Get Fast Cash Loans Online Instantly Without Hassle

- 1. What Are Fast Cash Loans Online?

- 2. The Need for Quick Financial Solutions

- 3. The Downsides of Traditional Loans

- 4. Why Fast Cash Loans Are the Answer

- 5. How to Apply for Fast Cash Loans Online

- 6. Eligibility Criteria to Consider

- 7. Common Misconceptions About Fast Cash Loans

- 8. Tips for Choosing a Reliable Lender

- 9. Managing Your Loan Responsibly

- 10. Benefits of Using Fast Cash Loans for Emergencies

Many Filipinos experience financial difficulties, needing immediate financing solutions to cover unexpected expenses.

In such scenarios, fast cash loans online provide an efficient and accessible way to obtain funds swiftly, ensuring that they meet their financial commitments without unnecessary delays.

Help is just a click away!

1. What Are Fast Cash Loans Online?

Fast cash loans online offer immediate financial relief.

These are short-term loans that can be quickly accessed via the Internet. The primary purpose is to aid with urgent, unexpected expenses, allowing individuals to meet their financial obligations in a timely manner. Unlike traditional loans that may have prolonged processing times, these online loans are designed for swift loan approval and disbursement.

The convenience of an online loan cannot be overstated.

Applicants generally need to provide minimal documentation, making the application process seamless and efficient. This ease of access can empower individuals to bridge financial gaps without enduring the stringent requirements typical of banks.

Various lenders offer these online loans, each presenting unique terms and conditions. Thoroughly researching and comparing options can help potential borrowers find the most suitable loan to address their immediate needs. Ensuring timely repayment not only secures their financial stability but also bolsters creditworthiness for future borrowing.

2. The Need for Quick Financial Solutions

In today's fast-paced world, financial challenges can arise without warning, overshadowing moments of peace and certainty. Securing immediate financial relief becomes a pressing need.

A solution that addresses urgent monetary needs can significantly lighten such burdens.

Fast cash loans online serve as a reliable means of obtaining swift financial aid, facilitating the resolution of unexpected expenses. Their rapid approval process stands in stark contrast to the often cumbersome traditional loan procedures.

By exploring these online avenues, individuals can effectively stabilize their financial situations with minimal delay. The expedited process allows for quick turnarounds, ensuring that barriers to accessing essential funds are removed. Consequently, they can focus on their personal and professional growth, confident in their financial resilience.

3. The Downsides of Traditional Loans

While traditional loans have their merits, many individuals find the process to be time-consuming and daunting, reflecting a paradigm in need of modernization.

Stringent requirements pose considerable hurdles, with applicants often facing rigorous credit checks.

Additionally, lengthy processing times can exacerbate financial difficulties, leaving borrowers in a prolonged state of uncertainty.

Traditional loan applications also demand extensive documentation, adding layers of complexity.

These challenges deter many from pursuing conventional lending avenues, necessitating a more streamlined and accessible alternative. By embracing fast cash loans online, they can circumvent these drawbacks, ensuring a smoother financial experience.

4. Why Fast Cash Loans Are the Answer

Fast cash loans offer unparalleled convenience and efficiency in today's fast-paced world.

Since 2016, numerous individuals in the Philippines have benefited from these streamlined solutions. With the rise of digital financial services, obtaining necessary funds has never been simpler or quicker.

It's no secret that many find themselves in urgent financial situations requiring immediate solutions. With fast cash loans online, they can secure funds swiftly without the traditional hurdles of extensive paperwork and long approval times.

This accessibility is the cornerstone of their appeal, ensuring that individuals can navigate financial setbacks effectively and promptly. Enhanced approval processes foster a sense of empowerment and readiness for unforeseen circumstances.

Embracing this innovative approach in financial services guarantees smoother, more efficient transactions.

5. How to Apply for Fast Cash Loans Online

Applying for fast cash loans online is seamless.

