Personal Loan Application Do's and Don'ts in PH

- Understanding Personal Loans

- How to Apply for a Personal Loan Online

- Do's and Don'ts for Personal Loan Application

Imagine needing to cover sudden medical expenses or unexpected home repairs, but lacking the immediate funds to do so.

Securing a personal loan can be the ideal solution to such pressing financial needs. Fortunately, the personal loan application process is now more streamlined, efficient, and accessible than ever before.

Understanding Personal Loans

Many individuals wonder about the benefits and workings of personal loans.

A personal loan is a sum of money borrowed from a bank or financial institution, typically unsecured and based on creditworthiness. Understanding the loan amount, terms, fees, and interest rates is crucial for making informed decisions.

Personal loans can be used for consolidating debt, making large purchases, or funding home improvements, offering valuable financial flexibility. With proper understanding, anyone can harness personal loans to achieve their financial goals.

Advantages of Online Loan Applications

Embracing online personal loan applications offers numerous advantages, including accessibility and efficiency. Borrowers can apply from home at any time, benefiting from faster processing times due to automated workflows. This digital approach reduces the need for physical paperwork and bank visits, simplifying the process and enabling quicker approvals for faster access to funds wisely when needed.

Speed and Convenience

The swift personal loan application process emphasizes speed and convenience, catering to the fast-paced lifestyle of today’s borrowers.

- Quick Online Application: Fill out the form in minutes.

- Instant Document Upload: Easily upload required documents.

- Immediate Feedback: Receive instant application status updates.

- Fast Approval: Enjoy expedited review and approval process.

- Rapid Fund Disbursement: Access your funds without unnecessary delays.

A streamlined application form ensures applicants spend less time waiting.

Modern technology enhances the loan application experience, making it seamless and efficient.

24/7 Accessibility

Round-the-clock loan application access.

Gone are the days of strict banking hours. With 24/7 access to personal loan applications, users can apply anytime, anywhere, free from traditional constraints. This flexibility allows individuals with unconventional schedules to secure financial assistance at their convenience, whether at midnight or during a lunch break.

Round-the-clock access to personal loan applications empowers individuals, facilitating timely financial decisions and contributing to a more resilient and financially inclusive society.

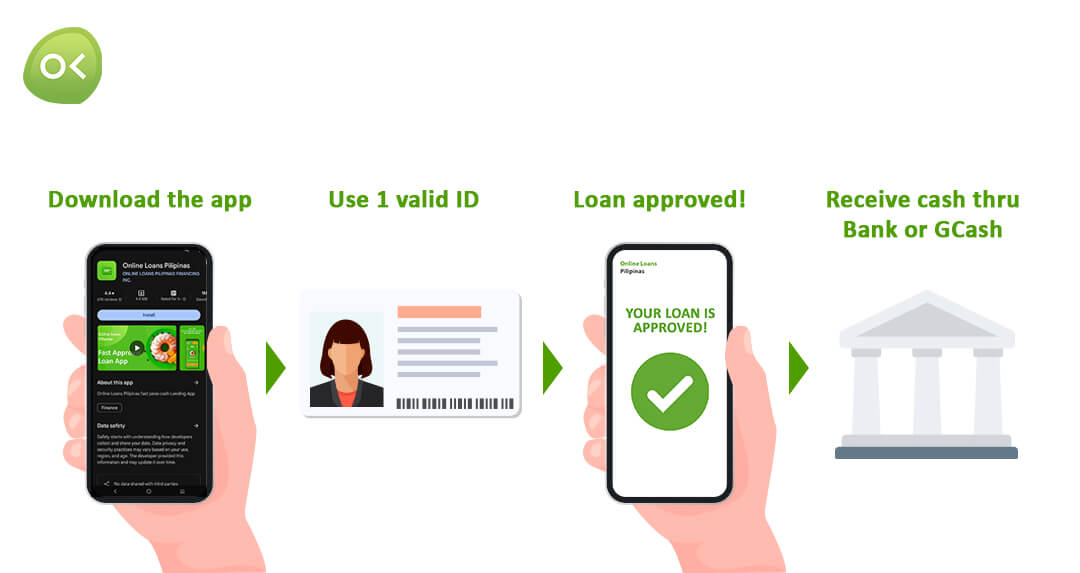

How to Apply for a Personal Loan Online

Applying for a personal loan online offers convenience, speed, and a streamlined experience for potential borrowers, facilitating a straightforward and efficient process.

Applicants must start by selecting a reputable financial institution that offers online personal loan application services.

