How to Find Online Loan Philippines Legit Providers

- 1. Struggling to Find Legit Online Loans?

- 2. The Dangers of Non-Legit Lenders

- 3. How to Identify a Legit Online Loan Provider

- 4. Benefits of Using Verified Loan Services

- 5. Top Legit Online Loans in the Philippines

- 6. What to Look for in Customer Reviews

- 7. Common Red Flags of Fraudulent Lenders

- 8. Steps to Apply for a Legit Online Loan

- 9. Protecting Yourself from Fraud

- 10. Maximizing the Benefits of Legit Loans

Navigating the vast sea of online loans can be daunting, akin to seeking a needle in a haystack.

Many people face challenges in identifying online loan Philippines legit options and determining the right loan amount amidst numerous fraudulent schemes.

1. Struggling to Find Legit Online Loans?

In today's fast-paced digital world, finding trustworthy financial solutions can be overwhelming. Since 2016, several reputable, government-regulated agencies have provided clearer pathways for obtaining legit loans.

However, discerning the credibility of online lenders in the Philippines can be challenging, with many fearing scams or unfair practices. Through dedicated research and the use of registered platforms, borrowers can ensure legitimate loan sources, transforming financial strain into stability and growth.

Verifying each lender’s credibility remains essential.

2. The Dangers of Non-Legit Lenders

Engaging with non-legit lenders exposes individuals to risks like fraud, exorbitant interest rates, and unethical collection practices, undermining financial stability and causing stress and legal troubles. Victims may become trapped in a debt cycle, facing ambiguous terms and hidden fees that inflate repayment amounts. Non-legit lenders often use aggressive, unlawful debt collection methods and may resort to personal data theft, worsening the borrower’s situation. Meticulous research is essential before choosing any lender. Vigilance and prudence are crucial to protect finances, peace of mind, and future financial health.

3. How to Identify a Legit Online Loan Provider

|

Key Factors |

Description |

Indicators |

|---|---|---|

|

Transparent Website |

A legitimate provider will have a clear, transparent website. |

Essential information is prominently displayed. |

|

SEC Registration |

Providers should be registered with the Securities and Exchange Commission. |

Guarantees adherence to Philippine financial regulations. |

|

Customer Reviews and Ratings |

Reviews and ratings offer insights into other borrowers' experiences. |

Positive feedback and high ratings. |

|

Clear Loan Terms |

Legitimate providers outline all fees, interest rates, and repayment schedules. |

Explicitly detailed terms and conditions. |

|

Accessible Customer Service |

Credible lenders provide prompt and helpful customer service. |

Quick, informative, and supportive responses. |

|

Feeling of Security |

Ensuring one feels secure in choosing to borrow. |

Confidence in the lender's legitimacy and practices. |

4. Benefits of Using Verified Loan Services

Verified loan services offer peace of mind, ensuring that borrowers engage with credible and trustworthy lenders.

Using verified loan services significantly minimizes the risks of fraud. Regulated by financial authorities, legitimate providers adhere to legal protections, ensuring financial security and transaction integrity.

Verified lenders provide clear, unambiguous loan terms, fostering transparency. They offer detailed, understandable contracts covering interest rates and repayment schedules, helping borrowers avoid unexpected charges and unfavorable terms.

Professionalism, accessible customer service, and clear loan options enhance the trustworthy experience. Verified loan services offer dedicated support teams that provide prompt, effective assistance, reassuring borrowers and ensuring a secure, supportive journey toward their financial goals.

5. Top Legit Online Loans in the Philippines

Borrowers can explore various credible online loan providers in the Philippines for financial empowerment, ensuring their bank account details remain secure.

- Online Loans Pilipinas:

- Recognized as a legitimate online loan provider in the Philippines.

- Offers various loan products catering to different financial needs.

- Maintains transparency regarding interest rates, fees, and repayment terms.

- Upholds stringent regulatory compliance.

- Leverages technology to streamline the loan application process.

- Ensures quick approval times and user-friendly interfaces.

- Prioritizes customer satisfaction with numerous support channels and resources.

- Exemplifies convenience, transparency, and professional customer service.

- Allows borrowers to confidently navigate their financial aspirations within a robust, regulated framework that safeguards their interests and promotes informed decision-making.

- Cashalo, Tala Philippines, and Home Credit:

- Recognized for reliability and ethical lending practices.

- Offer various loan products catering to different financial needs.

- Maintain transparency regarding interest rates, fees, and repayment terms.

- Uphold stringent regulatory compliance.

- GCash and CIMB Bank:

- Popular and dependable options.

- Leverage technology to streamline the loan application process.

- Ensure quick approval times and user-friendly interfaces.

- Prioritize customer satisfaction with numerous support channels and resources.

These legitimate online loan providers exemplify convenience, transparency, and professional customer service. Choosing these established institutions allows borrowers to confidently navigate their financial aspirations within a robust, regulated framework that safeguards their interests and promotes informed decision-making.

6. What to Look for in Customer Reviews

In the quest for online loan Philippines legit options, what should one seek in customer reviews?

- Consider overall customer satisfaction reflected in the reviews.

