How to Easily Loan Apply Online Today

Struggling with financial uncertainties can be overwhelming and challenging for anyone to manage.

By choosing to apply for a personal loan today, individuals can take the necessary steps towards achieving financial stability and realizing their dreams with just a few clicks.

Fast Loan Application Methods

Exploring fast loan application methods is crucial for those seeking urgent financing.

In recent years, online loan application platforms have become increasingly popular. They provide a swift, convenient way to submit applications without visiting a physical branch.

With just a few clicks, applicants can complete forms, upload required documents, and receive almost immediate feedback from the lenders. It’s efficiency redefined for the digital age.

Moreover, many banks and financial institutions offer pre-approved loan options for existing clients. This method significantly reduces processing time as it leverages existing customer information.

Ultimately, the key to a successful, quick loan application lies in leveraging these streamlined methods and staying prepared.

Benefits of Online Loan Applications

Online loan applications offer unparalleled convenience, ushering in a new era of seamless transactions.

Online loan platforms offer unparalleled accessibility, allowing applicants to apply from anywhere, anytime, without visiting physical branches. This flexibility saves time and minimizes disruptions.

Digital platforms streamline processes, reducing application time with automated checks and instant document uploads, often providing responses within hours for quicker access to funds, especially when applying for a personal loan.

Moreover, these platforms offer educational resources and customer support, guiding applicants through the process. This support ensures even those unfamiliar with loan applications can navigate the system efficiently and successfully.

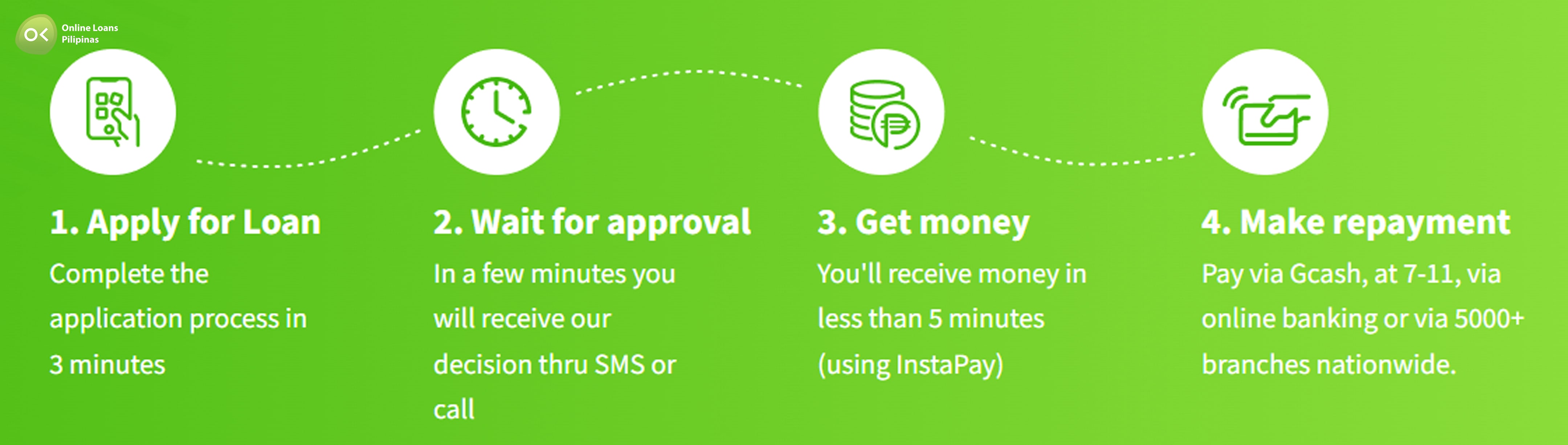

Steps to Apply for a Loan Online

Applying for a loan online is an efficient process that saves time, reduces paperwork, and provides a high level of convenience, ensuring a seamless experience for all applicants.

First, research various lending platforms to determine which offers the best terms and interest rate, and understand how to loan apply for the most favorable options.

Second, ensure all necessary documents such as identification, proof of income, and bank statements are ready for upload.

Third, create an account on the chosen platform, filling in necessary personal and financial information accurately.

Fourth, submit the personal loan application and monitor for any follow-ups or additional document requests, which may be handled via email.

Fifth, once the personal loan is approved, review the terms and conditions carefully before accepting the offer, paying particular attention to any hidden fees or penalties.

Finally, keep a copy of all documentation and establish a repayment plan to maintain a positive financial standing and future borrowing capability.

Common Mistakes to Avoid When Applying

Common Mistakes in Online Loan Applications

- Not researching various lending platforms can lead to missing better interest rates.

