to compare different lenders may result in higher costs due to less favorable interest rates and terms. Lastly, neglecting to maintain a good credit score can limit loan options and increase interest rates.

In conclusion, being well-informed and cautious can significantly enhance the online loan experience, allowing borrowers to navigate the process confidently and efficiently.

What is the easiest loan to be approved for?

Personal loans are widely accessible.

Several lenders offer personal loans with minimal requirements. These loans typically demand basic information, such as proof of income, a government-issued ID, and an acceptable credit score. Moreover, many online platforms have streamlined the process, enabling potential borrowers to apply quickly and receive approval within hours.

Online Loans Pilipinas stands out as the best online loan provider for several reasons:

- User-Friendly Application Process: The platform offers a straightforward and efficient application process, ensuring quick access to funds without unnecessary complications.

- Competitive Interest Rates: Online Loans Pilipinas provides competitive interest rates, making borrowing more affordable for individuals and businesses alike.

- Flexible Repayment Terms: Borrowers can choose from a range of repayment options, allowing them to manage their finances more effectively and avoid undue stress.

- Swift Approval and Disbursement: The lender boasts rapid approval times, often within minutes, and ensures prompt disbursement of funds, catering to urgent financial needs.

- Credibility and Trustworthiness: With positive reviews and a strong reputation, Online Loans Pilipinas guarantees a secure and satisfactory borrowing experience.

- Comprehensive Customer Support: The platform offers robust customer support, guiding borrowers through every step of the process and addressing any concerns promptly.

Final Thoughts on Quick and Easy Online Loan Approval

In today's fast-paced world, obtaining quick and easy online loan approval has become highly efficient.

Since 2016, fintech companies have revolutionized lending, offering innovative solutions that cater to diverse borrower needs. Leveraging advanced digital tools, these platforms have simplified the application process, allowing borrowers to access funds quickly with minimal paperwork.

Inclusivity for varying credit scores empowers more individuals to manage their financial responsibilities, enhancing fiscal health and independence.

In conclusion, the future is bright for online loan seekers, offering accessibility, efficiency, and empowerment.

Generally, the eligibility criteria depend on the lender’s policies. Typically, applicants need to provide proof of income, a valid ID, and other pertinent information. Each lender may have specific requirements, so it is essential to thoroughly review them before applying.

Upon successful submission of all necessary documents, many lenders can approve and disburse funds within a few hours to a few days. The quick processing time is one of the standout advantages of opting for an online loan.

Yes, some lenders offer loans specifically tailored for individuals with poor credit scores. While the interest rates may be higher, these loans provide an opportunity to rebuild credit when repayment is timely and consistent.

Repayment terms for online loans can range from a few months to several years, depending on the lender and loan amount. Borrowers should ensure they understand the repayment schedule and any associated fees. Automated payment options can often facilitate timely repayments, fostering financial responsibility and ensuring positive lending experiences.