Loan App Fast Approval: Quick Cash Today!

Imagine driving on a smooth highway without any bumps or obstacles to slow you down, that’s what using a fast loan app feels like. It's designed to get you to your destination quickly and efficiently.

With the fast loan app, there's no need to navigate through complicated paperwork or endless queues. You can apply for a loan at any time, from anywhere in the country, using only your smartphone, and even enjoy free coupons as part of the app's special promotions.

This app offers an intuitive interface and streamlined processes that make loan approval seamless. It’s specifically tailored to meet the needs of middle-income Filipinos seeking quick financial solutions.

Understanding Fast Loan App

Fast Loan App, such as Online Loans Pilipinas and Cashalo, revolutionized how middle-income Filipinos approach borrowing, offering unparalleled convenience and speed. It simplifies the loan application process, offering options for monthly installments and eliminating the traditional hurdles such as extensive paperwork and prolonged approval times.

By leveraging digital technology and advanced fintech algorithms, the Fast Loan App provides a seamless experience. Users can expect quick decisions on their applications, often within hours. This efficiency ensures timely financial support, whether for emergencies or other urgent needs.

The Fast Loan App provides effortless, hassle-free borrowing—eliminating the need to borrow money through tedious paperwork or long queues.

Instant loan approval decisions enhance financial accessibility for middle-income earners in the Philippines.

Users benefit from a streamlined, user-friendly mobile interface designed to simplify the entire borrowing process. With just a few taps, you can submit your loan application swiftly and securely.

Additionally, Cashalo utilizes advanced algorithms to evaluate applications in real-time, ensuring you receive your funds promptly, often within hours, thus providing immediate financial relief when you need it most.

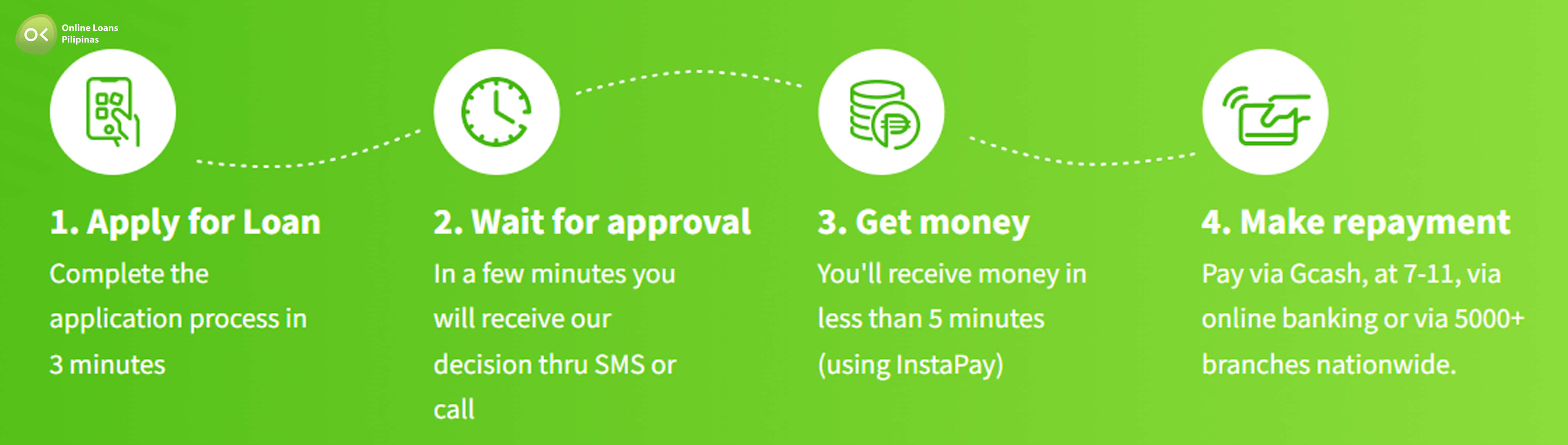

Steps to Apply for a Loan

First, download the Fast Loan App from the Google Play Store or Apple App Store. Register by creating an account using your valid email address and a secure password.

Next, navigate to the loan application section within the app. Here, you will need to fill out a form that includes personal information, employment details, and loan amount desired. Ensure that all information provided is accurate to facilitate smooth processing.

Once the form is complete, submit it through the app. You will receive a confirmation message, and the loan application will be reviewed promptly.

Quick Registration Process

The process is remarkably swift.

Upon downloading the Fast Loan App, the first step is to register for an account. The app requires only a few essential details to set up your profile, such as your valid email address and a secure password. The user-friendly interface guides you effortlessly through each step, making it seamless even for those who are not tech-savvy.

Enter all required details accurately.

It is worth noting that the Fast Loan App's registration process is designed to minimize the time spent on redundant tasks. This efficiency allows users to focus more on their loan application rather than struggling with lengthy registration forms.