Next, they should visit the lender’s official website and locate the online application section, ensuring they familiarize themselves with the requirements.

Typically, the application will require the same documents mentioned previously (proof of identity, income, and address). These should be prepared and in digital format.

Once on the application page, applicants need to input their personal information, upload the necessary documents, and double-check for accuracy before submission.

Finally, they can confidently submit their application, knowing that they’ve meticulously compiled their documents and provided accurate information, setting the stage for a swift approval process.

Steps in the Personal Loan Application Process

Navigating the personal loan application process is a blend of simplicity and efficiency. Applicants start by gathering essential financial documents, ensuring they have everything needed for a streamlined application process.

Once documentation is in order, they proceed to "fill out forms". This step is often done via a secure online portal, enhancing accuracy and expedience. With technology aiding the process, applicants can track their application's status and receive updates in real-time, contributing to a more transparent experience. By following these well-defined steps, they can promptly fulfill their financial goals.

Initial Inquiry and Pre-Approval

Starting is always the hardest part.

Applicants can initiate their personal loan application by submitting an online inquiry, marking the start of their financial empowerment journey. Upon receiving the inquiry, the lender provides a preliminary assessment to determine eligibility, laying a foundation of confidence for the next steps.

Key details such as income, employment status, financial obligations, and monthly amortization are shared to quickly ascertain borrowing capacity. This fast and efficient pre-approval stage sets the tone for an inspiring financial journey, with enhanced systems in 2023 ensuring quicker processes. Pre-approval builds momentum, empowering applicants to proceed with renewed determination.

Submitting Necessary Documents

Submitting necessary documents is a crucial step in the personal loan application process. It streamlines approval and ensures a smooth lending experience.

- Proof of Identity: Passport, driver's license, or government-issued ID.

- Proof of Income: Recent payslips, employment certificate, or tax returns.

- Proof of Address: Utility bills, lease agreements, or bank statements.

- Bank Statements: Recent bank statements to verify financial stability.

- Additional Documentation: As requested by the lender for specific needs.

Gathering the required documents in advance expedites the personal loan application process.

Ensuring that all paperwork is up to date and accurately reflecting one's current situation will minimize delays and increase approval chances.

Approval and Fund Disbursement

Once the necessary documents are submitted, the approval process can move swiftly. Lenders often review applications within a few business days, informing applicants through a message or notification.

After approval, funds are promptly disbursed to the applicant's chosen bank account, allowing them to address finance-related needs without delay. Whether for emergency expenses, home improvements, or investments, the immediate availability of funds helps meet objectives with confidence and optimism.

Do's and Don'ts for Personal Loan Application

Do's

- Do Check Your Credit Score: Ensure your credit score is in good standing before applying.

- Do Compare Lenders: Research and compare different lenders to find the best terms and interest rates.

- Do Gather Necessary Documents: Prepare all required documents, such as proof of identity, income, and address.

- Do Understand the Terms: Read and understand the loan terms, fees, and interest rates.

- Do Calculate Your Repayment Ability: Assess your ability to repay the loan based on your current financial situation.

Don'ts

- Don't Apply for Multiple Loans Simultaneously: Avoid applying to multiple lenders at once, as it can negatively impact your credit score.

- Don't Overborrow: Only borrow what you need and can afford to repay.

- Don't Ignore the Fine Print: Pay attention to all details in the loan agreement to avoid hidden fees or unfavorable terms.

- Don't Miss Payments: Ensure timely repayments to avoid penalties and damage to your credit score.

- Don't Provide Inaccurate Information: Always provide accurate and truthful information on your application to avoid delays or rejections.

Online Loans Pilipinas offers the best personal loan application experience due to several key factors:

- User-Friendly Platform: Their intuitive online platform makes the application process straightforward and accessible, even for those with limited technical skills.

- Quick Processing: With automated workflows, applications are processed swiftly, ensuring faster approvals and disbursements.

- 24/7 Accessibility: Applicants can apply anytime, anywhere, without being constrained by traditional banking hours.

- Transparent Terms: Clear and transparent loan terms, fees, and interest rates help borrowers make informed decisions.

- Flexible Loan Options: They offer a range of loan options tailored to meet various financial needs, from emergency expenses to home improvements.

- Strong Customer Support: Dedicated customer support is available to assist applicants throughout the process, enhancing the overall experience.

- Secure Transactions: Robust security measures ensure that personal and financial information is protected throughout the application process.

These features collectively make Online Loans Pilipinas a top choice for personal loan applications, providing a seamless, efficient, and secure borrowing experience.