Get a Fast Loan in 15 Minutes - Quick Cash!

- Understanding Fast Loans

- Safety Tips for Taking Urgent Loans

- Plan for Repayment

- Seek Professional Advice

When urgent financial needs arise, a fast loan in 15 minutes offers a quick and convenient solution. This speedy process ensures you can access the necessary funds without the hassle of a lengthy credit check, applications, and waiting periods. Whether it's an unexpected medical bill, car repair, or any other emergency expense, these fast loans provide a lifeline when you need it most. With minimal paperwork and a straightforward application process, you can secure the money you need and get back to focusing on what matters.

Understanding Fast Loans

A fast loan is a type of short-term loan designed to provide immediate financial relief. Unlike traditional loans that may take days or even weeks to process, fast loans can be approved and disbursed within a very short period, often in as little as 15 minutes.

Benefits of a Fast Loan

|

Benefit |

Description |

Advantage |

|---|---|---|

|

Quick Access to Funds |

Immediate access to cash during emergencies. |

Provides crucial financial support when needed most. |

|

Minimal Paperwork |

Requires less documentation compared to traditional loans. |

Simplifies and speeds up the application process. |

|

Convenient Application Process |

Often completed online with a straightforward procedure. |

Saves time and effort, making it easier to apply. |

|

Flexible Repayment Options |

Offers various repayment terms to suit different financial situations. |

Allows borrowers to choose a plan that fits their budget. |

|

No Collateral Required |

Unsecured loans that don't need collateral. |

Reduces risk for borrowers, making it accessible to more people. |

|

Improves Credit Score |

Successful repayment can positively impact credit scores. |

Enhances future creditworthiness and access to other types of credit. |

|

Peace of Mind |

Provides assurance of quick financial support during stressful times. |

Allows borrowers to focus on resolving their financial issues without added stress. |

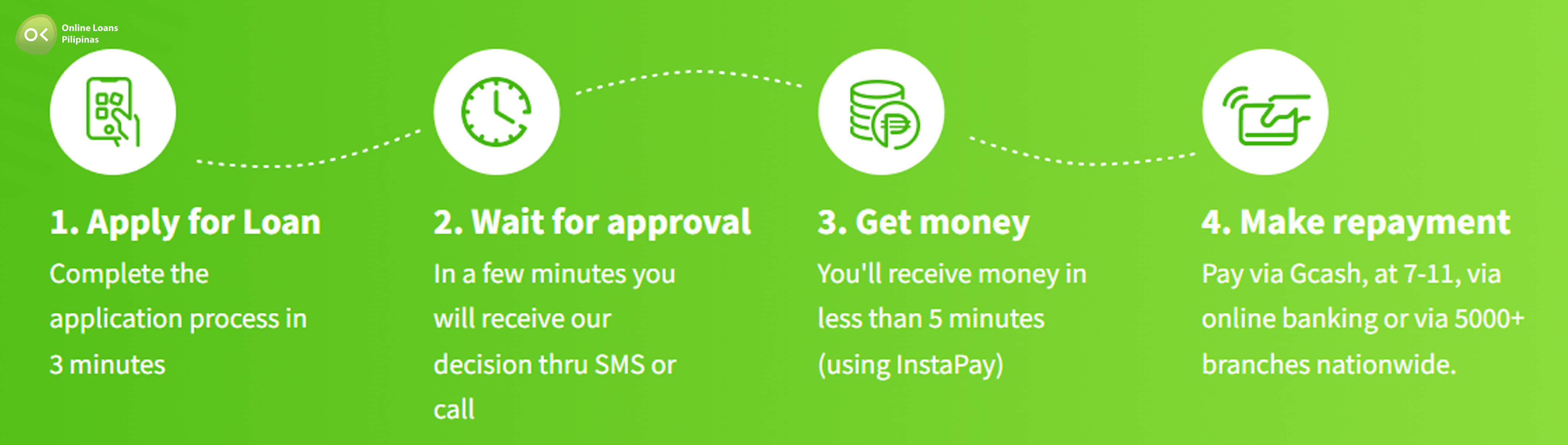

How to Apply for Fast Loans

- Research Lenders: Start by researching reputable lenders that offer fast loans. Look for reviews and ratings to ensure they offer genuine instant loan services.

- Check Eligibility: Review the eligibility criteria for the loan. Common requirements include being of legal age, having a stable income, and possessing a valid ID in the Philippines.

- Gather Necessary Documents: Prepare the required documents, such as proof of income, identification, and bank statements. Having these ready, along with meeting any additional requirements, will speed up the application process.

- Fill Out the Application: Complete the loan application form, either online or in person. Ensure all information is accurate to avoid delays.

- Submit the Application: Submit your application along with the necessary documents. Some lenders may require additional verification steps.

