Get Your Loan Online via GCash with Online Loans Pilipinas

- Why Choose Online Loans Pilipinas?

- Key Insights

- 1. What is Online Loans Pilipinas?

- 2. How does GCash disbursement work with Online Loans Pilipinas?

- 3. What are the benefits of using GCash for loan disbursement?

- 4. How do I select GCash as my disbursement method?

- 5. What should I do if I don’t have a GCash account?

- 6. Are there any fees associated with GCash disbursement?

- 7. How can I repay my loan?

- 8. What should I do if I encounter issues with my GCash disbursement?

- Conclusion

In today's fast-paced world, financial flexibility is essential. Online Loans Pilipinas, a trusted name in the lending industry, offers a seamless solution for those in need of quick financial assistance. By leveraging the convenience of GCash, borrowers can now receive their loan disbursements directly into their mobile wallets, making the process faster and more efficient.

Why Choose Online Loans Pilipinas?

Online Loans Pilipinas stands out for its commitment to providing accessible and hassle-free loan services. Whether it's for emergency expenses, business needs, or personal projects, their platform ensures that borrowers can secure an online loan without the lengthy procedures associated with traditional banks.

The Convenience of GCash Disbursement

GCash, a leading digital wallet in the Philippines, enhances the loan experience by offering a swift and secure disbursement method. Here’s why using GCash for your loan disbursement is a game-changer:

- Speed: Once your loan is approved, the funds are transferred to your GCash account almost instantly, eliminating the wait times typical of bank transfers.

- Accessibility: With GCash, you can access your funds anytime, anywhere. Whether you're at home or on the go, your money is just a tap away.

- Ease of Use: GCash’s user-friendly interface makes it easy to manage your loan funds. You can pay bills, transfer money, and even shop online directly from your mobile wallet.

- Security: GCash employs robust security measures to protect your financial information, ensuring that your transactions are safe and secure.

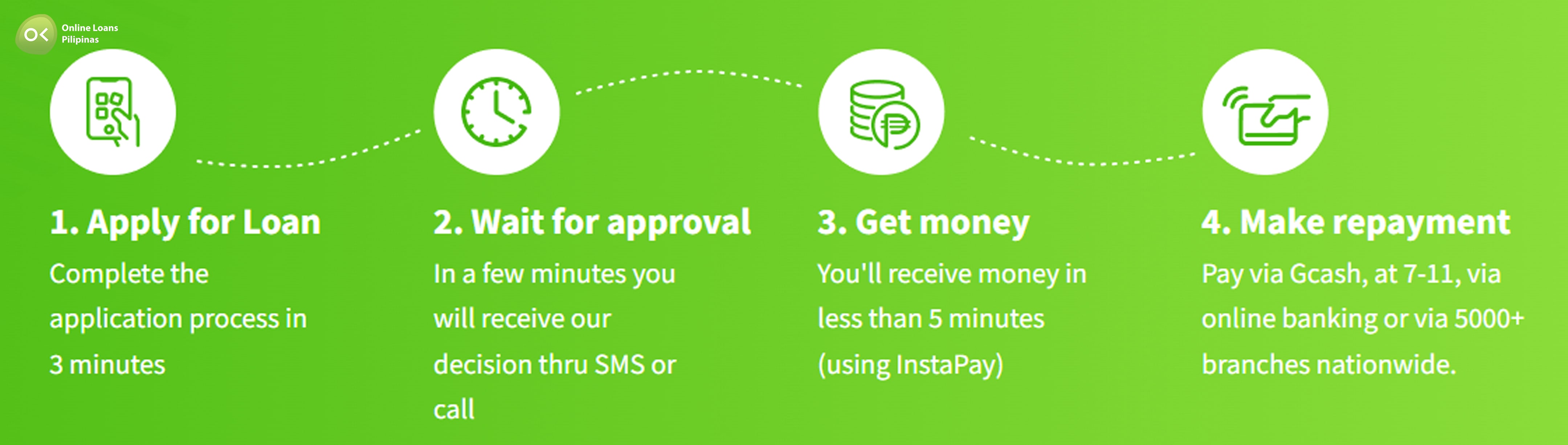

How to Apply for a Quick Loan Using GCash

Securing a loan through Online Loans Pilipinas and receiving it via GCash is straightforward. Follow these simple steps:

- Apply Online: Visit the Online Loans Pilipinas website and fill out the application form to apply for a loan online GCash. Provide the necessary details and submit your request.

- Approval Process: The team at Online Loans Pilipinas will review your application. Once approved, you will receive a notification.

- GCash Disbursement: Upon approval, select GCash as your preferred disbursement method. The funds will be transferred to your GCash account promptly.

- Access Your Funds: Open your GCash app to access your loan amount. From here, you can manage your funds as needed.

Key Insights

1. What is Online Loans Pilipinas?

Online Loans Pilipinas is a trusted online lending platform that offers quick and accessible loans to Filipinos. The platform simplifies the borrowing process, providing finance assistance without the lengthy procedures of traditional banks.

2. How does GCash disbursement work with Online Loans Pilipinas?

Once your loan application is approved by Online Loans Pilipinas, you can choose GCash as your disbursement method. The loan amount will be transferred directly to your GCash account, allowing you to access the funds instantly.

3. What are the benefits of using GCash for loan disbursement?

- Speed: Funds are transferred almost instantly after approval.

- Accessibility: Access your funds anytime, anywhere via the GCash app.

- Ease of Use: Manage your loan funds easily through GCash’s user-friendly interface.

- Security: GCash employs robust security measures to protect your financial information.

4. How do I select GCash as my disbursement method?

During the loan application process, you will be given the option to choose your preferred disbursement method. Select GCash, and ensure that your GCash account details are correctly provided.

5. What should I do if I don’t have a GCash account?

If you don’t have a GCash account, you can easily create one by downloading the GCash app from the App Store or Google Play Store and following the registration process.

6. Are there any fees associated with GCash disbursement?

Online Loans Pilipinas does not charge additional fees for choosing GCash as your disbursement method. However, standard loan fees and interest rate apply as per the loan agreement.

7. How can I repay my loan?

Repayment options will be provided by Online Loans Pilipinas. You can typically repay your loan through various methods, including bank transfers, payment centers, or directly via GCash.

8. What should I do if I encounter issues with my GCash disbursement?

If you experience any issues with your GCash disbursement, contact Online Loans Pilipinas customer support for assistance. They will guide you through resolving any problems.

Conclusion

In a world where time is of the essence, Online Loans Pilipinas and GCash provide a streamlined and secure way to borrow and access funds quickly. Whether for emergencies or planned expenses, this dynamic duo ensures that financial support is just a few clicks away. Embrace the future of lending and experience the ease of getting a loan online via GCash with Online Loans Pilipinas.

Visit the Online Loans Pilipinas website and fill out the application form with the required details. Submit your application for review.

Applicants typically need to provide personal identification, proof of income, and contact information. Specific requirements may vary, so check the Online Loans Pilipinas website for detailed information.

The approval process is usually quick. Once you submit your application, the team at Online Loans Pilipinas will review it and notify you of the decision promptly.

Yes, both Online Loans Pilipinas and GCash employ advanced security measures to protect your personal and financial information, ensuring a safe and secure transaction process.