Advance Loans: Quick Guide for Filipinos

In today's fast-paced world, financial emergencies can strike unexpectedly, leaving many in dire need of quick cash, prompting them to consider a personal loan for immediate relief. Cash advance loans and personal loans offer a viable solution for middle-income Filipinos who require rapid access to funds for family emergencies, providing a lifeline in critical situations. However, it’s essential to understand the terms, conditions, and potential pitfalls of any financing product before committing.

What Are Advance Loans?

Advance loans, also known as payday loans or cash advances, are short-term borrowing solutions designed to provide immediate funds, distinct from a personal loan which often offers more flexible terms. They are typically repaid on your next payday, making a cash advance an attractive option for urgent financial needs.

This type of loan, including personal loans, generally features a simple application process and quick approval times, offering significant benefits during emergencies when financial assistance is needed immediately.

Simple Definition

Advance loans, also known as payday loans, are short-term loans designed to cover immediate expenses until your next paycheck.

Some advance loans can be approved within minutes, making them ideal for urgent needs.

These cash advance loans usually come with higher APR and interest rates due to the convenience and quick turnaround, but they can be a lifesaver when used responsibly.

Borrowers should ensure they can repay the loan promptly to avoid falling into a cycle of debt, as fees and interest can accumulate rapidly if not managed.

How They Work

Advance loans and personal loans provide immediate funds by leveraging your upcoming paycheck. This setup allows for quick access to cash when needed most.

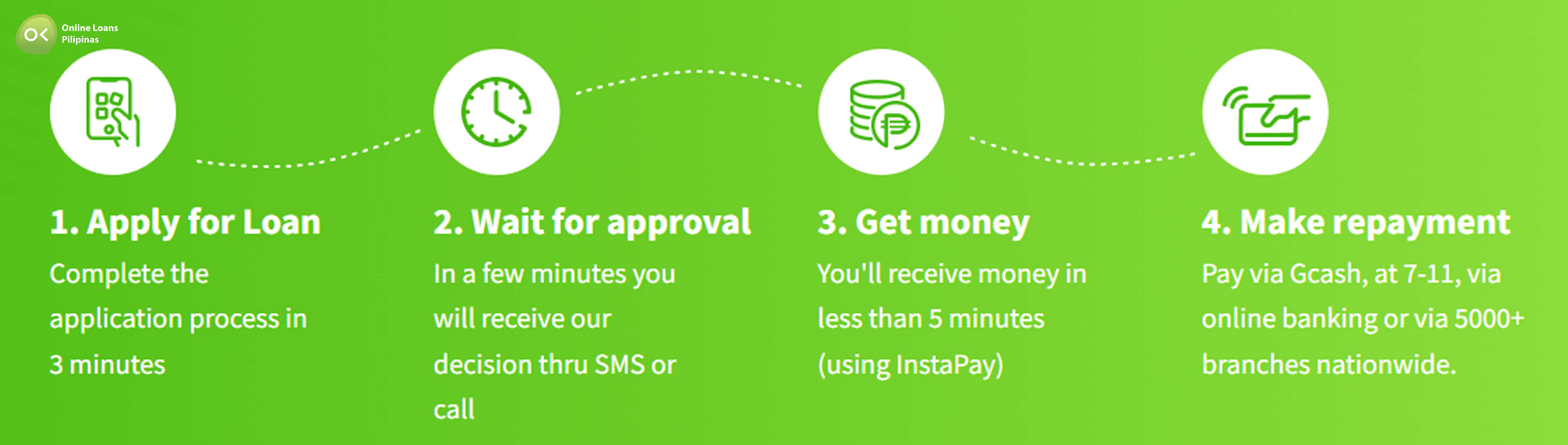

- Application Process: Typically simplified for convenience, often requiring minimal documentation.

- Approval Time: Fast, sometimes within minutes or hours after application submission.

- Repayment Terms: Usually due on the borrower's next paycheck date.

- Interest Rates and Fees: Higher than traditional loans due to the expedited nature and short term.

Once approved, the loan amount is disbursed directly to your bank account or E-wallet. This process ensures that funds are available almost immediately.

Borrowers should thoroughly understand the repayment terms to avoid additional fees. Ensure that you're financially prepared for the repayment of your cash advance to prevent a debt cycle.

Benefits of Advance Loans

Advance loans offer immediate financial relief, a crucial lifeline during emergencies, giving you access to funds within a short period. This quick disbursement can help manage unexpected expenses, providing a sense of security and stability.

