Best Personal Loans Online: Fast Approval Process

Imagine climbing a tall mountain only to find unexpected obstacles; this can feel like searching for financial solutions.

Thankfully, with the emergence of personal loans online, individuals now have access to flexible and straightforward options for managing their finances efficiently.

Understand Personal Loans Online

Navigating personal loans online, when informed, is like finding a well-lit path through a forest, inspiring confidence in securing credit and financial aid. These loans bridge the gap between need and opportunity.

Digital platforms have simplified the borrowing experience, offering transparency and speed, eliminating undue stress. Understanding eligibility criteria, interest rates, and repayment terms is essential as they differ among lenders.

Ultimately, the convenience and accessibility of a personal loan empower individuals to achieve their goals with optimism.

Benefits of Choosing Online Personal Loans

Opting for personal loans online offers numerous advantages that enhance the borrowing experience.

Since 2016, trusted online lenders have developed systems prioritizing user convenience, positioning themselves as practical alternatives to traditional banking.

Borrowers can apply for loans at their own pace, bypassing time-consuming bank visits. These platforms foster transparency, allowing easy comparison of interest rates and terms, enabling informed decisions without in-person pressure.

Online personal loans provide immediate, user-friendly, and efficient financial solutions tailored to modern needs.

How to Apply for Personal Loans Online

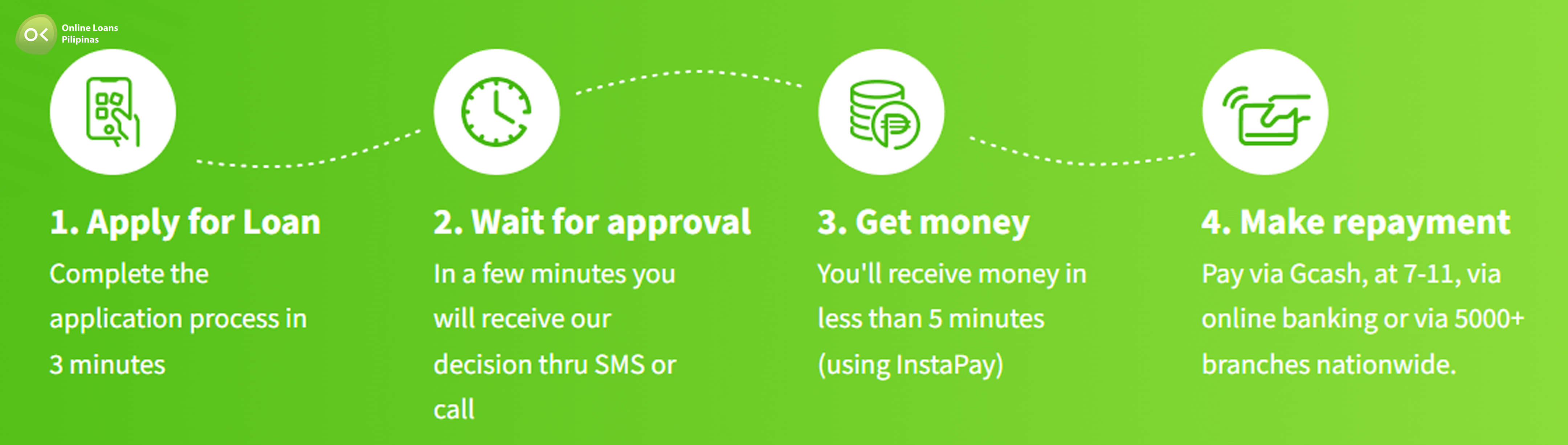

Applying for personal loans online can significantly streamline the borrowing process and provide immediate access to funds.

To begin, one should start by researching and selecting trusted online lenders known for their transparent terms and favorable conditions.

Next, gather all necessary documents such as identification, proof of income, and bank statements to ensure a smooth application process.

Utilize the lender's website to fill out the application form. This step is often user-friendly and can be completed in minutes.

Lastly, submit the application and closely monitor any communication from the lender. Approval and fund disbursement can often occur swiftly.

Tips for Finding Affordable Personal Loans Online

Finding the perfect loan solution begins with research:

- Shop Around and Compare Lenders: Explore various websites to find competitive rates and favorable terms.

- Examine Beyond Interest Rates: Look into processing fees and repayment flexibility for a comprehensive understanding.

- Check for Promotional Offers: Seek discounts and offers that can impact the affordability of personal loans online.

- Compare Online Reviews: Gain insights from other borrowers’ experiences.

- Ensure Transparent Lending Practices: Verify there are no hidden costs and evaluate lenders’ customer service reputations.

- Use Aggregator Platforms: Leverage platforms that provide personalized loan recommendations using advanced algorithms and data-driven insights.

By adhering to these strategies, anyone can confidently navigate the online lending landscape and secure affordable personal loans that empower their financial journey toward a brighter future.

Platforms to Find Personal Loans Online

In the digital age, securing financial assistance has become more accessible through various online platforms offering diverse options tailored to individual needs.

Noteworthy websites for personal and business loans include:

- Bank of the Philippine Islands (BPI): Offers comprehensive loan packages with transparent terms and competitive rates.

- Security Bank: Known for its user-friendly interface and swift approval processes.

- Citi Philippines: Provides flexible loan terms, emphasizing user satisfaction and efficiency.

The key to finding an ideal loan, especially for the self-employed, is thorough research. Exploring multiple online platforms helps individuals identify the best options that match their unique requirements..

Online Loans Pilipinas Offers the Best Personal Loan Online

Online Loans Pilipinas stands out by combining competitive rates, user-friendly processes, and exceptional customer service, making it the best choice for personal loans online.

|

Competitive Interest Rates: Online Loans Pilipinas provides some of the most competitive interest rates in the market, ensuring affordability for borrowers. |

|---|

|

User-Friendly Application Process: The platform offers a seamless and intuitive application process, allowing users to apply for loans quickly and easily. |

|

Fast Approval and Disbursement: With a streamlined approval process, borrowers can receive their funds promptly, often within the same day. |

|

Transparent Terms and Conditions: Online Loans Pilipinas ensures transparency in their lending practices, with no hidden fees or unexpected charges. |

|

Flexible Repayment Options: Borrowers can choose from a variety of repayment plans that best suit their financial situation. |

|

Excellent Customer Support: The platform is known for its responsive and helpful customer service, providing support throughout the loan process. |

|

Promotional Offers and Discounts: Regular promotional offers and discounts make their loans even more affordable. |

|

Advanced Security Measures: Online Loans Pilipinas employs robust security protocols to protect borrowers' personal and financial information. |

|

Positive Customer Reviews: Numerous positive reviews from satisfied customers highlight the reliability and effectiveness of their services. |

|

Personalized Loan Recommendations: The platform uses advanced algorithms to provide tailored loan options that meet individual needs. |

Final Thoughts

In the blog post titled "Best Personal Loans Online: Fast Approval Process," readers are guided through the advantages of securing personal loan online, emphasizing the speed and efficiency of the approval process. The post highlights the convenience of online applications, the competitive interest rates, and the flexibility of loan terms. It aims to inspire confidence in potential borrowers by showcasing how online personal loans can meet their financial needs swiftly and effectively.