Best Personal Loan Calculator: Pinoy Financial Tips

When it comes to managing finances, understanding the ins and outs of personal loans is crucial. A personal loan can help cover unexpected expenses, consolidate debt, or fund significant life events. However, it's essential to make informed decisions to avoid financial pitfalls. A personal loan calculator can be an invaluable tool for Filipinos looking to make informed financial decisions. In this guide, we'll explore the best personal loan calculators available, compare their features, and provide tips on how to use them effectively to manage your finances better.

Key details about the Personal Loan Calculator

What is a Personal Loan Calculator?

A personal loan calculator is an online tool that helps you estimate your monthly loan payments, total interest, and overall cost of a loan. By inputting details such as loan amount, interest rate, and loan term, you can get a clear picture of what to expect financially.

Why Use a Personal Loan Calculator?

Using a personal loan calculator offers several benefits:

- Financial Planning: It helps you plan your budget by providing an estimate of your monthly payments based on the interest rate.

- Comparison: You can compare different loan offers to find the best deal.

- Interest Savings: By understanding the total interest, you can make better decisions to save money.

How to Use Loan Calculators in Loan Apps

Using a loan calculator in a loan app is simple. Here’s how you can do it:

- Download the App: Install the loan app from the Google Play Store or Apple App Store.

- Open the Loan Calculator: Navigate to the loan calculator feature within the app.

- Enter Loan Details: Input the loan amount, interest rate, and loan term.

- Calculate: Tap the calculate button to see your estimated monthly payments and total interest.

Tips for Choosing the Best Personal Loan

- Compare Interest Rates: Look for the lowest interest rates to minimize your total cost.

- Check Fees: Be aware of any additional fees that may apply.

- Read Reviews: Research customer reviews to gauge the lender's reputation.

- Consider Loan Terms: Choose a loan tenure that fits your financial situation.

Top Loan Apps That Use Loan Calculators

In today's digital age, managing finances, understanding eligibility, and your credit score have become more convenient with the help of loan apps. These apps not only offer quick access to personal loans but also come equipped with loan calculators to help you make informed decisions. Here are some of the top loan apps in the Philippines that feature loan calculators.