In comparison with traditional loans, advanced loans, and personal loans are convenient and accessible options for those in need of quick financial relief, catering to urgent financial demands effectively. They often have a streamlined application process that minimizes the need for extensive paperwork. Furthermore, the rapid approval time means you can address urgent financial needs without enduring lengthy waiting periods typically associated with standard loan approvals.

Quick Approval

Quick approval of an advance loan is pivotal for those in urgent need of funds. Here’s a clear guide on how to achieve it:

- Complete Documentation: Ensure all required documents are prepared and submitted promptly. Missing or incomplete information can delay the approval process.

- Meet Eligibility Criteria: Verify that you meet all the lender’s eligibility requirements before applying. This might include income level, age, and credit score.

- Accurate Information: Provide accurate and truthful information on your application. Any discrepancies can cause delays or even rejection.

- Choose a Reputable Lender: Opt for a lender known for their quick processing times and reliable service.

- Follow-up: Stay in touch with the lender post-application to expedite the process if necessary. Understanding these steps can significantly shorten the loan approval timeline. Proper preparation and due diligence are key.By adhering to these guidelines, you enhance your chances of securing funds swiftly, ensuring your financial needs are met efficiently.

Flexibility

Flexibility in loan options is crucial, particularly when finances are tight and unexpected expenses arise.

Modern lending institutions offer a range of flexible loan products, allowing borrowers to choose from various repayment terms and loan amounts. These options cater to different financial circumstances, enabling individuals to select the loan structure that best suits their needs. For instance, some lenders may provide options to extend repayment tenure or adjust monthly installments.

Additionally, flexible loan terms can be a lifeline during financial emergencies. By accommodating changes in financial situations, these loans ensure that borrowers can manage payments without stressing over rigid schedules or penalties. This adaptability is particularly valuable in the dynamic economic landscape of the Philippines.