- Wait for Approval: Once submitted, the lender will review your application. Approval times can vary, but many fast loans offer decisions within minutes.

- Receive Funds: If approved, the funds will be transferred to your bank account, often within 15 minutes. Make sure to review the interest rate, loan terms and conditions before accepting the funds.

- Repay the Loan: Follow the agreed-upon repayment schedule to repay the loan. Timely payments can help improve your credit score and establish a good relationship with the lender.

Eligibility Criteria for Fast Loans

- Age Requirement: Applicants must be of legal age, typically 18 years or older.

- Stable Income: Proof of a stable income is usually required to ensure the borrower can repay the loan. This can include salary slips, bank statements, or tax returns.

- Valid Identification: A valid government-issued ID, such as a passport, driver's license, or national ID card, is necessary to verify the applicant's identity.

- Bank Account: Applicants must have an active bank account where the loan amount can be deposited and from which repayments can be made.

- Residency Status: Proof of residency, such as utility bills or lease agreements, may be required to confirm the applicant's address.

- Credit History: While some fast loans do not require a perfect credit score, having a good credit history can improve the chances of approval and may result in better loan terms.

- Contact Information: A valid phone number and email address are often required for communication purposes and to receive loan updates.

- No Outstanding Loans: Some lenders may require that applicants do not have any outstanding loans or significant unpaid debts to qualify for a new loan.

Safety Tips for Taking Urgent Loans

Read the Fine Print

Carefully read the terms and conditions of the loan agreement, including interest rates, fees, and repayment terms, to fully understand your obligations.

Avoid Over-Borrowing

Only borrow the amount you need and can afford to repay. Over-borrowing can lead to financial strain and difficulty in meeting repayment obligations.

Check for Hidden Fees

Be aware of any hidden fees, such as origination fees, late payment penalties, or early repayment charges, to avoid unexpected costs.

Verify Security Measures

Ensure the lender's website uses secure encryption methods to protect your personal and financial information during the application process.

Understand Repayment Terms

Make sure you fully understand the repayment schedule and terms. Know when payments are due and the consequences of missing a payment.

Keep Personal Information Private

Never share your personal or financial information with unverified sources. Protect your identity by using secure and trusted platforms.

Plan for Repayment

Create a realistic repayment plan to ensure you can meet your loan obligations without compromising your financial stability.

Seek Professional Advice

If you're unsure about taking an urgent loan, consider seeking advice from a financial advisor to explore other options and make an informed decision.

Monitor Your Credit

Regularly check your credit report to ensure there are no errors or fraudulent activities related to your loan. This helps maintain your credit health.

Online Loans Pilipinas: The Best Fast Loan in 15 minutes

When it comes to securing quick financial assistance, Online Loans Pilipinas stands out as the top choice. Here’s why they offer the best fast cash loan:

1. Unmatched Speed

Online Loans Pilipinas provides a fast loan in 15 minutes, ensuring you can address financial emergencies quickly. The streamlined online process eliminates lengthy paperwork and in-person visits.

2. User-Friendly Application

The simple, online application process saves you time and effort, allowing you to focus on resolving your financial needs.

3. Flexible Loan Options

Choose from a range of loan amounts to suit various financial requirements, whether for minor expenses or significant needs.

4. Transparent Terms

All loan terms and conditions are clearly communicated, with no hidden fees, building trust and confidence among borrowers.

5. Convenient Repayment

Flexible repayment plans fit your budget and schedule, reducing financial stress.

6. Excellent Customer Support

A dedicated customer support team is available to assist with any questions or concerns, ensuring a smooth borrowing experience.

7. Positive Feedback

Numerous positive testimonials highlight the reliability and efficiency of Online Loans Pilipinas, making it a trusted choice for fast cash loans.

Final Thoughts

Online Loans Pilipinas offers the best fast cash loans due to their unmatched speed, user-friendly application process, flexible loan options, transparent terms, convenient repayment plans, and excellent customer support. When you need quick financial assistance, trust Online Loans Pilipinas to deliver a fast loan in 15 minutes, ensuring you can handle any financial emergency with ease.

A fast loan in 15 minutes is a type of loan that provides quick access to funds, typically within 15 minutes of loan approval.

You can apply for a fast loan by researching reputable lenders, checking eligibility criteria, gathering necessary documents, and completing an online or in-person application.

Commonly required documents include proof of income, valid identification, bank account details, proof of residency, and contact information.

Eligibility criteria usually include being of legal age, having a stable income, possessing a valid ID, having an active bank account, and providing proof of residency.

If approved, you can typically receive the funds in your E-wallet or bank account within 15 minutes.

While a good credit score can improve your chances of approval and better loan terms, some fast loans do not require a perfect credit score.

Yes, fast loans may come with fees such as origination fees, late payment fees, or early repayment penalties. Always review the loan terms and conditions carefully.