Top 5 Best Online Loans: Instant Approval Options

Securing financial assistance can be as straightforward as clicking a button.

Like a lifeline thrown to someone adrift, online loans offer timely support.

For individuals seeking the best online loans with instant approval, there are a plethora of reliable options available.

What Are Instant Approval Online Loans?

Instant approval online loans are financial products that expedite the process of obtaining quick cash.

In 2016, fintech advancements, a remarkable industry breakthrough, allowed clients to access fast cash solutions within minutes, revolutionizing how people secured funds.

Today, it's not unusual for wary borrowers to feel reassured by the swift convenience of instant approval loans, eliminating the once laborious wait times traditionally associated with loan applications.

Many online lenders leverage cutting-edge algorithms and artificial intelligence to approve loans in as little as 3 minutes, offering an unprecedented combination of speed, security, and financial flexibility.

These innovations have paved the way for more accessible and efficient borrowing options for many people.

Benefits of Instant Approval Loans

Instant approval loans offer quick financial relief, gaining popularity since 2016 for their swift processing and ease of access. They bypass traditional loan procedures, providing immediate cash for emergencies or planned investments, ensuring financial stability when needed most.

These loans feature user-friendly online platforms, enhancing the borrowing experience with efficiency and minimal stress. Advanced algorithms ensure speed and security, fostering trust among borrowers.

Overall, instant approval loans bridge financial gaps effortlessly, instilling confidence in those who need quick financial solutions.

How to Qualify for Instant Approval Loans

Eligibility criteria for instant approval loans vary by lender, requiring attention to specific requirements. Typically, borrowers need to show stable income, good credit history, and valid identification. These factors help lenders assess risk and creditworthiness.

Maintaining a consistent credit score, clearing debts, and providing accurate documentation like bank statements and proof of employment can expedite approval and increase success chances.

Understanding and preparing for these requirements enhances the likelihood of instant approval, aligning with lenders' expectations and empowering borrowers with prompt financial solutions.

Comparing Interest Rates and Fees

Examining interest rates, fees, repayment terms, and loan amount is crucial when selecting the best online loans instant approval options. Interest rates vary among lenders, affecting total repayment amounts. Some offer fixed rates, while others provide variable rates.

Borrowers should also consider fees like origination, late payment penalties, and prepayment charges, which impact overall loan costs. A thorough analysis helps in making informed decisions, ensuring an affordable and manageable loan.

Prioritizing these comparisons empowers borrowers to achieve successful financial outcomes.

Application Process for Instant Approval Loans

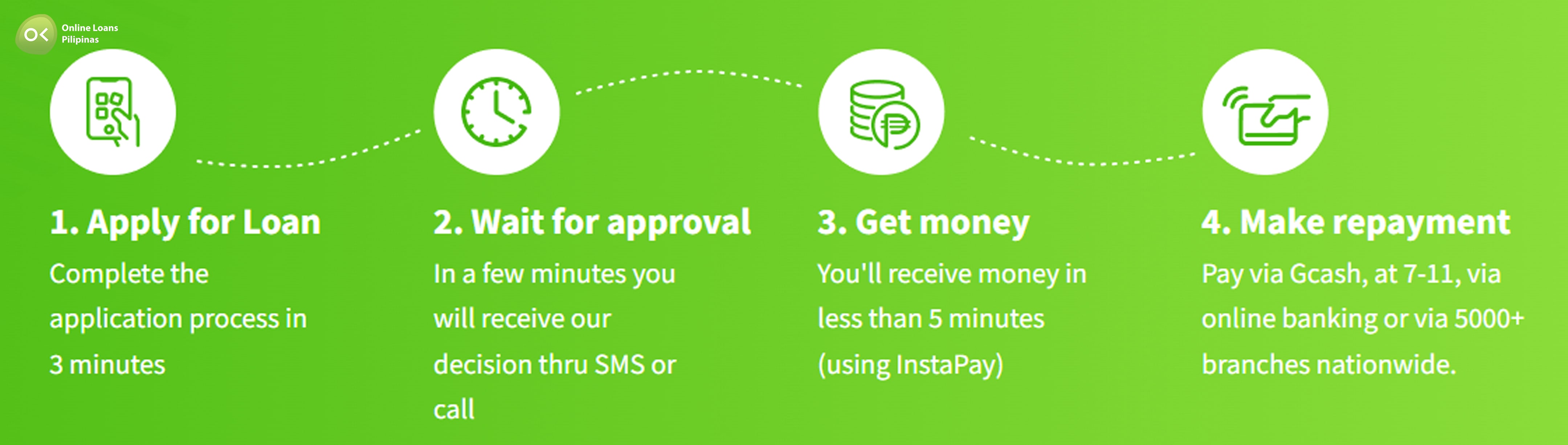

Applying is quick and straightforward.

