Best Loan Online App for 2024

In search of a faster alternative, she discovered the convenience of a loan online app.

Today, these apps have revolutionized the way people access credit, providing swift, secure, and user-friendly solutions. The year 2024 promises to be an exciting frontier for such innovations.

Effortlessly access funds instantly through a loan app.

Why Choose a Loan Online App in 2024?

In an evolving digital age, convenience remains paramount, and the loan online app industry has enthusiastically responded to this need.

Since 2016, technological advancements and increased internet penetration have simplified traditional loan processes. These platforms offer seamless applications and quick loan approval, aligning with the fast-paced lifestyle of modern users.

Beyond convenience, loan online apps provide unprecedented financial accessibility, transcending geographical limitations and serving previously underserved areas.

Incorporating AI and machine learning, these apps analyze financial behavior to tailor loan products to individual needs, enhancing financial management and decision-making. The result is an empowering experience that combines speed, security, and personalized service, making loan online apps indispensable in 2024.

Comparing Interest Rates of Top Apps

A critical aspect of selecting a loan online app is comparing interest rates, as they significantly impact the overall cost of the loan.

Interest rates vary between lenders, and choosing wisely can save substantial amounts of money. Top apps ensure transparency in disclosing their rates, equipping users with the information needed to make sound financial decisions.

Ultimately, the best loan online app in 2024 will balance low-interest rate with excellent service. Users should research thoroughly, considering both rates and the provider's reputation, to secure the best deal and pave the way for a financially secure future.

User Reviews and Ratings

User reviews and ratings provide crucial insights into a loan online app's performance, highlighting user experiences and satisfaction levels.

Since 2016, online platforms have amassed vast user feedback, showcasing both positive and negative aspects of various apps. This feedback is invaluable for potential borrowers.

Apps that actively engage with users and maintain ratings above 4.5 stars often earn greater loyalty. Transparency and excellent customer support are frequently cited as key strengths.

In conclusion, user reviews and ratings are essential for guiding potential borrowers in choosing the best loan online app for 2024.

Security Features of Loan Online Apps

Security is indeed a paramount concern.

Loan online apps have robust security frameworks, including high-grade encryption and multi-factor authentication, to protect user data. These measures ensure that personal and financial information remains secure.

Regulatory compliance is also critical, with top apps adhering to local and international data protection regulations, ensuring user privacy and safety.

These security measures protect millions of records, making it essential to choose an app with strong security features. Users seeking the best loan online app for APR 2024 should prioritize those committed to rigorous security protocols.

Customer Service Quality

Exceptional customer service sets loan apps apart.

The best loan online apps in 2024 distinguish themselves with unparalleled customer service. Their support teams are readily available, ensuring a seamless user experience by anticipating and addressing concerns promptly.

These teams are trained to provide proactive solutions, ensuring user needs are always prioritized. This excellence is evident in prompt response times, comprehensive assistance across multiple channels, and a genuine dedication to user satisfaction.

Impeccable customer service elevates these apps beyond mere utility, making them indispensable financial tools.

