Get Fast Loans Now with Instant Approval

Imagine needing immediate funds to seize a once-in-a-lifetime business opportunity or to cover an unexpected expense with a competitive comparison rate. Fast loans can provide the quick financial support you need to act without delay. In this blog post, we'll delve into the different fast loan options available in the Philippines, ensuring you have the knowledge to make prompt and informed financial decisions.

Fast Loans: 4W1H (What, When, Where, Why and How)

What Are Fast Loans?

Fast loans provide quick access to funds for urgent expenses like medical bills or car repairs. They feature rapid approval, minimal documentation, and short-term repayment periods. Often applied for online or via mobile apps, fast loans offer immediate financial relief with funds typically transferred directly to your bank account.

When to use Fast Loans?

In financial emergencies, such as sudden medical expenses or urgent home repairs, fast loans can be a lifesaver thanks to their competitive comparison rate. They offer immediate access to necessary funds, allowing individuals to handle unexpected costs without delay.

Business owners can also find fast loans advantageous for seizing time-sensitive opportunities. Whether it's purchasing inventory or capitalizing on a hot market trend, quick financial support can lead to profitable outcomes.

For students or parents managing educational expenses, fast loans can ease financial strain, often providing a favorable comparison rate that makes them an attractive option. These loans can cover tuition, books, and other academic costs timely, ensuring continued education without interruption.

During financial transitions, such as moving to a new city for a job, fast loans provide much-needed stability. They bridge financial gaps, offering resources for relocation expenses and initial living costs.

Moreover, during holiday seasons or special occasions, fast loans can assist in creating memorable experiences. They ensure individuals don't miss out on celebrations or important life events due to temporary cash flow issues.

Therefore, while caution and responsible borrowing are essential, the strategic use of fast loans can positively impact financial and personal endeavors. Their timely aid can turn potential setbacks into stepping stones for success.

Where to apply for fast loans?

Online Lending apps are quick loans that offer quick and convenient financial solutions.

