Quick Cash Loans: Instant Money, No Hassle

During a sudden household emergency, Maria needed to find funds quickly. Fast cash loans became her immediate solution, especially after considering the comparison rate.

Such loans offer immediate financial help, designed to provide quick relief during urgent situations. Understanding these options can empower individuals in times of need.

1. Understanding Quick Cash Loans

Quick cash loans offer an efficient solution for immediate financial emergencies. When unexpected expenses arise, understanding the comparison rate and securing fast funding becomes crucial.

Since 2016, financial institutions have streamlined loan processes to meet the growing demand for quick cash loans, providing quicker turnaround times and enhancing the consumer experience.

Today, quick cash loan approvals can be secured within hours, significantly alleviating financial stress during urgent situations. Understanding these options empowers individuals facing sudden monetary challenges.

Typically, quick cash loans range from ₱5,000 to ₱50,000, with the loan amount and repayment periods between 3 to 12 months, ensuring financial stability while addressing immediate needs.

Many online platforms now specialize in quick cash loans, offering diverse and accessible options for borrowers to make informed financial choices based on their experience.

2. Benefits of Quick Cash Loans

Quick cash loans provide a dependable solution for urgent financial needs, expediting the process of securing funds and alleviating delays.

Borrowers can swiftly address unexpected expenses with minimal paperwork. The ease of application and approval is a key advantage of these loans.

Individuals gain peace of mind knowing financial support is just a click away, reducing stress during emergencies. This is particularly beneficial for medical emergencies or sudden household repairs, enabling prompt action.

These loans often do not require a high credit score, making them accessible to more people. This inclusivity empowers those who might be excluded from traditional loan products.

The quick and convenient nature of these loans boosts confidence during financial crises, enabling borrowers to tackle challenges head-on without undue worry or delay.

3. Types of Quick Cash Loans

Several loan options exist for those seeking quick cash loans, each catering to different financial needs with flexibility and convenience.

Payday loans provide short-term cash to be repaid by the next payday, ideal for emergency expenses. Personal loans offer slightly longer repayment terms and are easier to qualify for, addressing urgent needs promptly.

Pawnshop loans use personal items as collateral, making them accessible to those with poor or no credit history. Cash advances from credit cards offer immediate cash but come with higher interest rates, suitable for ongoing financial management needs.

4. Eligibility Criteria

Understanding the eligibility criteria for quick cash loans is essential for successful application and approval.

Applicants must be Filipino citizens or legal residents, at least 21 years old, and provide income proof through salary slips or business revenue. A legitimate and active bank account is also necessary for seamless fund transfers and repayments.

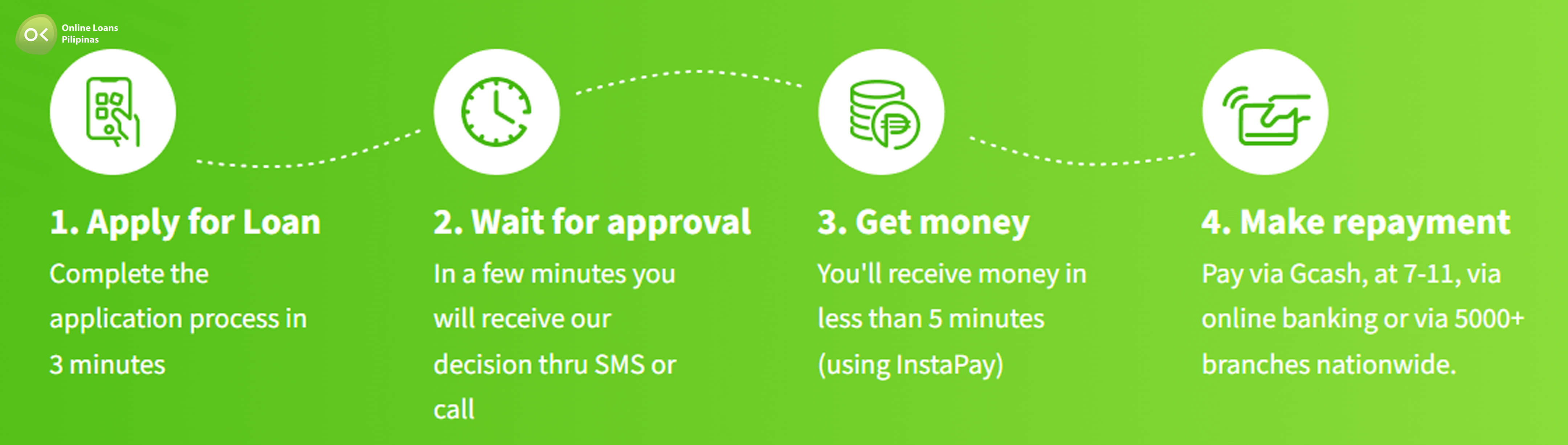

5. Application Process

Applying for quick cash loans is straightforward, a breeze of uncomplicated paperwork, which saves time. Applicants can start with an online form submission, ensuring convenience and speed. After verification, the loan is swiftly processed, minimizing waiting periods and providing individuals with the financial assistance they need with utmost efficiency.