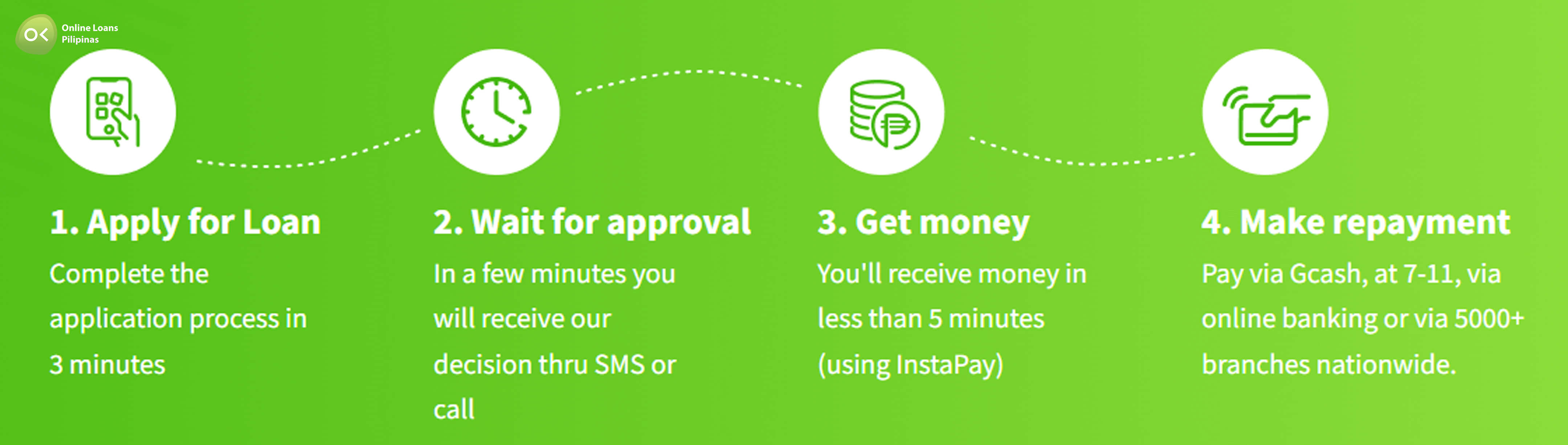

How to Apply for a Loan Online

First, prospective borrowers should download the loan online app.

After opening the app, users are guided through a straightforward registration process, entering personal information such as their full name, email address, mobile number, and setting a secure password. Accurate information expedites approval.

Next, users verify their identity by uploading necessary documents, including a government-issued ID, proof of residence, and recent payslips or bank statements provided by the lender. Clear, up-to-date scans prevent delays.

Finally, users fill out the loan application form, specifying the loan amount, preferred repayment terms, the type of cash loan they need, and desired number of installments. After submission, they can expect a response within a few business days, ensuring quick access to financial support.

Mobile vs. Web-Based Loan Apps

Deciding between mobile and web-based loan apps depends on lifestyle and preferences. Mobile apps offer convenience on the go, while web-based apps provide more extensive features like detailed financial analyses and in-depth loan management tools.

Mobile apps are ideal for busy professionals and travelers, whereas web-based apps appeal to those seeking comprehensive financial oversight. In both cases, selecting a secure, efficient, and user-friendly loan online app is essential for achieving financial goals seamlessly.

Top 10 Best Loan Online App for 2024

In the evolving landscape of digital finance, selecting the best loan online app for 2024 can significantly impact your financial well-being. With a myriad of choices available, it's crucial to identify the apps that excel in reliability, user experience, and favorable terms. Here are the top 10 contenders:

1. Online Loans Pilipinas

Online Loans Pilipinas offers a seamless and efficient loan application process through its loan app, making it a top choice for many users. With quick approvals, competitive interest rates, and flexible repayment terms, this app is designed to meet the diverse financial needs of its users.

2. MoneyCat

MoneyCat offers a flexible line of credit, allowing users to borrow as little or as much as they need, up to their approved limit. The app features a seamless application process, quick approvals, and competitive interest rates.

3. Cashalo

Cashalo is designed to provide quick and easy access to personal loans. With a user-friendly interface and swift approval process, it caters to those who need funds urgently via their mobile phone. The app also offers educational resources to help users manage their finances better.

4. Tala

Tala is renowned for its fast loan disbursement and minimal documentation requirements. The app uses advanced algorithms to assess creditworthiness, making it accessible to a broader audience, including those with limited credit history.

5. Home Credit

Home Credit stands out for its transparent terms and flexible repayment options. The app provides a range of loan products, from personal loans to installment plans for gadgets and appliances, making it a versatile choice for various financial needs.

6. GCash

GCash, a popular mobile wallet in the Philippines, also offers loan services through its GCredit feature. Users can enjoy the convenience of applying for loans directly within the app, with instant approval and competitive interest rates.

7. JuanHand

JuanHand is tailored for those seeking small, short-term loans. The app prides itself on its quick application process and immediate disbursement, making it ideal for emergency financial needs.

8. Cashwagon

Cashwagon provides fast and easy access to personal loans with a straightforward application process. The app is known for its high approval rates and quick disbursement, catering to users who need immediate financial assistance.

9. UnaCash

UnaCash offers a seamless loan application process with flexible repayment terms. The app is designed to cater to various financial needs, from personal expenses to business investments, ensuring users have access to funds when they need them most.

10. BillEase

BillEase provides installment loans that allow users to spread their payments over time. The app is particularly useful for those looking to finance larger purchases without the burden of upfront costs, offering a convenient and manageable repayment plan.

Conclusion

Choosing the best loan online app for 2024 depends on your specific financial needs and preferences. Whether you prioritize quick approval, flexible terms, or user-friendly interfaces, these apps offer a range of options to help you manage your finances effectively. Embrace the convenience of digital lending and take control of your financial future with the right loan online app.