Eligibility Criteria

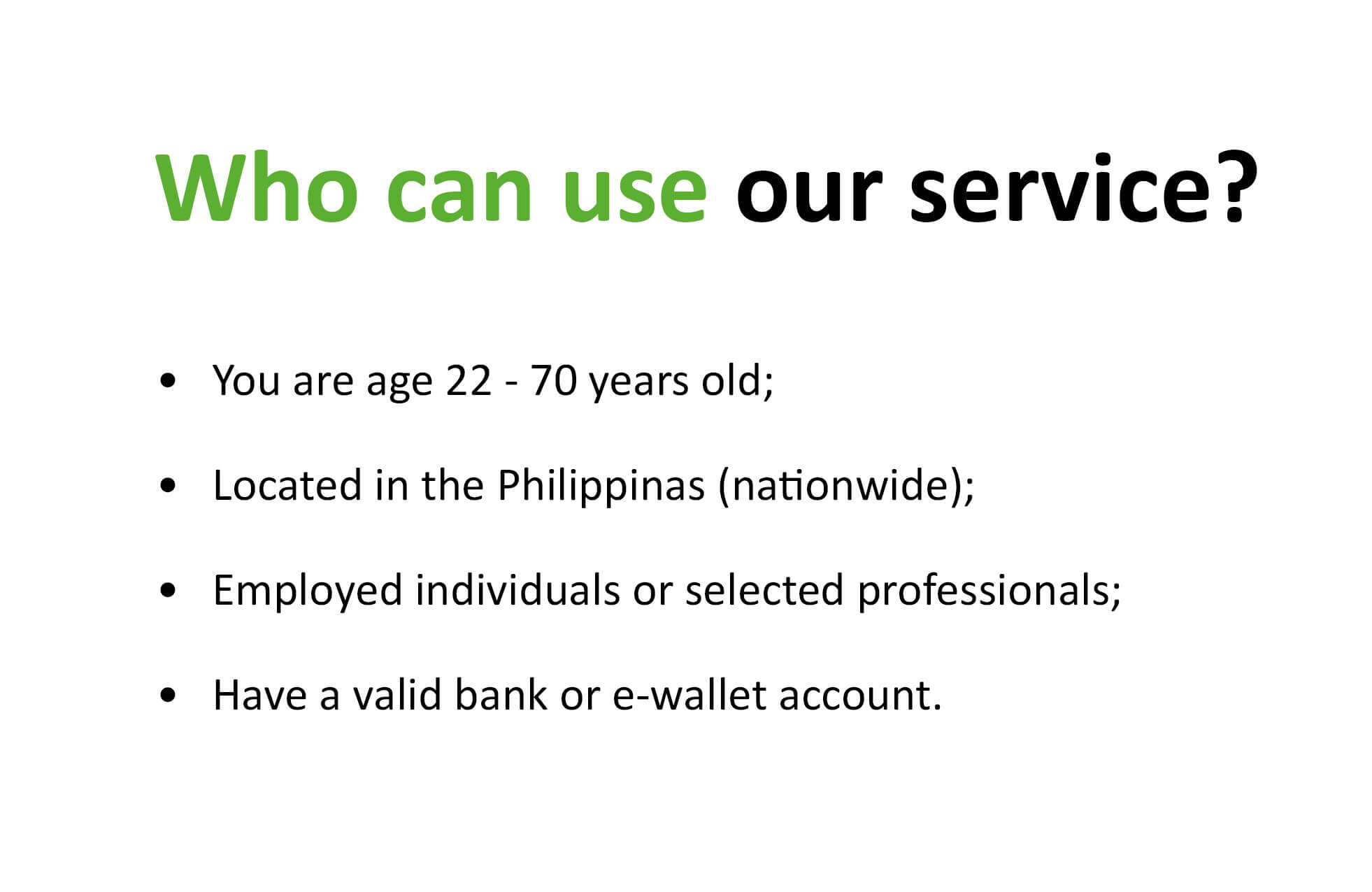

Eligibility criteria often involve minimum income requirements, a review of employment status, credit score, and age. Lenders may also check for active loans and overall financial health, to assess an applicant's capacity to repay without undue hardship.

In the Philippines, typical requirements include being at least 21 years old, having a stable income, and possessing valid identification. Evidence of residency and employment status is often requested, making it essential to have documentation ready. By having clear eligibility criteria, lenders ensure responsible borrowing and safeguard borrowers from overextending themselves financially.

Basic Requirements

For those seeking to avail an advance loan, meeting the basic requirements is crucial for a successful application.

Generally, you must be at least 21 years old and not older than 65 at the loan maturity date. This age range ensures that borrowers are legally able to contract loans and more likely to be in a stable financial position. Additionally, having a stable source of income is typically mandatory to demonstrate your ability to make regular repayments.

Applicants are also required to possess valid identification, such as a government-issued ID (e.g., Passport, Driver's License, or UMID). These IDs help verify your identity and residency status, which is essential for the lender's due diligence process. Combining these with proof of residence, such as utility bills or lease agreements, strengthens your application.

Lastly, most lenders necessitate proof of employment or business registration if self-employed. This can include recent payslips, Certificate of Employment, or business permits, ensuring your ability to sustain loan repayments. Adherence to these requirements fortifies the lender’s confidence in your financial capacity, directly influencing your loan approval and terms.

Application Process

The application process for advance loans is relatively straightforward but requires attention to detail.

Firstly, gather all the essential documentation such as valid identification, proof of income, and residency. Ensure that all the required documents are up-to-date and accurate.

Next, complete the application form provided by the lender. This can typically be done online or in-person. The form will ask for personal information, employment details, and the loan amount requested.

Upon submission, the lender will conduct a preliminary review to assess your eligibility. This involves verifying your documents and conducting a credit check to evaluate your repayment capacity.

Finally, if approved, the lender will notify you and disburse the loan amount into your specified bank account.

Risks and Considerations

Taking out an advance loan comes with a range of potential risks that borrowers must carefully assess.

For starters, advance loans typically carry higher interest rates compared to traditional loans, which can significantly increase your repayment amounts over time. Another concern is the potential for debt cycles where multiple loans overlap, exacerbating financial strain.

Lastly, always scrutinize 'hidden fees' and 'penalties' that might be associated with a cash advance loan.

High Interest Rates

High interest rates are a key characteristic of advance loans, and they can considerably affect your overall repayment amount.

- Increased Monthly Payments: High interest rates lead to higher monthly payments, putting additional pressure on your budget.

- Longer Repayment Terms: To manage high-interest payments, you might opt for longer repayment terms, which can prolong financial strain.

- Debt Accumulation: High interest rates can quickly inflate your debt, especially if you miss payments or take out multiple loans.

- Credit Score Impact: Consistently high interest payments can negatively impact your credit score if not managed properly. Given these points, it's crucial to calculate the total interest you will pay over the loan term. By understanding the implications, you can better assess whether an advance loan fits your financial situation.

Potential Debt Cycle

Borrowing repetitively can trap individuals into a continuous cycle of debt, complicating their financial stability.

Clear financial planning helps avoid scenarios where payday loans become habitual.

Advance loans, while providing quick relief, can lead to a situation where you take another loan to repay a previous one, creating a perpetual cycle of borrowing, repaying, and borrowing again.

This cyclical nature poses risks of escalating debt levels, making it increasingly difficult to break free from. Careful consideration is required when repeatedly relying on such loans, as it is paramount to assess the feasibility of sustainable repayment practices.