Easy Loans Online Tips: Apply Instantly Today

Securing easy loans online is now more accessible than ever.

Quickly acquire cash without time-consuming paperwork, right from home, while keeping an eye on the interest rate.

These loans cater to those needing prompt financial solutions, eliminating traditional barriers.

Take the first step today.

1. Understanding Easy Loans Online

Easy loans online revolutionize borrowing with unparalleled convenience.

In the digital age, they offer swift financial solutions, eliminating lengthy approval processes and excessive paperwork.

These loans provide transparent credit options with flexible repayment plans, helping applicants manage their finances and maintain financial health, regardless of strict requirements.

The simplicity and speed of easy loans online empower borrowers to seize opportunities and address needs confidently, navigating financial challenges with ease and assurance.

2. Benefits of Easy Loans Online

Easy loans online have transformed the borrowing landscape, offering a world of convenience and efficiency. Borrowers can access any loan amount quickly and easily, eliminating the cumbersome processes traditionally associated with loan applications.

Furthermore, the application process itself is straightforward, often only requiring basic information, making it easy for those who wish to borrow quickly. This accessibility ensures a broad spectrum of individuals can benefit from these loans. Ultimately, the transparency and speed of easy loans online empower users to address their financial needs promptly and responsibly.

2.1 Quick Approval Process

Digitally-enriched platforms assure a swift, seamless, and efficient approval process, minimizing wait time for applicants.

Online loans can be approved within minutes, providing timely access to necessary funds for borrowers.

Easy loans online eliminate conventional delays, expediting verification and approval. This benefits those needing urgent financial assistance.

Applicants receive instant feedback, boosting confidence and reducing uncertainty. Streamlined algorithms ensure swift, reliable service, enhancing borrower satisfaction.

2.2 Minimal Documentation Required

Easy loans online in the Philippines are user-friendly, requiring minimal documentation for swift processing.

Leveraging technology, these loans simplify applications with essential personal information and ID documents, eliminating cumbersome paperwork.

Applicants in the Philippines can upload documents online in minutes, ensuring a convenient, seamless experience that meets all essential criteria for approval. This streamlined approach saves time and reduces stress, ensuring borrowers can get their desired loan amount quickly.

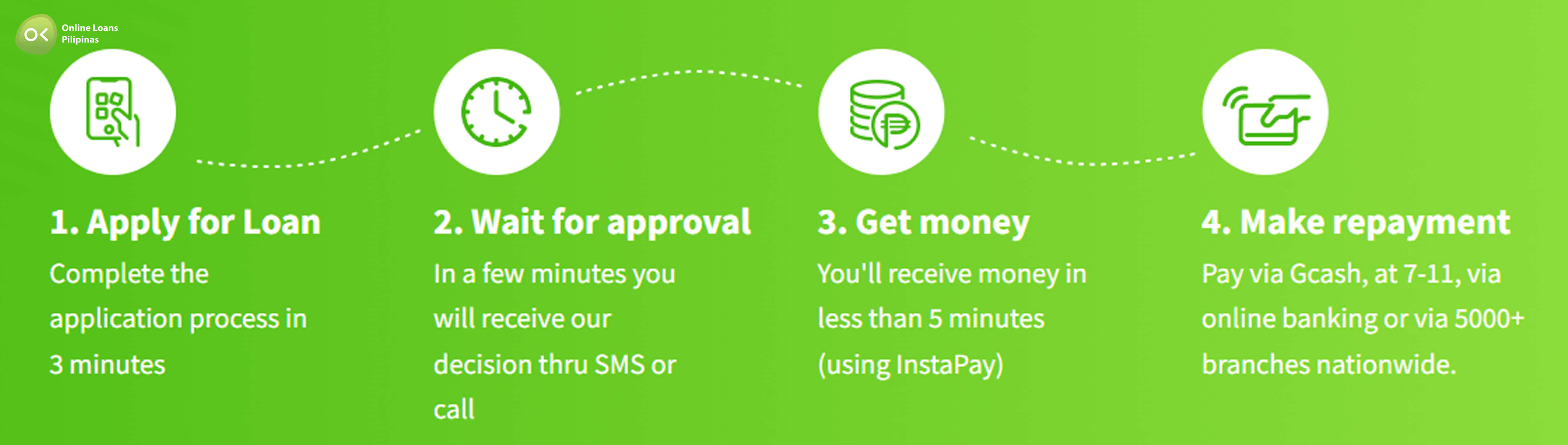

3. How to Apply for Easy Loans Online

Applying for easy loans online is simple. Visit the lender’s website and fill out the online application form with accurate personal information.