Verification is a critical component of the registration process. The Fast Loan App employs robust verification methods to ensure the authenticity of user information, which not only enhances security but also expedites the entire process. Hence, registrants can rest assured that their data is handled with the utmost confidentiality and precision.

Document Requirements

To ensure a smooth loan application process, the following documents are needed for verification:

- Valid Government-Issued ID: This can include a driver's license, passport, national ID and other government issued ID.

- Proof of Residence: A recent utility bill, barangay certificate, or lease contract will suffice.

- Income Statement: Latest pay slips, bank statements, or any official document reflecting regular income.

- Selfie: You are required to take a selfie for identity verification purposes.

Submitting these documents accurately expedites the approval of your loan application. Ensure that all submitted copies are clear and legible to prevent any delays. Properly preparing these documents ahead of time will streamline your application process, ensuring a quicker decision.

Benefits of Using Fast Loan App

Speed and Convenience: A hallmark of contemporary practicality, Fast Loan App offers rapid approval. Users can experience minimal waiting times, leveraging technology to facilitate a seamless application process and instant access to needed funds, thereby enhancing financial flexibility.

User-Friendly Interface: Fast Loan App features an intuitive design, making it accessible even to those with limited technological proficiency. From application submission to fund disbursement, every step is streamlined, ensuring a hassle-free experience and immediate financial support when necessary.

Swift Approval Time

Fast Loan App ensures swift approval, minimizing waiting periods.

- Submit Requirements: Upload verified documents via the app.

- Automated Evaluation: The system instantly reviews your application.

- Quick Notification: Receive immediate approval status.

- Rapid Disbursement: Funds are credited straight to your bank account or E-wallet. These steps exemplify the fast and efficient process, setting new standards in loan approvals. Experience unparalleled convenience with expedited approval times, ensuring your financial needs are swiftly met.

Competitive Interest Rates

Fast Loan App offers highly competitive interest rates, designed to fit the financial needs of Filipinos.

Since 2016, Fast Loan App has been committed to providing transparent and affordable loan options. By leveraging advanced algorithms and financial technology, the app ensures that borrowers receive fair interest rates tailored to their credit profiles.

In addition, the app provides detailed information and easy-to-use calculators to help you understand your loan terms better. This way, you can make informed decisions, knowing exactly what to expect in terms of repayments and charges.

Ultimately, competitive interest rates from Fast Loan App empower you to meet your financial goals without excessive cost.

Ensuring Loan Approval

Getting approved through Fast Loan App is streamlined by understanding key eligibility criteria. Ensuring that all necessary documents are complete and accurate enhances your chances significantly. Clear communication of your financial history also plays a critical role in the approval process.

Additionally, maintaining a good credit score boosts the likelihood of swift approval. Fast Loan App's algorithms evaluate creditworthiness, so it’s advisable to regularly check and correct any discrepancies in your credit report. By doing so, you're presenting a solid financial profile that stands a higher chance of acceptance.

Improving Your Credit Score

Improving your credit score and overall credit profile is integral to securing loans on favorable terms. But how does one go about enhancing their creditworthiness?

Firstly, paying your bills on time is crucial. Lenders view timely payments as an indicator of reliable financial behavior. Delinquent payments or defaults can severely affect your credit score.

Secondly, managing your debt efficiently can make a substantial difference. Keeping your credit card balances low relative to your credit limit demonstrates prudent management. High balances can signal financial distress.

It's also wise to avoid applying for multiple credit accounts in quick succession. Each application generates a hard inquiry, which can lower your score temporarily. Instead, focus on keeping existing accounts in good standing.

Lastly, regularly reviewing your credit report ensures accuracy. Discrepancies or errors can negatively impact your score, so swift correction is vital. A clean report enhances your loan approval prospects.

Maintaining Accurate Personal Information

Ensuring the accuracy of your personal information is critical for swift loan approval with apps like Cashalo.

- Update your contact details: Ensure your phone number, email, and address are current.

- Review your identification documents: Verify that IDs such as your passport or driver’s license are up-to-date.

- Check your financial information: Regularly review and update employment and income details.

- Monitor your credit report: Regularly check for any discrepancies or outdated information.

Accurate personal information streamlines the verification process, reducing delays in loan approval.

A proactive approach to maintaining your details enhances your credibility with lenders.

In today’s fast-paced financial landscape, mobile applications cater to the urgent need for instant loans with greater efficiency. One prominent app offering this service is Online Loans Pilipinas, known for its user-friendly interface and rapid processing times. The app is designed to cater to the borrowing needs of middle-income Filipinos.

Online Loans Pilipinas enables users to apply for loans up to PHP 30,000 with minimal documentation. The approval process is typically completed within minutes, making it a reliable option for those who need quick access to funds. Users are required to fill out a few personal details and provide a valid ID to complete the application.

While these apps provide convenience, responsible borrowing must remain a priority. It is crucial to understand the repayment terms, interest rates, and potential penalties for late repayment. Opt for these instant loan options in emergencies, always keeping financial health in balance.