Loan Online Review: Pros, Cons, and Tips

Securing a loan online is like opening a door to countless opportunities. Are you ready?

In this loan online review, we’ll navigate through the various benefits and potential drawbacks of using loan apps.

By understanding both sides, especially when it comes to using loan apps, you can make informed choices that align with your financial goals.

Understanding Online Loans

Online loans have redefined access to financial solutions, offering unparalleled convenience and speed for Filipinos seeking immediate funds. Traditionally, individuals had to visit physical banks to apply for loans, but online loans have revolutionized this process with easier accessibility and faster approval times. Catering to diverse needs, from personal emergencies to business investments, these loans eliminate cumbersome paperwork and lengthy waiting periods.

Remarkably, online loans promote financial inclusion, reaching even remote areas. Leveraging technology, lenders provide quick assessments and same-day disbursements, efficiently addressing urgent financial needs. This innovation empowers individuals to overcome financial hurdles and contributes to the broader economic growth of the Philippines.

Pros of Applying for Loans Online

Understanding the advantages and disadvantages of online loans can help you make an informed decision. Here's a comprehensive look at the pros and cons of securing a loan online.

Pros

- Convenience and Accessibility Applying for a loan online can be done from the comfort of your home, eliminating the need to visit a physical bank. This convenience is particularly beneficial for those with busy schedules or limited mobility.

- Speedy Approval Process Online loans often boast faster approval times compared to traditional loans. Many online lenders can process applications and disburse funds within a few hours or days, making them ideal for urgent financial needs.

- Competitive Interest Rates Due to lower overhead costs, online lenders can offer competitive interest rates. This can result in significant savings over the life of the loan, especially for borrowers with good credit scores.

- Flexible Loan Options Online lenders typically provide a variety of loan products tailored to different needs, from personal loans to business financing. This flexibility allows borrowers to find a loan that best suits their specific requirements.

- Transparent Terms and Conditions Many online lenders prioritize transparency, providing clear and detailed information about loan terms, fees, and repayment schedules. This helps borrowers make well-informed decisions without hidden surprises.

Potential Drawbacks to Consider

Cons

While online loans offer convenience, they come with notable drawbacks.

- Security Concerns Sharing personal and financial information online can pose security risks. It's crucial to ensure that the lender uses robust encryption and security measures to protect your data.

- Potential for Scams The online lending space can attract fraudulent entities. Borrowers must be vigilant and conduct thorough research to verify the legitimacy of the lender before applying.

- Limited Customer Support Unlike traditional banks, online lenders may offer limited customer support options. This can be a drawback if you prefer face-to-face interactions or need immediate assistance.

- Higher Interest Rates for Poor Credit While online loans can offer competitive rates, borrowers with poor credit scores may still face higher interest rates. It's essential to compare offers from multiple lenders to find the best deal.

- Shorter Repayment Terms Some online loans come with shorter repayment terms, which can result in higher monthly payments. Borrowers should carefully assess their ability to meet these payments to avoid financial strain.

In conclusion, online loans offer a convenient and efficient way to access funds, but they come with their own set of challenges. By weighing the pros and cons, you can determine if an online loan is the right choice for your financial needs.

