Personal Loan: Fast Approval and Low Interest

Are you in need of quick cash?

Managing finances can sometimes feel overwhelming, especially when unexpected expenses arise and savings are insufficient.

Obtaining a personal loan provides a viable solution to bridge the financial gap, allowing you to address urgent needs without disrupting your financial stability. However, choosing the right loan product is critical to managing repayments effectively.

Here's what you need to know.

Understanding Personal Loans

A personal loan is a type of unsecured loan, where you don't need to provide collateral, unlike home or auto loans. These loans offer a fixed loan amount for a set period, with payments made in regular installments.

In the context of financial emergencies, personal loans can be a lifeline. They are often easier to obtain than other types of credit, providing quick access to funds. Nevertheless, the interest rate can be higher, and it's essential to read the terms and conditions thoroughly to ensure you're getting a fair deal.

What is a Personal Loan?

A personal loan is an unsecured loan—no collateral required—available to borrowers from various financial institutions.

Personal loans deliver quick financial support, typically processed and disbursed within a few hours, often with well-defined payment terms.

These loans come with fixed repayment terms and interest rate, making it easier to plan your finances. They have flexible usage, allowing you to allocate funds where needed most, from medical expenses to home renovation.

Consider personal loans a viable option when you require urgent funds and can commit to regularly scheduled repayments, ensuring financial stability and meeting unexpected financial demands effectively.

Loan Types in the Philippines

Understanding the different loan types available in the Philippines is crucial, especially when seeking fast access to funds. Various options cater to diverse financial needs.

Personal loans are the most common type, offering unsecured borrowing for various purposes.

Salary loans, often provided by employers or banks, cater to salaried employees for their immediate financial needs.

Home loans are designed for property purchase or home improvement, requiring collateral like the property itself.

Auto loans**, another secured loan, are used exclusively for purchasing vehicles, with the car serving as collateral.

Business loans cater to entrepreneurs and enterprises needing capital for business operations or expansion, typically requiring a detailed business plan.

Lastly, microfinance loans are aimed at individuals or small businesses, particularly in underserved regions, to foster financial inclusion and economic growth.

How to Apply Successfully

To apply successfully for a personal loan, start by gathering all necessary documents such as valid IDs, proof of income, and bank statements. Ensure your credit score is in good standing, as this significantly impacts approval.

Conduct thorough research on various loan providers, comparing interest rates, terms, and eligibility criteria to find the best fit for your financial needs.

Preparing Required Documents

Thorough preparation of required documents is crucial to streamline the loan application process. Ensuring you have comprehensive documentation ready can significantly increase your chances of approval.

The most essential documents usually include valid IDs and proof of income. These identifiers allow lenders to verify your identity and financial stability.

Having these documents organized and readily available saves time and demonstrates your reliability and seriousness to lenders. It also minimizes the risk of delays in your loan processing, ensuring a more efficient and less stressful experience.

Choosing the Right Lender

Selecting the right lender for your personal loan is critical for ensuring favorable terms and manageable repayment conditions.

- Interest Rates: Compare interest rates from multiple lenders to find the most competitive option.

- Repayment Terms: Evaluate the flexibility and duration of repayment terms to match your financial capability.

- Eligibility Criteria: Ensure you meet the eligibility requirements before applying to avoid unnecessary rejections.

- Customer Service: Look for lenders who offer excellent customer support for a smoother loan experience.

- Reputation: Research lender reputation through reviews and ratings to gauge reliability and trustworthiness.

By prioritizing these factors, you will be better positioned to find a lender that suits your needs. Taking the time to choose the right lender ensures a more secure and less stressful borrowing experience.

