Online Loans Fast Approval Philippines: Quick Tips

Imagine needing to borrow fast cash urgently for an unexpected expense, like a medical emergency or home repair, and worrying about the competitive interest rates on a website.

When quick financial solutions are essential, fast approval cash online loans in the Philippines can be a lifeline, offering swift and efficient relief without requiring collateral.

Understanding the Basics of Online Loans

In recent years, online loans have revolutionized the financial landscape, providing quick access to funds for millions. These digital solutions, including personal loans available on their website, have gained popularity due to their ease of access. Many institutions now offer online loans with fast approval in the Philippines, streamlining the borrowing process. By leveraging technology, online lenders can quickly assess information, ensuring swift decisions and disbursements. The rise of online loans signifies a shift towards more convenient and efficient financial services.

Advantages of Fast Approval Online Loans

Fast approval online loans in the Philippines offer a significant advantage by removing traditional hurdles and anxieties. Applicants can often receive approval within hours, provided they meet eligibility requirements, allowing quick access to funds. This immediacy is crucial during emergencies, enabling prompt management of urgent needs and unforeseen expenses over the term of the loan. Efficient loan processing highlights advancements in financial technology, empowering individuals to conduct financial activities with confidence and ease, making fast approval online loans a model of modern financial convenience and reliability.

Availability and Accessibility

Fast approval online loans in the Philippines ensure immediate financial relief for borrowers.

Online loan applications often take less than 24 hours to process and approve.

With the widespread availability of internet access across the Philippines, individuals from various regions can easily apply for online loans without the typical geographical constraints of traditional banking.

This accessibility fosters financial inclusion, enabling underserved populations to integrate into the formal financial system seamlessly. The convenience of applying anytime, anywhere, signifies a progressive leap towards a more inclusive economy.

Legal Framework and Regulations

The legal framework for online loans with fast approval in the Philippines is robust. Republic Act No. 9510, or the "Credit Information System Act," ensures accurate credit information exchange, protecting both lenders and borrowers from fraud. The Bangko Sentral ng Pilipinas (BSP) oversees online lending platforms, enforcing ethical practices and transparency. Additionally, the Anti-Money Laundering Act (AMLA) mandates strict customer verification, enhancing financial system integrity. These regulations inspire confidence among borrowers, driving the adoption of fast-approval online loans in the Philippines.

How to Ensure a Speedy Loan Application

Applying for online loans with fast approval in the Philippines is a streamlined process. Individuals begin by researching reputable, compliant online lenders. After selecting a lender, they complete a secure online application with personal and financial details. Verification is swift, often requiring digital document submission. Applicants receive feedback quickly, allowing them to access funds promptly and address immediate financial needs with confidence and ease.

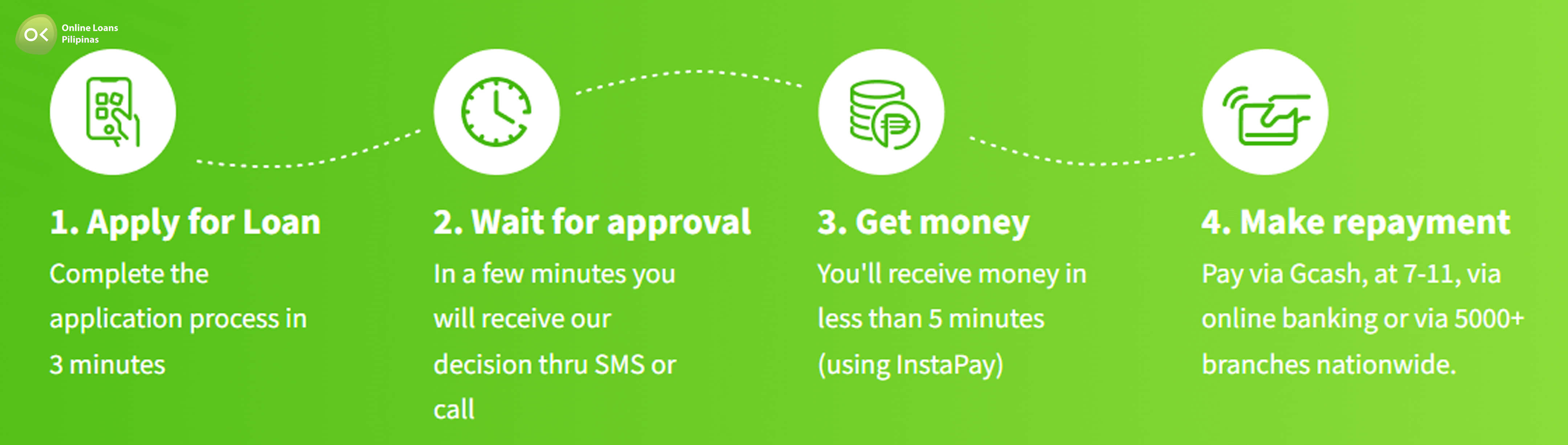

Step-by-Step Guide

Applying for online loans with fast approval in the Philippines is straightforward and efficient.