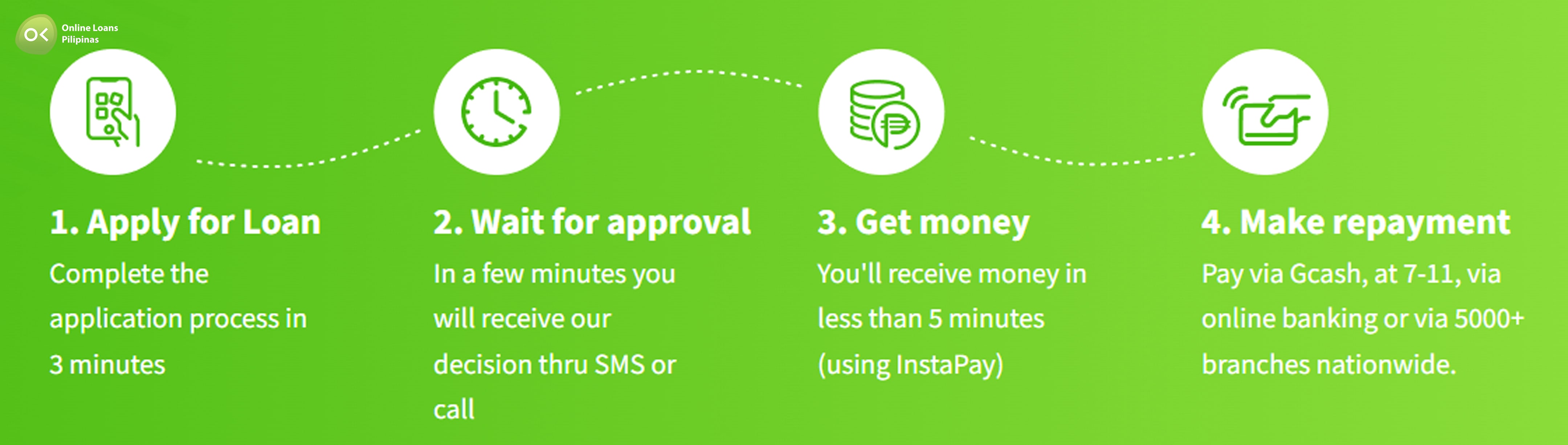

Steps to Apply for an Online Loan

Embarking on your journey toward financial empowerment, following a few streamlined steps can secure the financial aid you need.

Start by researching reputable online lenders, comparing reviews, interest rates, repayment terms, and application processes on their loan app to find the best match for your needs. Prepare necessary documents like identification, proof of income, and bank statements to streamline your application.

Fill out the online form accurately, double-checking entries to avoid delays. Stay responsive to follow-up communications from the lender. With clarity and preparation, securing an online loan can be efficient and rewarding, helping you achieve your financial goals.

Common Terms in Online Loan Agreements

Understanding common terms aids borrowers immensely.

The loan amount, or principal, is the sum you borrow, determining your total repayment with interest. The interest rate is the annual percentage charged on the principal. Repayment terms dictate your payment schedule.

The Annual Percentage Rate (APR) includes both the interest rate and additional fees. Payment frequency, whether monthly or bi-monthly, affects cash flow management. Understanding these terms empowers informed borrowing decisions.

Interest Rates and Fees Comparison

In online loans, interest rates, fees, and collateral requirements are crucial for the borrower. Comparing these factors helps borrowers find cost-effective options. Since 2016, many financial institutions have offered varied rates and fees online, influenced by market conditions and policies.

Understanding lender reputability and transparency is essential, as some may have hidden fees despite lower rates. Reviewing the loan agreement thoroughly prevents unexpected charges and aids informed decisions.

This careful approach ensures you secure a loan that aligns with your financial goals.

Security Measures for Online Loans

Ensuring the safety of online transactions is crucial.

Lenders use advanced encryption technologies like SSL and multi-factor authentication to protect user data. Compliance with industry standards and local regulations, such as the Data Privacy Act in the Philippines, ensures diligent protection of consumer information. Dedicated security teams monitor and address potential threats.

These robust measures allow borrowers to confidently navigate the digital landscape, fostering trust and ensuring a safe borrowing experience.

Tips for First-Time Online Borrowers

Entering the world of online loans?

First, research and compare multiple lenders to find the best interest rates, repayment terms, and resources through the app. Always read the fine print to understand all fees, interest rates, and repayment schedules, and clarify any ambiguities with the lender.

Utilize budgeting tools offered by lenders to track your loan and ensure timely repayments. These tips help first-time borrowers navigate the lending process confidently, ensuring a secure and satisfying borrowing experience.

Online Loans Pilipinas: A Reliable Loan Online

In the ever-evolving financial landscape, Online Loans Pilipinas stands out as a reliable option for those seeking quick and convenient financial solutions. Offering a seamless online application process, this platform caters to a wide range of financial needs, from personal emergencies to business investments.

Why Choose Online Loans Pilipinas?

- User-Friendly Application Process The platform's intuitive interface makes it easy for users to apply for loans from the comfort of their homes. The application process is straightforward, requiring minimal documentation and effort.

- Fast Approval and Disbursement One of the standout features of Online Loans Pilipinas is its speedy approval process. Borrowers can receive approval within minutes and have funds disbursed on the same day, making it ideal for urgent financial needs.

- Competitive Interest Rates Online Loans Pilipinas offers competitive interest rates, ensuring that borrowers get the best possible deal. This affordability makes it a preferred choice for many Filipinos.

- Flexible Repayment Terms The platform provides flexible repayment options, allowing borrowers to choose terms that best suit their financial situation. This flexibility helps in managing monthly payments more effectively.

- Robust Security Measures Ensuring the safety of personal and financial information, Online Loans Pilipinas employs advanced encryption technologies and complies with local regulations like the Data Privacy Act in the Philippines.