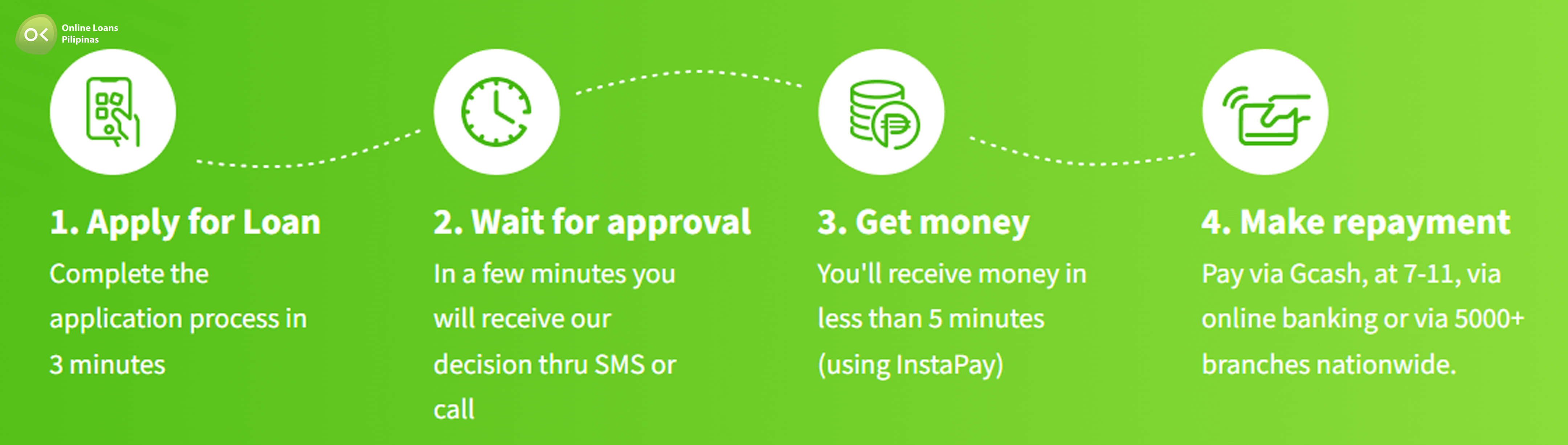

First, potential borrowers should visit the lender's website. The process typically involves filling out a straightforward application form, which can be completed within minutes. Subsequently, they may need to upload certain documents for verification purposes. Keeping these documents ready will further streamline the application process.

Next, they must submit the completed application.

After submission, the lender reviews the provided details. In the digital age, this review process is often expedited, allowing applicants to receive feedback promptly.

Finally, upon approval, the funds are disbursed swiftly, often within the same day. This efficient process ensures that financial solutions are readily available, empowering individuals to handle urgent financial needs with confidence and ease.

6. Eligibility Criteria to Consider

When seeking fast cash loans online, applicants should be aware of several key eligibility criteria to ensure their application proceeds smoothly.

First, borrowers must meet the age requirement.

Typically, lenders require applicants to be at least 21 years old.

Additionally, a stable source of income is often mandated by lenders.

Many lenders also prefer individuals who have a valid bank account and proof of residence.

These requirements are in place to ascertain the borrower's ability to repay the loan, thereby reducing default risk and fostering a responsible lending environment.

Ultimately, meeting these criteria not only simplifies the application process but also increases the likelihood of approval, allowing applicants to access funds quickly and efficiently.

7. Common Misconceptions About Fast Cash Loans

Many people hold misconceptions about fast cash loans due to a lack of understanding or misinformation.

One common misconception is that fast cash loans have outrageously high interest rate. While rates can be higher than conventional loans, they are often reasonable given the loan's short-term nature.

Another prevalent myth is that fast cash loans are intended for financially irresponsible individuals. In truth, they serve as invaluable tools for those facing unexpected financial emergencies.

Some also believe that obtaining fast cash loans online is a cumbersome process. On the contrary, the application procedure is streamlined and user-friendly, often requiring just a few simple steps.

It's important to debunk these myths to appreciate the utility and practicality of fast cash loans.

8. Tips for Choosing a Reliable Lender

When seeking fast cash loans online, selecting a trustworthy lender is crucial for a positive borrowing experience.

First, research potential lenders' reputations through customer reviews and testimonials.

Third-party review sites and forums are excellent resources, offering unbiased insights (experiences from actual borrowers).

Additionally, ensure the lender is transparent about fees, interest rates, and repayment terms. Ambiguity can be a red flag.

Next, verify if the lender is licensed and regulated by relevant financial authorities, confirming their legitimacy.

Finally, look for customer support availability. Reliable lenders provide robust support, ensuring borrowers have access to help when needed.

In the realm of fast cash loans online, Online Loans Pilipinas stands out as a reliable lender. They offer a seamless and efficient process, ensuring that borrowers can access funds quickly and without unnecessary complications. With a commitment to transparency and customer satisfaction, Online Loans Pilipinas has built a reputation for being a trustworthy source for financial assistance. Their user-friendly platform and dedicated customer support make them a preferred choice for those in need of immediate financial relief.

9. Managing Your Loan Responsibly

Managing a loan requires deliberate effort and planning.

Firstly, he should create a detailed budget to track his expenses. This budget will help him allocate funds effectively and ensure timely repayment of his fast cash loans online. Additionally, sticking to the budget will deter overspending which can lead to financial instability. She should regularly review her budget and make adjustments as needed.

Regular payments build trust.

Automated payments can simplify his repayment process - set it up once, and let technology handle the rest - freeing him from forgetting due dates and incurring unnecessary late fees.

While having a cushion for unforeseen emergencies is important, ensuring responsible loan management should not be compromised. They must prioritize loan repayment over non-essential spending. Their financial well-being must always be a top priority for maintaining long-term stability.

10. Benefits of Using Fast Cash Loans for Emergencies

Fast cash loans online provide immediate financial relief during times of unexpected distress through rapid disbursement processes.

Since 2016, these financial solutions have become a crucial safety net, granting borrowers quick access to money crucial in emergencies.

Firstly, they offer speed and convenience, often disbursing funds within hours of application approval, thus allowing borrowers to address urgent needs promptly.

Furthermore, the streamlined online application process diminishes the need for excessive paperwork, making it easier and less stressful for individuals under duress.

Thus, embracing the capabilities of fast cash loans online can transform emergency situations into manageable moments.