- Research Lenders: Investigate reputable online lending platforms registered and compliant with local regulations.

- Complete Application: Fill out a secure online form with personal and financial details.

- Submit Documents: Provide required documents digitally for verification.

- Await Feedback: Wait for approval notification, typically within a short timeframe.

- Receive Funds: Access the approved loan amount promptly.

Each step is designed to ensure a streamlined experience for the borrower.

Following these steps, one can secure the necessary financial assistance without hassle.

Maintaining a diligent approach throughout the process assures quicker approval and disbursement.

Required Documents

When applying for online loans with fast approval in the Philippines, having the correct documents is crucial. Applicants typically need a government-issued ID, proof of income or employment, and a recent utility bill for residence verification. Most platforms prefer digital copies, so clear, scanned versions should be ready. Proper preparation and meeting all eligibility criteria can greatly expedite the approval process.

Managing Your Loan Responsibly

Borrowers must plan wisely to manage their loans effectively, ensuring their financial health and stability.

To do this, they should create an organized repayment schedule, aligning it with their income and expenses. Sticking to this plan can prevent missed payments and mounting debt, fortifying their long term financial well-being.

Using tools like budgeting apps can offer additional support in managing repayments.

Repayment Strategies

Repayment is a crucial aspect of loans.

Crafting a well-defined repayment strategy requires careful planning. Borrowers should assess their financial situation, considering income, debts, and expenses, to determine the best approach for repaying their loan. A solid repayment plan builds financial resilience and avoids defaults.

Utilizing automatic payments ensures timely payments, minimizing late fees and maintaining a good credit score. Staying in contact with the lender during financial difficulties can lead to renegotiated terms or better interest rate. This proactive communication fosters a positive relationship with the lender and contributes to financial success.

Avoiding Common Pitfalls

Obtaining quick loans with fast approval in the Philippines can be a seamless experience, yet there are common pitfalls to avoid.

- Neglecting to read terms and conditions: Always scrutinize the fine print for hidden fees and interest rate.

- Overborrowing: Limit loan amount to what you genuinely need to prevent overwhelming debt.

- Ignoring repayment capacity: Consider your income and expenses to ensure you can comfortably meet payment schedules.

- Disregarding lender credibility: Choose reputable financial institutions to safeguard against fraud.

- Skipping research: Compare multiple offers to secure the best term and conditions.

By being mindful of these common pitfalls, borrowers can navigate the loan process with confidence.

Avoiding these mistakes not only ensures a smooth loan experience but also fortifies one's financial standing.

Adopting a careful and informed approach to borrowing paves the way for financial success and stability.

What is the best Fast-approval Online Loan?

Online Loans Pilipinas stands out as the best option for online loans with fast approval in the Philippines due to several compelling reasons:

- Rapid Approval Process: Online Loans Pilipinas is renowned for its swift approval times, often providing decisions within minutes, which is ideal for those in urgent need of funds.

- User-Friendly Application: The platform offers a seamless and straightforward online application process, making it accessible even for those who are not tech-savvy.

- Flexible Loan Amounts: Borrowers can choose from a range of loan amounts, catering to various financial needs, whether for emergencies, business, or personal expenses.

- Transparent Terms: Online Loans Pilipinas maintains transparency in its terms and conditions, ensuring borrowers are fully aware of interest rates, fees, and repayment schedules.

- Strong Customer Support: The lender provides excellent customer service, assisting borrowers throughout the application process and addressing any concerns promptly.

- Secure Transactions: With robust security measures in place, Online Loans Pilipinas ensures that all transactions and personal information are protected, giving borrowers peace of mind.

These attributes make Online Loans Pilipinas a top choice for those seeking quick, reliable, and transparent online loans in the Philippines.

Conclusion and Final Thoughts

Fast approval online loans in the Philippines empower individuals to address urgent financial needs quickly and efficiently, no matter the amount they require. By selecting reputable lenders and preparing thoroughly, borrowers can enjoy expedited loan approval, leading to stress-free financial management. This ensures a brighter future where immediate needs are met, and future aspirations are seamlessly invested in. The evolving digital finance landscape opens unprecedented opportunities, giving every Filipino the confidence to navigate their financial journey successfully.

Approvals are generally within 24 hours, with some lenders offering even faster processing.

Decisions are based on credit score, income stability, and completeness of documentation.

Some lenders charge processing fees, but many reputable online lenders offer fee-free applications.

Prepare documentation thoroughly, select reputable lenders, and maintain a good credit score to secure loans with minimal delay.