5.1 Required Documentation

Applying for affordable quick cash loans requires minimal but crucial documentation to ensure a smooth and swift process.

Having valid identification can expedite the loan approval process, demonstrating both credibility and reliability to lenders.

Applicants need to provide a government-issued ID to verify their legal status and proof of income to assess their ability to repay the loan, fostering a trustworthy financial relationship.

5.2 Online vs. In-store Applications

Choosing between online and in-store applications for quick cash loans and exploring various funding options can impact the ease and speed of the process.

- Convenience: Online applications are accessible 24/7 from home.

- Speed: Online applications typically process faster.

- Documentation: Online uploads facilitate quicker submissions.

- Personal Interaction: In-store applications offer face-to-face interactions.

- Accessibility: Online applications are ideal for remote locations.

Online applications are preferred for convenience and efficiency, while in-store applications benefit those needing personalized assistance.

6. Approval and Disbursement

Once an individual submits their application, the approval process begins promptly.

The lenders review the applicant's information, ensuring all requirements are met. This crucial stage can often determine the loan's approval status within hours.

Currently, many financial institutions offer streamlined processes and increased funding, making it possible for applicants to receive approvals faster than ever before. This efficiency is particularly evident with online loan providers.

After approval, the disbursement of funds can be remarkably swift. In most cases, applicants can expect the money to be transferred directly into their bank accounts within 1 to 3 business days.

This prompt service exemplifies the convenience and reliability of quick cash loans, providing much-needed financial relief efficiently.

7. Repayment Terms

Repayment terms for quick cash loans vary by lender. Borrowers should review interest rates, fees, repayment schedules, and potential late payment penalties.

Lenders often provide an "amortization table" detailing each scheduled payment. Examining this table helps borrowers plan effectively and maintain financial health.

7.1 Interest Rates

Interest rates for quick cash loans vary based on lender policies and applicant creditworthiness. Borrowers should compare different offers to secure the best comparison rate.

Understanding interest rate nuances empowers borrowers to make informed financial decisions, reducing borrowing costs and aligning with their financial goals.

7.2 Payment Schedules

Knowing the payment schedules for quick cash loans is crucial for effective planning and maintaining financial health.

Loan providers typically offer clear monthly, weekly, or bi-weekly repayment schedules. Flexible options accommodate different income streams.

Borrowers should assess their financial situation and compare the comparison rate to choose the right schedule, as failure to adhere can result in penalties. A well-chosen schedule fosters discipline, encourages timely payments, and ensures financial stability.

8. Tips for Managing Quick Cash Loans

It’s essential to handle quick cash loans with care to avoid financial pitfalls. How can one efficiently manage their loans?

First, one should carefully read and comprehend the loan agreement. Understanding all terms and conditions helps avoid unexpected fees and charges.

Second, borrowers should create a detailed repayment plan that includes the loan amount. Allocating a portion of their income to loan payments ensures timely repayment and avoids penalties.

Additionally, timely communication with the lender is crucial to discuss any potential finance issues. If any payment issues arise, discussing them with the lender may lead to alternative solutions or extensions.

By staying organized and proactive, borrowers can effectively manage quick cash loans. This ensures their financial stability and peace of mind.

9. Risks and Precautions

Understanding potential risks is essential.

Before committing to quick cash loans, one must evaluate the significant financial risks and critically look at the comparison rate. High interest rates or hidden fees can easily burden borrowers, making it difficult to repay the loan. Furthermore, defaulting on loans could lead to severe consequences, affecting one’s credit score and financial reputation.

Debt can spiral out quickly.

Carefully consider the repayment terms to avoid unfavorable outcomes. Planning a strategic budget that prioritizes loan repayment helps mitigate the risks associated with quick cash loans.

Finally, borrowers should undertake rigorous research to select reputable lenders. Reading reviews and ensuring regulatory compliance will shield them from unfair practices, ensuring that their financial decisions are sound and sustainable.

10. Alternatives to Quick Cash Loans

Exploring alternatives to quick cash loans provides individuals with practical options to address sudden financial concerns, fostering a balanced approach to managing unexpected expenses.

One alternative is borrowing from friends or family.

Additionally, liquidating non-essential assets such as jewelry (pawnshops usually consider valuable items) can be effective.

Employers may offer an early paycheck to alleviate immediate financial stress, providing short-term relief.

Credit card cash advances are another quick solution, though they often involve higher interest rates compared to other options.

Finally, exploring community resources or non-profits that provide emergency financial assistance can empower individuals to manage crises without incurring high-interest debt burdens.

By considering these options, one isn’t solely reliant on quick cash loans. Diverse financial strategies build a stronger, more resilient foundation.