After submission, the lender quickly verifies identity, bank account, and banking details. Upon successful verification, approval notifications are sent swiftly, with funds typically disbursed within 24 to 48 hours.

3.1 Step-by-Step Application Guide

First, navigate to the lender's website and complete the application form with accurate details.

Next, upload clear proof of identity and income statements.

The lenders will then swiftly verify the information, providing prompt feedback on the application status.

Upon successful verification, applicants receive approval and funds are disbursed directly into their account, typically within a day or two, showcasing the convenience of easy loans online.

3.2 Required Information and Documents

To expedite the loan application process, applicants must gather and submit essential documents to verify identity and financial credibility.

Required documents include government-issued ID (e.g., driver's license, passport), proof of income (e.g., payslips, bank statements, tax returns), and proof of residency (e.g., utility bills, lease agreement).

Having these documents ready streamlines the application, leading to quicker approvals and faster fund disbursement, showcasing the simplicity of easy loans online.

4. Tips for a Successful Loan Application

A well-prepared loan application boosts approval chances. Applicants should organize and present comprehensive financial documents, including payslips and bank statements, to illustrate repayment capability.

Include a cover letter summarizing the "easy loans online" request, clearly articulating the applicant's financial situation.

4.1 Check Your Credit Score

Regularly checking one's credit score is crucial for financial health, influencing loan eligibility, interest rates, and terms. Applicants can obtain their credit score online to anticipate approval chances for easy loans online.

A high credit score results in better loan offers, while a low score may require credit repair. Understanding and improving one's credit score maximizes loan approval chances and fosters informed financial decisions.

4.2 Compare Loan Offers

Comparing loan offers is essential.

With many easy loans online, individuals must scrutinize terms, interest rates, fees, and repayment conditions. Attention to fine print can reveal hidden costs.

Online loan comparison tools make this task easy, providing a clear overview of various offers. These tools help prospective borrowers make smarter financial decisions.

Leveraging these platforms allows borrowers to select loans that align with their financial goals, resulting in better loan conditions and long-term financial well-being.

5. Common Mistakes to Avoid

When pursuing easy loans online, neglecting to review the loan terms and conditions can lead to unexpected fees, higher interest rates, or unfavorable repayment terms.

Another common mistake is not comparing multiple loan offers, potentially missing out on better deals. Consistent research ensures the most beneficial terms.

5.1 Ignoring Terms and Conditions

Borrowers must thoroughly read terms and conditions before committing to an online loan.

- Hidden Fees: Terms reveal additional costs.

- Interest Rates: Clarify variable or fixed rates.

- Repayment Schedules: Know exact dates and amounts.

- Penalties: Understand penalties for late or missed payments.

Failing to review these can lead to costly surprises. Awareness ensures reliable financial planning.

5.2 Overborrowing

Overborrowing occurs when borrowers take out more loans than they can repay, leading to financial distress.

- High Interest Rates: Strain finances.

- Accumulating Debt: Leads to mounting debt.

- Credit Score Impact: Negatively affects credit scores.

- Financial Stress: Managing multiple loans induces stress.

- Limited Future Borrowing: Restricts access to future loans.

Prudent borrowing prevents unmanageable debt and maintains financial health. Evaluating repayment capacity and avoiding excessive loans ensures financial stability and long-term prosperity.

Online Loans Pilipinas: Easy Loans Online

Online Loans Pilipinas offers easy loans online to provide a convenient, efficient, and accessible borrowing solution for individuals needing quick financial assistance. By leveraging digital platforms, OLP streamlines the application process, reduces paperwork, and expedites approval and fund disbursement. This approach caters to the modern borrower’s need for speed, transparency, and flexibility, ensuring a hassle-free experience while addressing urgent financial needs.