Money Loan FAQs: Quick Guide for Filipinos

In the midst of an ever-evolving financial landscape, Filipinos need reliable website options for securing funds. The right money loan can provide timely support and open avenues for growth.

Loans are essential for achieving financial stability, as their effective uses can bridge gaps and create opportunities.

As of 2024, financial institutions in the Philippines offer a broad spectrum of money loan options, catering to varying needs and circumstances.

Understanding Money Loans

Money loans serve as financial lifelines for many Filipinos addressing diverse needs. In the Philippines, options include personal, business, and housing loans, each tailored to specific requirements.

These loans are crucial for achieving personal and professional goals. Understanding key features like interest rates and repayment terms is essential.

Choosing the right money loan helps individuals seize opportunities and manage financial challenges effectively. With thorough research on financial websites and discernment, money loans can transform lives and drive progress.

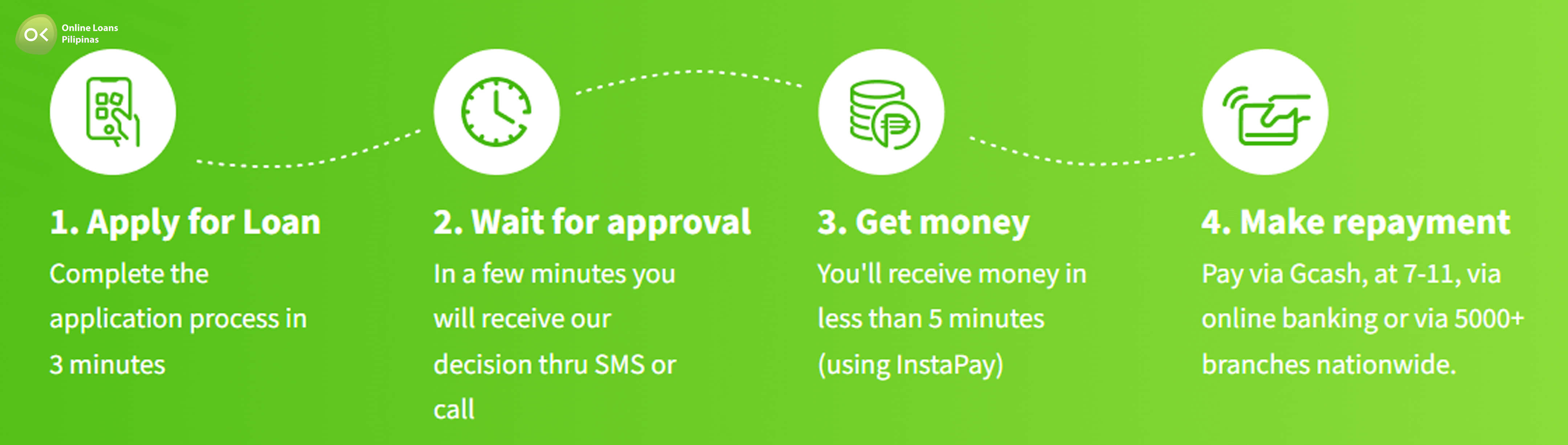

How to Apply for a Money Loan

Applying for a money loan involves several key steps that ensure both the borrower and lender are protected.

First, potential borrowers must gather necessary financial documents, such as payslips, tax returns, proof of identity, and details of their bank account. These documents will verify their ability to repay the loan.

Next, they should research different lenders and loan options by visiting each lender's website. Each lender offers varying interest rates, terms, and conditions, making it crucial to find the best fit for their financial situation.

Once a suitable lender is identified, the borrower can complete the loan application either online or at a physical branch. Accurate and thorough information speeds up the approval process.

Finally, after submission, the lender will evaluate the application. Approved applicants will then receive the loan amount, while the terms of repayment will be clearly articulated for transparency.

Requirements for Loan Approval

Securing a money loan is a streamlined process when one understands the necessary requirements and uses this knowledge to their advantage.