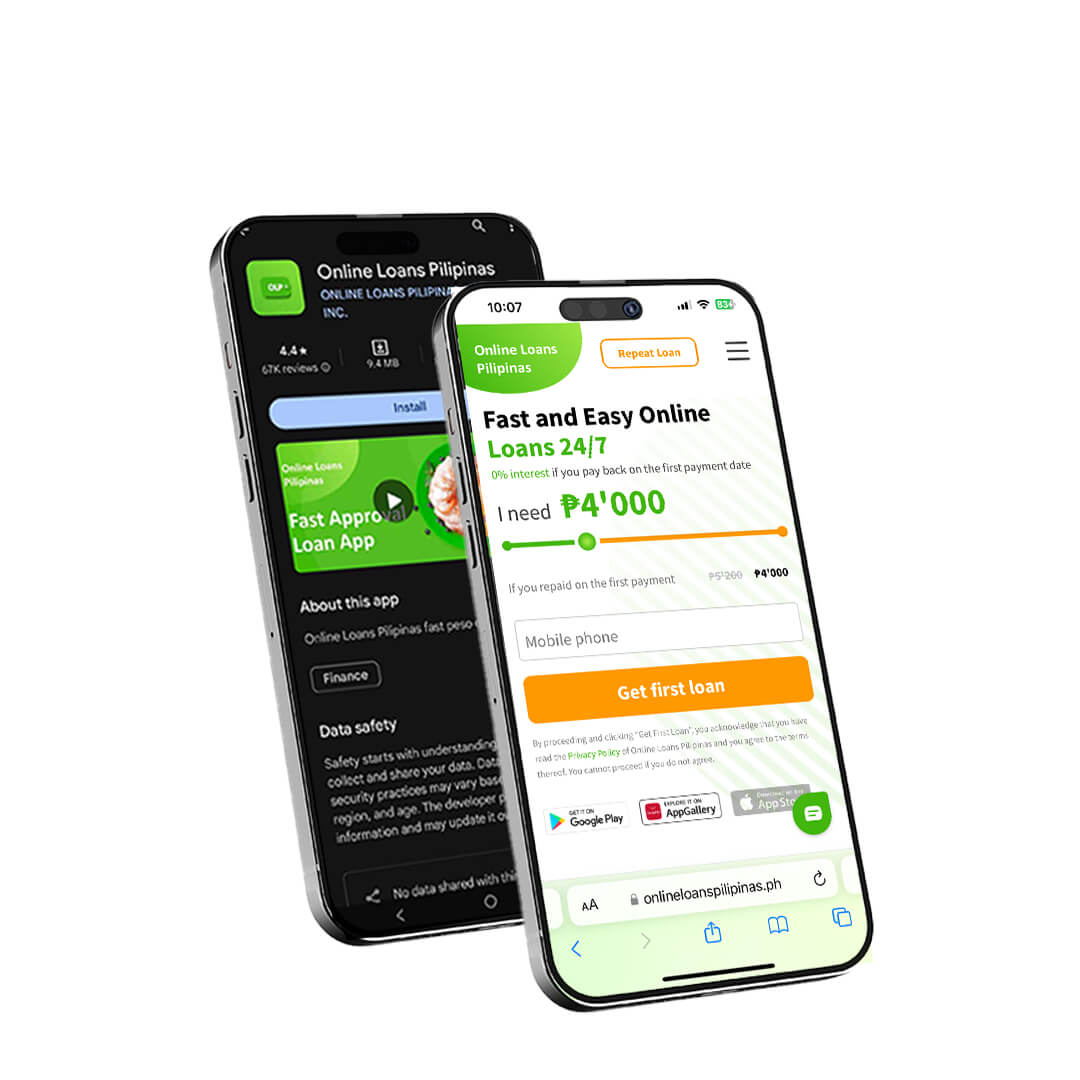

Online Loans Pilipinas: Your Go-To for Fast Loans

Online Loans Pilipinas is revolutionizing the way Filipinos access fast loans. With their seamless process, you can tackle any financial emergency head-on. Don't let unexpected expenses catch you off guard—download the app today and experience the convenience of fast loans at your fingertips!

Traditional banks are one of the most common places individuals can explore.

While traditional banks may have slightly stringent criteria, they often provide competitive interest rates and attractive comparison rates, along with personalized service. Additionally, online lenders have become a popular choice, offering faster loan approval processes and flexible terms suited to various needs.

Credit unions can be a great alternative.

People seeking quicker approval might find payday loans providers advantageous. These lenders specialize in providing cash advances for short-term needs, ensuring the funds are accessible almost immediately. Furthermore, some financial technology companies offer fast loans with streamlined application processes via mobile applications or websites.

Lastly, peer-to-peer lending platforms offer another viable pathway for securing a fast loan.

These platforms connect borrowers with individual investors who are willing to fund loans, often resulting in quicker processing times compared to conventional institutions. By exploring these varied options, individuals can find the perfect fast loan solution suited to their unique circumstances.

Why Opt for Fast Loans?

Fast loans offer quick access to funds, minimal documentation, and rapid approval, often providing competitive comparison rates, making them ideal for urgent finance needs. They provide immediate relief for unexpected expenses and are easily accessible through online applications or mobile apps.

How can fast loans help in emergencies?

In moments of unexpected crises, fast loans can become a valuable resource, providing quick financial relief when it's most needed. These loans are designed to be accessible, ensuring that borrowers can address urgent situations without delay.

Furthermore, they often come with simplified application processes. This means that potential borrowers can bypass the usual cumbersome paperwork and lengthy waiting periods typically associated with traditional loans.

Such rapid accessibility ensures that individuals facing medical emergencies or abrupt travel needs can secure funds promptly. Fast loans help maintain peace of mind during times of uncertainty, offering a financial safety net.

Given their expedited approval times, these loans also support businesses facing sudden operational shortfalls. Entrepreneurs can bridge the gap between expenses and income with minimal disruption to their business.

Moreover, the flexibility of fast loans means borrowers can tailor the loan terms to their specific needs. Whether it's a short-term financial hiccup or a more extended necessity, these loans cater to a wide range of financial demands.

Ultimately, the quick accessibility of funds alleviates stress and enables individuals and businesses to navigate and overcome emergencies confidently. Fast loans are an expedient solution for unpredictable financial challenges.

Common Pitfalls to Avoid

While fast loans can be a convenient solution for urgent financial needs, they come with several potential pitfalls.

|

Pitfall |

Description |

Advice |

|---|---|---|

|

High Interest Rates |

Fast loans often come with significantly higher interest rates than traditional loans. |

Compare rates from multiple lenders and consider the total cost of borrowing before committing. |

|

Short Repayment Terms |

These loans usually require repayment within a short period, which can strain your finances. |

Plan your budget carefully to ensure you can meet the repayment schedule without difficulty. |

|

Hidden Fees and Charges |

Some lenders may include hidden fees that increase the overall cost of the loan. |

Read the loan agreement thoroughly and ask the lender to clarify any unclear terms or fees. |

|

Risk of Predatory Lenders |

In urgent situations, you may encounter lenders who exploit your need with unfavorable terms. |

Research lenders' reputations and choose only those with positive reviews and transparent practices. |

|

Potential for Debt Cycle |

Difficulty in repaying fast loans can lead to taking out additional loans, creating a cycle of debt. |

Borrow only what you need and have a clear repayment plan to avoid falling into a debt trap. |

Summary

Looking for quick financial assistance? Our blog post on "Get Fast Loans Now with Instant Approval" provides essential information on how to secure fast loans with minimal hassle. Learn about the benefits of instant approval, the application process, and tips to ensure a smooth experience. Perfect for those in urgent need of funds, this guide will help you navigate the world of fast loans efficiently.