Online Loan App Philippines: Instant Approval Guide

Are you looking for the best online peso loan app in the Philippines? Discover how an online loan app Philippines can be your financial savior.

As of September 6, 2023, millions of Filipinos are now benefitting from the convenience and efficiency of this top-rated online loan app.

Key Features of Online Loan Apps

Effortless application processes, a hallmark of online loan apps, enable users to quickly complete necessary procedures. These platforms are designed to be intuitive, allowing even those with minimal tech-savvy to navigate efficiently, thus reducing the common stresses associated with traditional loans.

Additionally, the convenience of accessing credit, including installment loans, from anywhere is revolutionary and future-oriented. Applicants no longer need to visit physical branches, saving valuable time and resources, especially when interest rates are favorable. The ability to track and manage one's loan through a mobile device ensures that financial management is just a few taps away, promoting a culture of financial inclusivity.

Fast Approval Process

Getting an online loans in the Philippines has never been this swift and convenient.

Many online loan apps in the Philippines process applications within 24 hours, providing instant relief.

These platforms utilize advanced algorithms and automated systems, significantly speeding up the loan approval process, bringing relief when it’s needed most. Applicants no longer need to wait days or even weeks to know their loan status, which can make a tremendous difference in urgent situations.

By streamlining the necessary checks and verifications, online loan apps ensure that users experience minimal delay. This efficiency not only enhances user satisfaction but also sets a new standard in financial services, empowering individuals to meet their needs promptly.

Flexible Loan Amounts

Choosing the right online loan app in the Philippines can empower borrowers with flexibility regarding loan amounts.

- Customizable Loan Amounts: Borrowers can select loan amounts tailored to their specific needs.

- Small to Large Loans: Options range from microloans to substantial financial packages.

- Transparent Terms: Clear and understandable financial terms make decision-making easier.

This flexibility ensures that users can address immediate financial needs without borrowing excessively.

Tailoring loan amounts to individual requirements, while considering the processing fee, promotes responsible borrowing and financial stability.

Benefits of Using Online Loan Apps

Utilizing online loan apps presents a myriad of advantages, paving the way for unparalleled convenience. Borrowers benefit from swift approval times, which drastically reduces the waiting period crucial for urgent financial needs.

In addition to accelerating access to funds, online loan apps offer "anytime, anywhere" accessibility. Whether they are at home or on the go, users can apply for and manage their loans effortlessly. With the power of technology in their hands, they can achieve financial goals without the limitations of traditional banking hours. This blend of efficiency and flexibility renders online loan apps an invaluable tool in today's fast-paced world.

Convenience and Accessibility

Online loan apps in the Philippines provide an unmatched level of convenience and accessibility for all users.

- 24/7 Application - Users can apply for loans at any time, regardless of traditional banking hours.

- User-Friendly Interface - The intuitive design allows even first-time borrowers to navigate and complete applications with ease.

- Quick Approvals - Swift processing times mean users often receive approvals within minutes.

- Minimal Documentation - Simplified requirements reduce the need for excessive paperwork, expediting the loan process.

- Remote Access - Applications can be submitted from any location, eliminating the need to visit physical branches.

These features ensure that financial support is always within reach, facilitating urgent needs effortlessly.

Such accessibility empowers users to make timely financial decisions, promoting economic resilience and stability.

Secure Transactions

Security underpins the foundation of trust, making the best online loan app in the Philippines highly reliable. Rigorous encryption protocols safeguard personal and financial information, while advanced security measures prevent data breaches and unauthorized access.

The app uses state-of-the-art authentication methods, including multi-factor authentication, to verify identities and deter fraud, maintaining user trust.

Continuous monitoring and auditing ensure top protection standards, providing a seamless and secure borrowing experience. Constant innovation empowers users to achieve their financial goals without security concerns.

How to Choose the Best Online Loan App

Selecting the best online loan app in the Philippines demands a blend of meticulous research, user reviews, and financial prudence. Prospective borrowers should first scrutinize the app's security protocols, ensuring that it offers robust encryption and privacy measures. Additionally, evaluating the app's interest rates, fees, and repayment terms is crucial for making an informed decision. It's equally important to consider the app's user interface and customer support services, which can significantly affect the borrowing experience. By prioritizing these aspects, individuals can confidently choose an online loan app that aligns with their financial needs and aspirations, optimizing their path to financial success.

Comparing Interest Rates

When selecting an online loan app in the Philippines, comparing interest rate is crucial. Rates can vary significantly, so borrowers should examine whether they are fixed or variable and consider the Annual Percentage Rate (APR).

Additionally, evaluating the loan term helps determine the cumulative interest paid. By comparing different apps, borrowers can find competitive rates that align with their repayment capabilities and financial strategy.