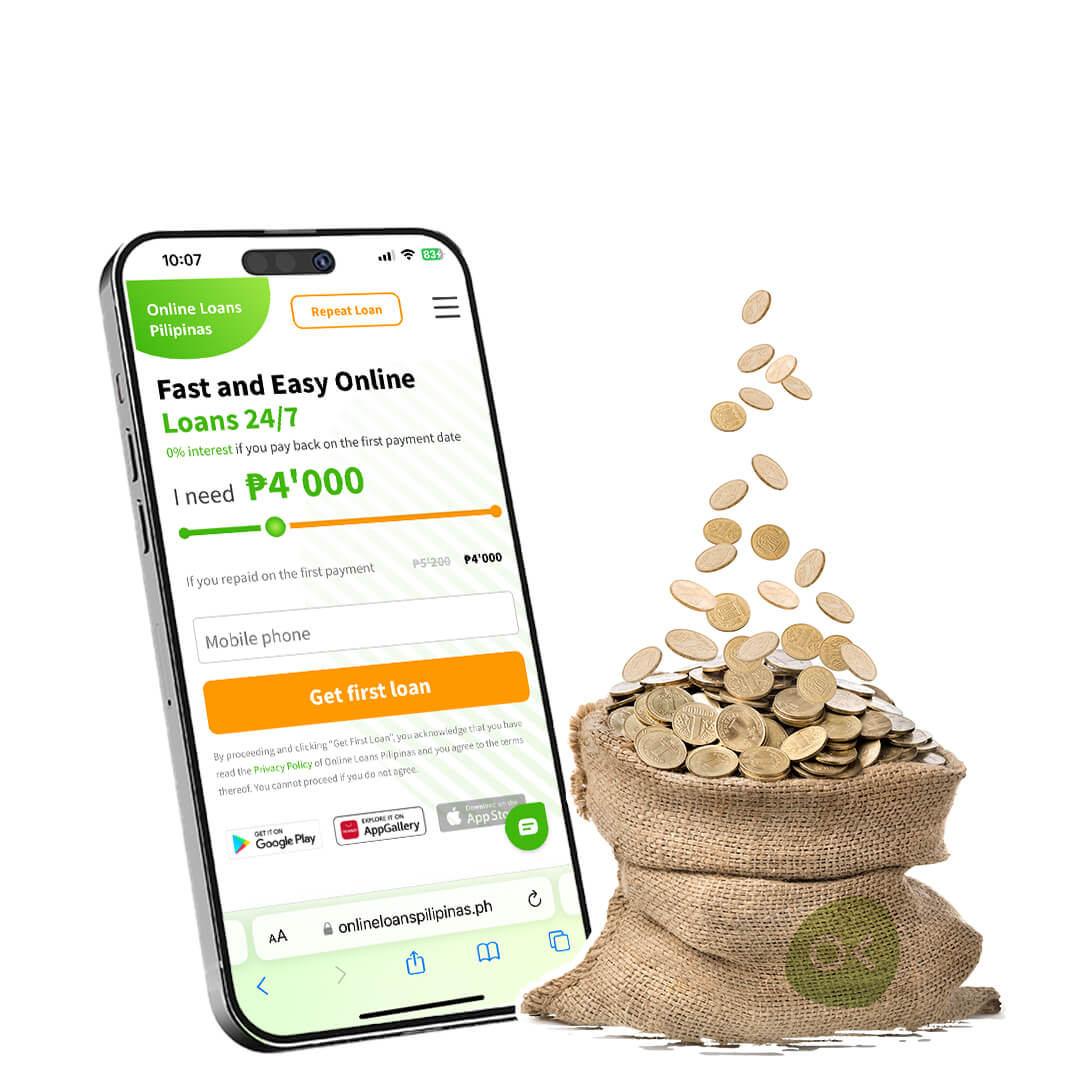

1. Online Loans Pilipinas

Online Loans Pilipinas provides easy access to personal loans with a focus on speed and convenience. The app includes a loan calculator to help you understand your loan terms and repayment schedule.

- Features:

- Fast approval process

- Transparent loan terms

- User-friendly loan calculator

- Website: Online Loans Pilipinas

2. Cashalo

Cashalo is a popular loan app in the Philippines that provides quick and easy access to personal loans. The app includes a loan calculator to help you estimate your monthly payments and total loan cost.

- Features:

- Fast loan approval

- Flexible repayment terms

- User-friendly loan calculator

- Website: Cashalo

3. Tala Philippines

Tala offers small, short-term loans to Filipinos with a straightforward application process. The app includes a loan calculator to help you understand your repayment schedule and interest.

- Features:

- Quick disbursement

- Transparent fees

- Easy-to-use loan calculator

- Website: Tala Philippines

4. Home Credit

Home Credit is known for its consumer financing options, including personal loans. The app features a loan calculator that allows you to estimate your monthly payments and total interest.

- Features:

- Flexible loan options

- Instant approval

- Comprehensive loan calculator

- Website: Home Credit

5. MoneyCat

MoneyCat offers fast and convenient personal loans with a simple application process. The app includes a loan calculator to help you plan your finances effectively.

- Features:

- Quick loan processing

- No collateral required

- Detailed loan calculator

- Website: MoneyCat

Conclusion

The blog post titled "Best Personal Loan Calculator: Pinoy Financial Tips" provides valuable insights into selecting the best personal loan calculator for Filipinos. It emphasizes the importance of using a personal loan calculator to make informed financial decisions, comparing different calculators available, and offering tips on how to maximize their benefits. The post aims to help readers understand the features and advantages of various personal loan calculators to manage their finances effectively.

Loan calculators are valuable tools that provide useful estimates for potential borrowers. Their accuracy, however, can vary depending on several factors.

First, it is essential to understand that loan calculators often make certain assumptions. These assumptions may not always align perfectly with the terms and conditions of specific lenders.

For instance, calculators typically use a standard interest rate and fixed repayment schedules. However, lenders may offer variable interest rates or have different repayment structures that influence the overall cost of the loan.

Additionally, fees and charges, such as processing fees and management fees, may not be factored into the calculator's estimates. These additional costs can significantly affect the total loan amount and monthly payments.

Despite these limitations, loan calculators offer a valuable starting point for borrowers. They provide a general sense of affordability and help in planning financial decisions effectively.