- Since 2016, online lending platforms have increasingly focused on user experience.

- Note any recurring themes or issues mentioned by reviewers.

- Specific aspects like interest rates or customer support can offer valuable insights.

- Pay attention to how the lender addresses complaints and resolves problems.

- A reputable institution should acknowledge concerns and rectify them in a timely manner.

- Customer reviews highlight strengths and areas for improvement in chosen online loan providers.

7. Common Red Flags of Fraudulent Lenders

Spotting the red flags of online loan scams is crucial for protecting one’s finances and personal information.

One must avoid lenders who request upfront fees or payments.

It is important to be wary of providers who guarantee approval without any background checks, as this is often a hallmark of fraudulent operations.

Furthermore, unauthorized use of a company's name, lack of verifiable contact information, and insistence on secrecy are all indications that an offer may be a scam. By being vigilant and conducting thorough research, individuals can safeguard themselves from falling victim to fraudulent schemes. Always remember, reputable lenders value transparency and ethical practices.

8. Steps to Apply for a Legit Online Loan

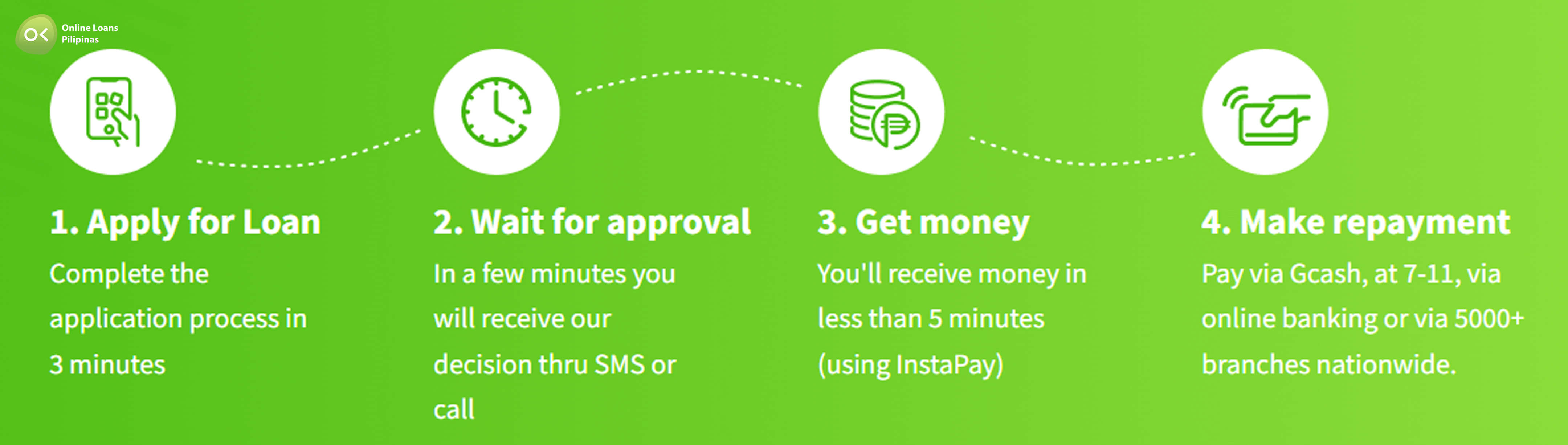

Applying for a legitimate online loan in the Philippines is straightforward, especially when you understand the necessary requirements and have the right guidance.

Firstly, potential borrowers need to identify credible online loan providers. Look for companies registered with the Securities and Exchange Commission (SEC).

Next, gather all necessary documents. Typically, these include valid IDs, proof of income, and sometimes utility bills to verify address as these are basic requirements.

Once documents are in order, applicants must fill out the online application form carefully and accurately. This step is crucial to avoid processing delays.

Finally, submit the application and wait for the loan approval. Legitimate lenders usually provide feedback within a few days.

9. Protecting Yourself from Fraud

Ensuring safety in online loans with fast approval is crucial as scammers seek to deceive individuals, often by misrepresenting the loan amount. Key strategies include spotting red flags like offers too good to be true or upfront fees with ambiguous terms. Cross-referencing information with official sources like the SEC can verify a lender’s legitimacy.

Staying aware of prevalent scams and educating oneself on common fraud tactics helps in recognizing and avoiding traps. Prioritizing self-education and diligence in evaluating loan offers safeguards finances. Leveraging trusted information and maintaining caution allows for confident navigation of online loans, maximizing positive borrowing experiences.

10. Maximizing the Benefits of Legit Loans

Maximizing the benefits of legit loans begins with a clear understanding of the potential advantages these financial tools offer.

Since 2016, financial experts have observed significant improvements in household stability due to access to credible lending options, validating their positive impact on livelihoods.

One’s ability to maximize these benefits lies largely in the careful selection of loan products tailored to specific needs and in maintaining awareness of varying loan terms.

Attention to loan terms can prevent pitfalls like excessive interest rates, safeguarding one's financial health, and ensuring that the funds contribute effectively to personal goals.

Ultimately, legit loans can be powerful allies in financial growth, supporting endeavors with reliability and transparency.