Finance Loan Tips for Filipino Borrowers

In the realm of financial management, comprehending the nuances of a finance loan can be likened to navigating through uncharted waters. Just as a sailor needs a map to avoid treacherous shoals, a borrower must understand the terms and conditions to steer clear of financial pitfalls.

Knowledge is power.

By grasping the essentials of finance loans, they equip themselves with the tools necessary to make informed and strategic decisions.

1. Understanding Finance Loans

A finance loan involves borrowing a loan amount from a lender and repaying it with interest over a specified tenure. Various types of finance loans cater to different financial needs and objectives, making it essential to understand the available options for informed decisions.

Loans differ in terms and conditions, with some offering fixed interest rates and others variable rates. It's also crucial to distinguish between secured and unsecured loans, as secured loans typically require collateral.

Choosing the right finance loan or personal loan requires understanding the requirements, repayment schedule, interest rates, and associated fees. Thorough research and evaluation of loan products help individuals select the most suitable solution for their financial goals.

2. Benefits of Finance Loans

Finance loans provide essential support for individuals, entrepreneurs, and businesses, offering immediate access to funds and flexible repayment terms. This flexibility allows manageable monthly payments aligned with the borrower’s income cycle. Consistent repayments can improve credit scores, creating a positive credit history and future financial opportunities. Ultimately, finance loans represent an investment in personal, business, or home growth, leading to long-term success.

3. Steps to Apply for a Finance Loan

Applying for a finance loan requires a methodical approach, beginning with researching various financial institutions. Prospective borrowers should compare interest rates, repayment terms, and eligibility criteria to find the best fit.

Next, gather essential documents like identification, proof of income, and credit history. Complete the lender's application form and submit it online or at a branch. After submission, patience is key as the lender reviews the application and documentation before making a final decision.

3.1. Preparing Documents

Compiling the necessary documents ensures a smoother loan application process and reflects financial responsibility.

A well-organized set of documents significantly increases the chances of swift loan approval.

Proof of income, credit history, identification, and asset documentation top the checklist for most lenders. Gather these meticulously to avoid delays.

Ensuring accuracy and completeness in document submission showcases your commitment and redoubles trust in your financial capability.

3.2. Choosing the Right Lender

Choosing the right lender that offers a welcome finance package is crucial for financial well-being and should be a principal consideration for any borrower. Aligning with a lender's terms, interest rates, and repayment structures is essential. Borrowers should compare multiple lenders to make an informed decision.

Transparency is key; exploring customer reviews can gauge a lender's reputation and reliability, reducing risks and ensuring a smoother loan experience.

By prioritizing personal finance needs and aligning them with the right financing options, borrowers can confidently secure a lender that supports both immediate and long-term financial health, fostering stability and future opportunities.

4. Interest Rates and Fees

Understanding interest rates and fees is crucial when taking out a personal loan. Interest rates represent the cost of borrowing and vary by lender, influenced by credit scores and repayment terms. Higher rates can increase the total repayment amount, so comparing rates is essential.

Fees, such as application, processing, or prepayment penalties, can significantly impact the overall loan cost. Borrowers should meticulously review these details to make informed financial decisions, ensuring their loan remains sustainable and manageable over its term.

5. Repayment Options

Understanding repayment options is crucial for managing a finance loan. Options include fixed monthly payments, adjustable payments, or income-based repayments, each with its own advantages.

Automatic deductions ensure timely payments and improve credit scores. Discussing options with a financial advisor helps tailor the choice to one's financial situation and goals. Informed decisions foster financial growth and stability.

6. Tips for Loan Approval

Securing a finance loan may seem daunting, yet several strategies can increase your chances of success.

Applicants should present a reliable credit report to showcase financial responsibility, as lenders scrutinize credit history to gauge repayment capacity. Timely bill payments, diverse loan types, and low credit balances are beneficial.

Demonstrating a stable income is crucial. Lenders prefer applicants with consistent employment and steady income, supported by payslips, tax returns, or bank statements.

Personal savings reflect financial discipline and enhance credibility. An emergency fund or significant savings reassure lenders of the applicant's ability to manage finances and handle unforeseen circumstances, solidifying trustworthiness.

Online Loans Pilipinas: Best Finance Loan

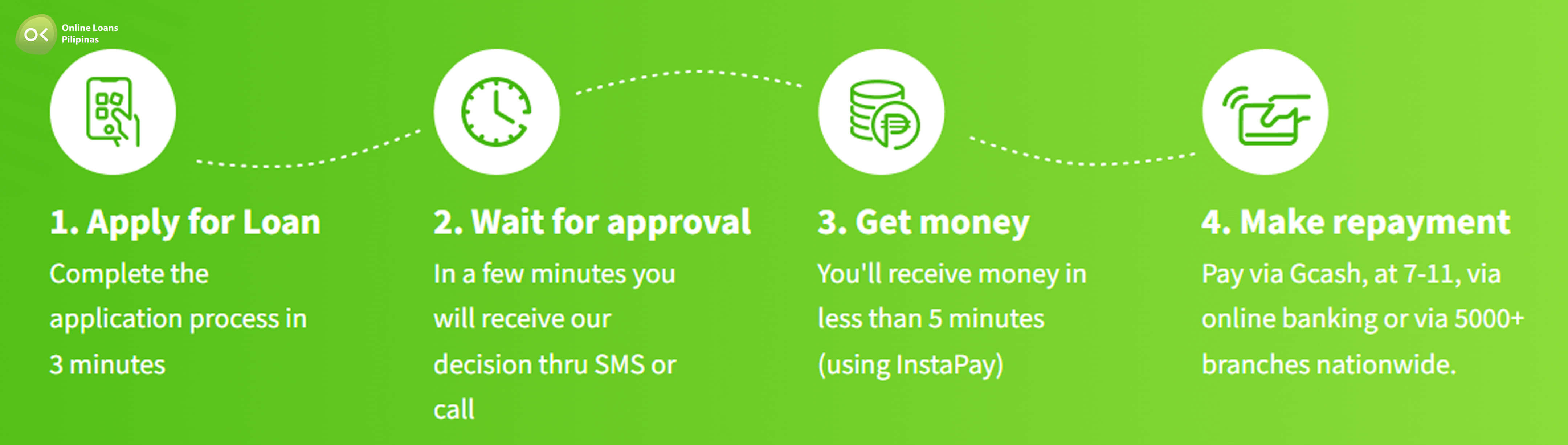

Online Loans Pilipinas stands out as the best finance loan option for several reasons. Firstly, it offers a streamlined application process that can be completed entirely online, providing convenience and speed for borrowers. This eliminates the need for lengthy paperwork and in-person visits.

The swift approval process provides decisions within minutes, ideal for immediate financial needs. The platform also offers flexible loan amounts and repayment terms to suit various borrower profiles.

Online Loans Pilipinas offers transparent terms with no hidden fees, ensuring borrowers understand their commitments. The platform also provides excellent customer support, guiding applicants and addressing concerns promptly.

The company's reliability and positive customer reviews make it a preferred choice. Combining convenience, speed, flexibility, transparency, and strong customer service, Online Loans Pilipinas is an exceptional finance loan option.