Meticulously comparing interest rates ensures borrowers minimize overall borrowing costs, empowering them to achieve their financial goals without being hindered high-interest payments.

Understanding Repayment Terms

Understanding repayment terms for installment loan is essential for sound financial planning. These terms outline the payment schedule, duration, frequency, and amount due, enabling effective financial management.

Exploring the flexibility of various online loan apps in the Philippines can reveal options for extending or modifying repayment schedules, which is invaluable during unforeseen financial challenges.

Transparent communication with the chosen app allows borrowers to negotiate favorable terms and find timely solutions. Engaging deeply with repayment terms and maintaining proactive interactions ensures a fulfilling borrowing experience.

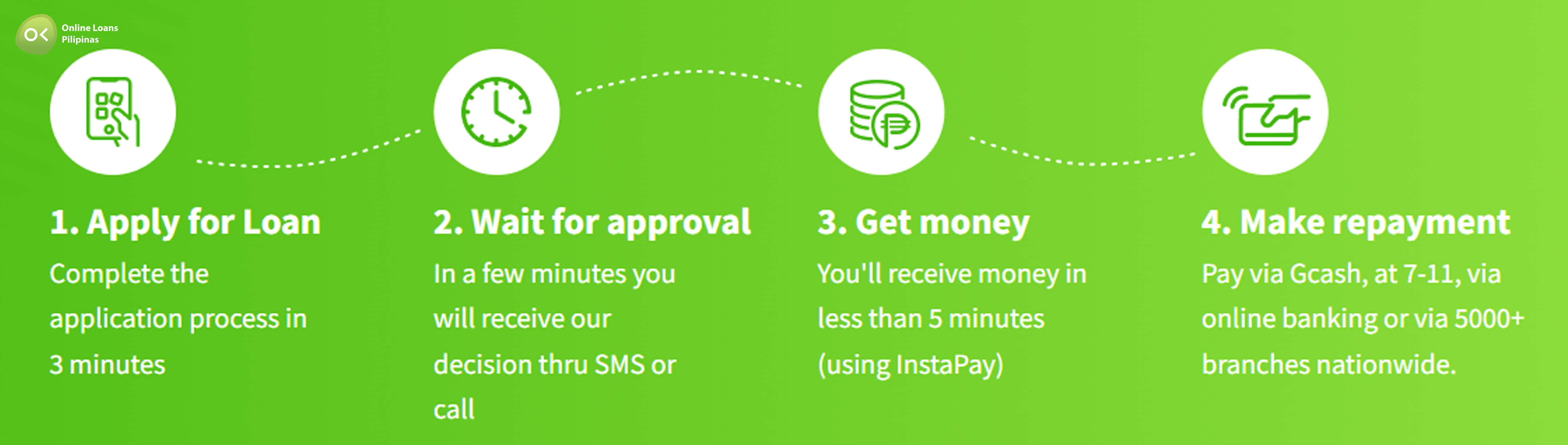

Steps to Apply for an Online Loan

Numerous online loan apps in the Philippines offer seamless application processes. Borrowers create an account, provide essential personal information, and meet stipulated requirements.

Once registered and verified, applicants select a loan type, input details like loan amount and repayment terms, and submit the application. Upon approval, funds are disbursed directly to the borrower's bank account, often within hours.

Required Documentation

Applicants should prepare essential documents, including a valid government-issued ID and proof of income, such as payslips. An updated bank statement may also be required to verify banking details.

Having these documents ready enhances the borrower's credibility and increases the chances of a successful loan application through the best online loan app in the Philippines.

Application Process Explained

Applying for an online loan in the Philippines is remarkably straightforward.

- Download the App: Access the official loan app from Google Play or the Apple App Store.

- Create an Account: Register by providing basic information and setting up a secure password.

- Verify Identity: Upload a valid government-issued ID for identification verification.

- Submit Financial Documents: Provide payslips or bank statements as proof of income.

- Apply for Loan: Choose your loan amount and tenure, then submit your application.

Applicants can expect a prompt response regarding their loan status.

The convenient digital process eliminates the need for physical paperwork, making it efficient and hassle-free.

Understanding each step ensures applicants confidently navigate through the application process, maximizing their chances of approval.

One might wonder about the best options available.

Filipinos seeking the most affordable financing often prioritize apps with low interest rates. By opting for the right app, they can significantly reduce their overall borrowing costs, ensuring a financially sound decision. Among the top contenders are those platforms that have tailored their offerings to meet this specific need.

A notable mention is Online Loans Pilipinas, which emphasizes transparency in its loans. With straightforward terms and competitive rates, they provide an accessible option for many. Additionally, Tala and Atome focus on customer-centric features, consistently offering some of the lowest rates in the market.

By choosing an app with such favorable terms, Filipinos can embrace their financial goals with confidence. These platforms not only make borrowing easier but also help build a financially stable future.