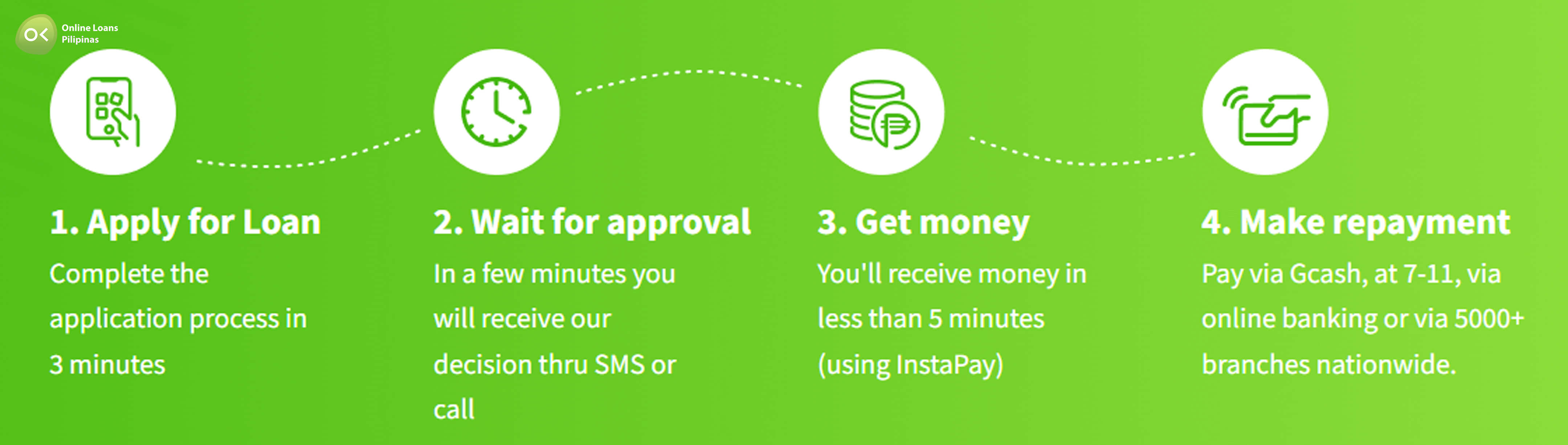

Online Loans Pilipinas is one of the reputable lending apps that checks all of the qualifications above.

Managing Loan Repayments

Regularly monitoring your payment deadlines is essential in avoiding late fees and negative impacts on your credit score.

It is recommended that you set up automated debit arrangements (ADA) to ensure timely payments, thus allowing you to focus on other financial obligations and reduce stress.

Creating a “buffer” fund can also be advantageous in mitigating ‘unexpected expenses’.

Setting a Repayment Plan

Creating a well-thought-out repayment plan is crucial in managing your personal loan effectively. This involves examining your monthly cash flow and aligning your repayment schedule with your income cycle.

Begin by evaluating your monthly income and expenses. This will help in determining the portion of your income you can comfortably allocate towards loan repayments.

It's advisable to set aside a specific amount each month to build an emergency fund. This can cover unexpected expenses without disrupting your repayment plan, ensuring continuous financial stability.

Finally, communicate proactively with your lender if you anticipate any challenges. Many lenders offer options such as loan rescheduling or restructuring, which can be invaluable in maintaining a good credit standing. By doing so, you safeguard your financial health and ensure a smoother repayment process.

Avoiding Late Fees

A proactive approach is essential in ensuring that you do not incur late fees on your personal loan repayments.

- Set up automatic payments to ensure your loan repayments are made on time each month.

- Create reminders using your mobile phone or calendar apps to alert you of upcoming due dates.

- Review your loan contract to fully understand the terms and conditions, including the grace period and late fee policy.

- Maintain a financial buffer in your account to avoid insufficient funds during automatic withdrawals.

- Communicate immediately with your lender if you are unable to meet a payment deadline.

Utilizing these practices can significantly mitigate the risk of incurring additional fees. Remember, punctual loan repayments not only save money but also enhance your credit score.

Tips for a Positive Experience

Organize your documents properly, ensuring that all required paperwork is readily available, including the completed application form, to streamline your loan application process reducing the likelihood of delays. Properly organized documentation reflects your responsibility and preparedness.

Maintain clear and open communication with your lender throughout the loan term. Engaging in transparent conversations can help prevent misunderstandings and ensure that any issues are promptly addressed.

Research on reliable financial institutions to find one with a solid reputation and favourable customer reviews.

Maintaining a Good Credit Score

A good credit score is essential for securing better loan terms and favorable interest rates. Here are some crucial steps to maintain it effectively:

- Pay your bills on time. Timely payments are the most significant factor affecting your credit score.

- Keep credit card balances low. High balances can negatively impact your credit utilization rate.

- Limit new credit applications. Too many inquiries in a short period can lower your score.

- Review your credit report regularly. Ensure accuracy and promptly dispute any errors.

- Manage debt responsibly. Avoid taking on more debt than you can handle and consistently work towards reducing existing debt. By following these strategies, you can build and maintain a strong credit profile.

Remember, maintaining a good credit score requires consistent effort and disciplined financial habits.

Knowing Your Rights

Before applying for a personal loan, it's crucial to understand your rights as a borrower in the Philippines.

Under the Consumer Act of the Philippines (Republic Act No. 7394), lenders must disclose all terms and conditions clearly. This includes interest rates, fees, and other relevant charges.

Furthermore, Republic Act No. 3765, or the Truth in Lending Act, mandates that all lenders provide full transparency on their loan agreements. Borrowers must receive a detailed statement of the loan's total cost and other related information.

It's also important to know that harassment from lenders is illegal. According to Republic Act No. 10175 or the Cybercrime Prevention Act of 2012, lenders cannot use abusive conduct or threats to collect debts.

Understanding and exercising your rights protects you from unfair practices and empowers you to make informed borrowing decisions.