In the Philippines, lenders generally assess an applicant's creditworthiness by examining their financial history and stability. They often require payslips or employment certificates as proof of steady income.

Additionally, applicants need to present valid government-issued IDs to authenticate their identity. These may include a Philippine passport, driver’s license, or a Unified Multi-Purpose ID (UMID).

Collateral documentation is sometimes required, depending on the loan type. For secured loans, assets like property titles or vehicle registration papers may need to be submitted as part of the collateral.

Carefully compiling these documents will significantly enhance an applicant's chances of a swift and favorable approval.

Interest Rates and Fees

Understanding the interest rates, finance charges, and fees associated with a money loan is crucial. It empowers borrowers to make informed decisions and manage their finances effectively.

Interest rates can differ depending on the type of loan selected.

Banks and financial institutions typically offer competitive rates, while alternative lenders may present higher fees to compensate for riskier loans with flexible terms.

Borrowers should thoroughly compare different loan options to find the ones that offer the most favorable interest rates and minimal fees, as well as how these loans may affect their credit score. Financial literacy is key—being well-versed in the cost implications allows for a more calculated approach to debt repayment. Knowing the intricacies of interest and fees not only fosters financial responsibility but also alleviates unnecessary stress.

Repayment Options

Repayment options for a money loan are diverse, catering to various financial situations and borrower preferences.

One popular choice is the fixed monthly installment, which offers predictability and stability, allowing borrowers to plan their finances confidently.

Another favorable alternative is the flexible payment scheme, which adjusts according to the borrower’s income flow, providing relief during financially challenging months.

For those looking to pay off their loans early, some institutions offer prepayment benefits, enabling them to save on interest and reduce the overall debt burden more swiftly.

By understanding and choosing the right repayment option, borrowers can take control of their financial journey and experience peace of mind.

Risks and Considerations

Understanding risks is essential.

While securing a money loan can provide immediate financial relief, there are inherent risks. One major concern is the potential for accruing substantial interest and fees, which can escalate quickly if not managed wisely. Borrowers, however, can mitigate these risks by thoroughly researching their options and choosing reputable lenders.

High interest rates pose challenges.

It is crucial to assess one's repayment capability - lest they find themselves trapped in a cycle of debt accumulation due to high-interest rates.

Another factor to consider is loan terms continuity—specific loans may have stringent conditions that could impact one’s financial flexibility.

Being aware of these potential pitfalls illustrates the importance of astute financial planning. By proactively addressing these considerations, individuals can navigate the world of money loans confidently, transforming short-term solutions into long-term financial health.

Choosing the Right Money Loan

Choosing the right money loan requires careful analysis of various factors, including interest rates, repayment terms, and lender reputation. Borrowers should prioritize a loan that aligns with their financial goals. Reputable lenders are crucial in this decision-making process - they ensure transparency.

