Easy Loan Online Application: Apply in Minutes

Applying for a loan has never been easier for a borrower, thanks to the advent of online applications. This modern approach offers convenience, speed, and efficiency, making it an ideal choice for middle-income Filipinos seeking fast financial solutions.

With just a few clicks, you can access a wide range of lenders and loan products, compare their terms, and choose the best option for your needs. The digital process eliminates the need for lengthy paperwork and physical visits to banks, saving you valuable time and effort. In this article, we will explore the ins and outs of loan online applications, providing you with a comprehensive guide to navigate the process smoothly and successfully.

The Rise of Loan Online Applications

Why Choose Online Over Traditional Methods?

Online loan applications have revolutionized the borrowing landscape. Unlike traditional methods that require physical visits to banks and lengthy paperwork, online applications can be completed from the comfort of your home. This shift not only saves time but also reduces the hassle associated with conventional loan processes.

The Digital Advantage

The digital nature of online loan applications means you can access a wide range of lenders and loan products with just a few clicks. This accessibility allows you to compare different options and choose the one that best suits your needs.

Is online loan secure?

The question of security in online loans is paramount for borrowers. They seek confidence in knowing their personal and financial information is safeguarded.

Recent advancements in technology have significantly bolstered the security of online loan applications. Robust encryption methods and secure servers ensure that data remains confidential and protected from unauthorized access.

Additionally, financial institutions often employ multi-factor authentication and other security measures. These practices further enhance the protection of sensitive information, providing peace of mind to applicants.

Moreover, it's essential to verify the legitimacy of the lender. Reputable online lenders are regulated and follow strict compliance measures, which further ensure the security of online loan applications.

With proper precautions and awareness, applying for a loan online can be a secure and seamless experience.

Steps to Apply for a Loan Online

Step 1: Research and Compare Lenders

Before diving into the application process, it's crucial to research and compare various lenders. Look for reputable institutions with favorable terms and conditions. Online platforms often provide comparison tools to help you make an informed decision.

Step 2: Gather Necessary Documents

Having the required documents ready can streamline your application process for a salary loan and help you meet the eligibility criteria. Commonly needed documents include a valid ID, proof of income, and bank statements. Ensure all information is accurate to avoid delays.

Step 3: Complete the Online Application Form

Once you've chosen a lender, fill out the online application form. This step typically involves providing personal information, employment details, and the loan amount you wish to borrow. Double-check all entries for accuracy.

Step 4: Submit Your Application

After completing the form, submit your application. Many online platforms offer instant feedback, allowing you to know the status of your application within minutes. If approved, the funds are usually disbursed quickly.

Common Mistakes to Avoid

- Providing Incomplete Information

Incomplete applications are a common reason for delays and rejections. Ensure all required fields are filled out and all necessary documents are uploaded.

- Ignoring Interest Rates and Fees

Interest rate and fees can significantly impact the total cost of your loan. Compare these factors across different lenders to find the most cost-effective option.

- Applying for Multiple Loans Simultaneously

Applying for multiple loans at once can negatively affect your credit score and reduce your chances of approval. Focus on one application at a time.

What is the easiest app to get a loan online application?

Securing a loan online can be a straightforward process if one knows where to look and what criteria to meet.

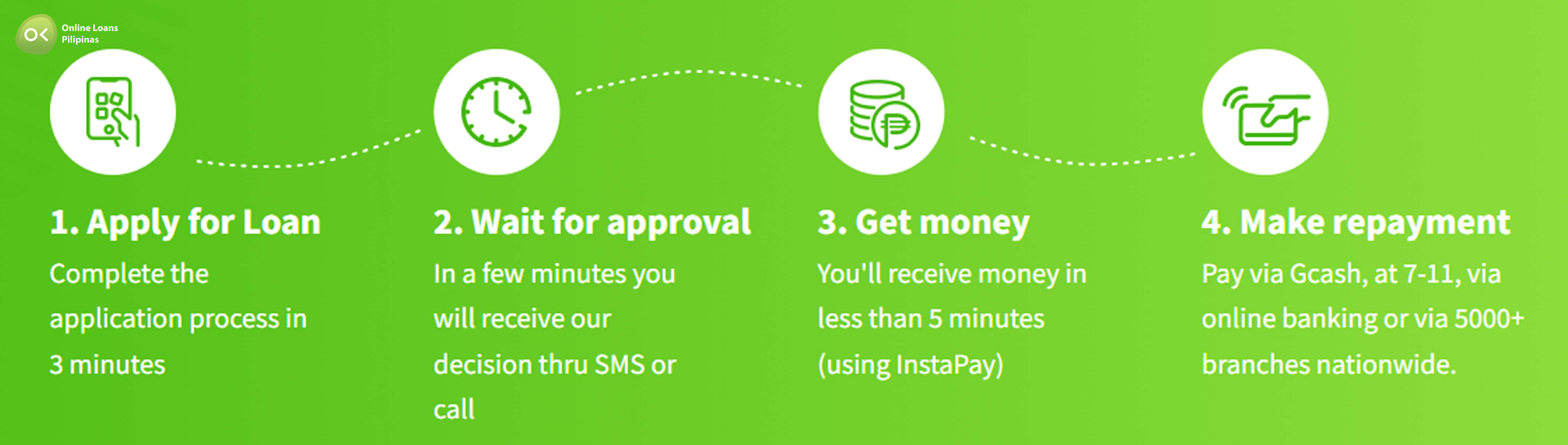

Online Loans Pilipinas provides quick access to personal loans through its mobile app. The application process is simple, and approval times are fast, making it an excellent choice for those in need of immediate funds.

This app is designed to offer a hassle-free loan application experience, ensuring that you can get the funds you need quickly and efficiently. Users can apply for a loan directly through the app, and approval can be granted within minutes.

Conclusion

Embrace the Convenience of Online Loan Applications

Loan online applications offer a convenient and efficient way to secure the funds you need. By following the steps outlined in this guide and avoiding common pitfalls, you can navigate the process with ease. Embrace this modern approach to borrowing and enjoy the benefits it brings.

When immediate financial assistance is required, several reliable options are available in the Philippines.

One can turn to well-established online lending platforms such as Online Loans Pilipinas, Tala, Juanhand, or Cashalo. These platforms boast a streamlined application process that allows for quick approval and disbursement. Additionally, traditional banks like BDO or BPI offer personal loan that can be applied for online, making it convenient to access funds swiftly in times of need.

Microfinance institutions also provide viable alternatives. Organizations such as CARD Bank or ASA Philippines Foundation offer microloans tailored for quick access. These institutions cater especially to those who might not meet stringent bank requirements, thus making microloans accessible to a wider audience.

Furthermore, peer-to-peer lending platforms present an innovative way to borrow money. Sites like FundKo connect borrowers directly with lenders, often leading to quicker funding processes. Embracing these modern financial solutions can expedite the urgent need for funds, providing peace of mind and supporting financial stability.