Applicants fill out an online form requiring personal, employment, and financial information, including the desired loan amount. Lenders may also request supporting documents like ID and proof of income. The process is designed for efficiency, prioritizing convenience and speed.

Fast verification and fast approval ensure swift processing.

Instant approval loans use advanced digital verification to quickly cross-check details, providing almost immediate feedback. If criteria are met, approval can occur within minutes, with funds disbursed directly to the borrower’s bank account.

This seamless process showcases financial technology advances, reassuring borrowers they can secure necessary funds promptly and focus on broader financial goals without delays.

Documents Needed for Application

Securing the best online loans with instant approval involves preparing necessary documents.

Applicants need to ensure they have valid identification. This typically includes a government-issued ID, such as a passport, driver's license, or national ID card.

Additionally, proof of income is paramount. This often entails recent payslips, a certificate of employment, or if self-employed, bank statements showing consistent earnings over the past few months.

Applicants are also required to submit proof of residence. Utility bills, lease agreements, or bank statement copies with the applicant's address are commonly accepted as valid proof.

Gathering these documents beforehand streamlines the application process, fast-tracking approval and fund disbursement.

Understanding Loan Terms and Conditions

Understanding loan terms and conditions is critical.

When considering the best online loans with instant approval, scrutinize the fine print. Lenders have varying terms that impact the loan experience. Key aspects include the interest rate, repayment schedules, and penalties for late payments.

Understand the difference between fixed and variable interest rates to make an informed decision and assess the impact of the interest rate on your total repayment amount. Also, be aware of hidden fees like processing fees, prepayment penalties, and late payment charges. Comprehensive knowledge of these terms helps borrowers choose a loan that aligns with their financial situation and repayment capabilities.

Managing Repayments Effectively

Effective management of loan repayments is essential to maintaining financial health, reducing stress, and building a stronger credit profile. Borrowers need to prioritize their loan repayments.

Tips for Managing Loan Repayments

- Set up automatic payments to avoid missed deadlines.

- Maintain a budget that includes loan repayments.

- Create a separate savings account for loan repayments.

- Regularly review and renegotiate loan terms.

- Proactively manage repayments to build a strong credit history.

Risks Associated with Instant Approval Loans

While instant approval loans offer quick access to funds, borrowers must remain cautious and understand the potential risks involved. These loans, although convenient, often carry high interest rates.

In addition, some lenders may impose hidden fees and charges. Borrowers should thoroughly read all terms and conditions to understand each term clearly.

Borrowers who opt for instant approval loans should be mindful of the potential for escalating debt. It is essential to assess their ability to repay under the specified terms before proceeding.

Ultimately, the allure of quick funding should not overshadow the importance of financial diligence. By exercising prudence and carefully evaluating all loan options, individuals can secure the financial assistance they need while safeguarding their economic well-being. This conscientious approach fosters a balanced and informed decision-making process.

What to Expect from the Top Providers

In today's fast-paced world, securing a loan quickly and efficiently is crucial. Here are the top 5 best online loans with instant approval options, designed to meet various financial needs:

1. Online Loans Pilipinas

Online Loans Pilipinas is known for its fast and efficient loan approval process. With a focus on customer satisfaction, they offers instant approval loans with flexible repayment options, making it an excellent choice for those seeking quick financial solutions.

2. Tala Philippines

Tala offers quick and easy loans through its mobile app. With a user-friendly interface and a straightforward application process, Tala provides instant approval and disburses funds directly to your bank account or through cash pick-up points.

3. Cashalo

Cashalo is a popular choice for Filipinos seeking fast and reliable online loans. Their platform offers instant approval and flexible repayment terms, making it a convenient option for those in need of immediate financial assistance.

4. GCash

GCash, a leading mobile wallet in the Philippines, also offers GCredit, an instant loan service. With GCredit, users can access funds quickly and enjoy the convenience of managing their loans directly through the GCash app.

5. Home Credit

Home Credit provides instant approval loans with competitive interest rates. Their online application process is simple, and they offer a range of loan products to suit different financial needs, from personal loans to gadget financing.

These top 5 best online loans with instant approval options provide a seamless and efficient way to access funds when needed. Whether for personal expenses, emergencies, or business needs, these platforms ensure a hassle-free borrowing experience.

Securing the best online loans with instant approval can be straightforward with the right steps:

- Maintain a Good Credit Score: Ensure a pristine credit history to bolster approval chances.

- Organize Necessary Documents: Gather identification proofs, income verifications, and residential proofs before applying.

- Have a Stable Income: Ensure consistent and verifiable earnings to reassure lenders of repayment ability.

- Research Lenders: Choose lenders that specialize in your financial profile to align with their criteria and increase approval likelihood.