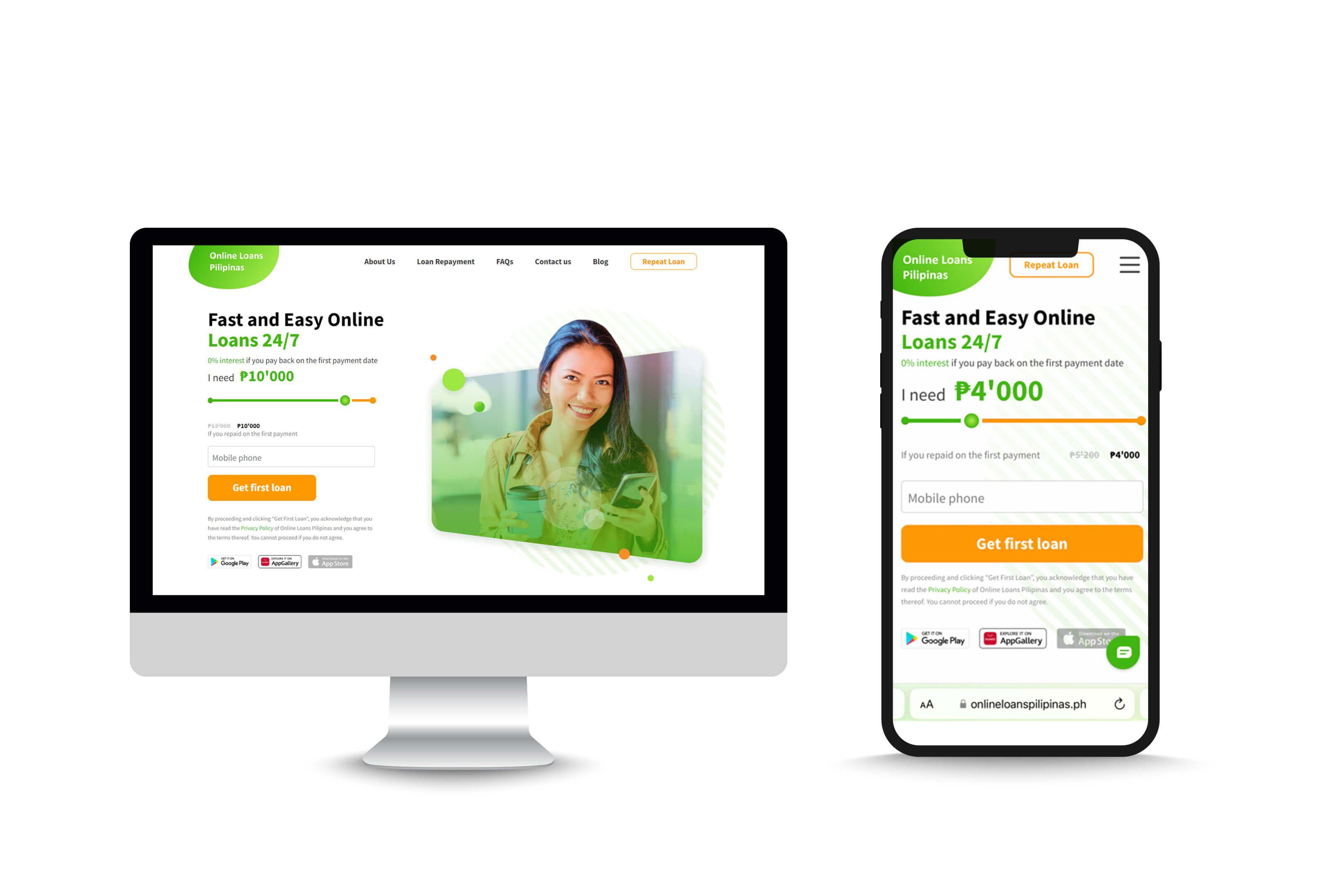

Online Loans Pilipinas stands out as the ideal choice for money loans due to several compelling reasons. They offer a seamless online application process, ensuring convenience and speed, allowing borrowers to apply from the comfort of their homes. Their transparent terms and competitive interest rates provide clarity and affordability, making it easier for individuals to manage their finances. Additionally, their customer support is highly responsive, guiding borrowers through every step of the process with professionalism and care.

With flexible repayment options tailored to suit different financial situations, Online Loans Pilipinas ensures that borrowers can repay their loans without undue stress. Their commitment to responsible lending practices further underscores their dedication to the financial well-being of their clients. By choosing Online Loans Pilipinas, individuals can confidently meet their financial needs, seize opportunities, and overcome challenges effectively.

Alternatives to Money Loans

Exploring alternatives to money loans provides valuable options for those seeking financial support without incurring debt.

One viable option is tapping into savings.

Savings can be an excellent source of funds in emergencies or unexpected expenses, eliminating the need to apply for loans through financial websites. Additionally, borrowing from friends or family can offer low or no-interest advantages, maintaining both financial stability and relationships.

Another strategy includes selling unused assets to raise money. Liquidating possessions like electronics, jewelry, or furniture can be an immediate and effective way to generate cash without resorting to loans. Crowdfunding platforms can also serve as powerful tools for raising funds for personal projects, demonstrating innovation, and community support.