- Inconsistent information causes processing delays.

- Providing incomplete or inaccurate data can result in serious issues.

- Not reading the fine print can lead to unexpected financial burdens.

- Being vigilant and meticulous enhances approval chances and secures favorable terms.

Comparing Loan Offers from Different Lenders

Comparing loan offers from different lenders can save substantial amounts on interest rates and fees. Each lender may offer unique benefits, making it essential to analyze various options before deciding. Understanding different terms, interest rates, and fees helps individuals make informed choices aligned with their financial goals.

Utilizing comparison tools or loan calculators to evaluate factors like APR, loan tenure, and repayment flexibility can identify the best value. Seeking expert advice from financial consultants can further streamline the process, providing insights into lender reliability and customer service quality.

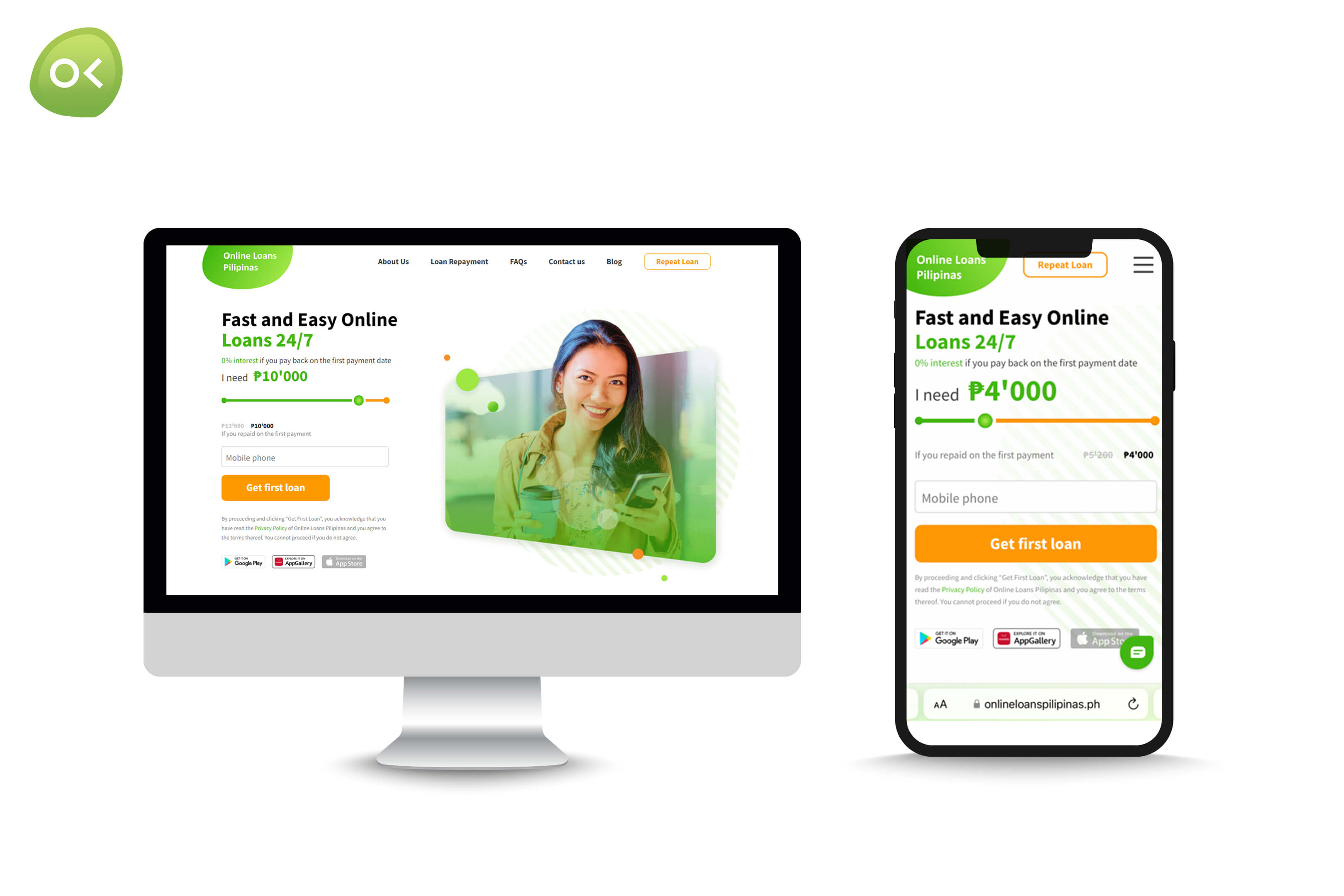

Using Mobile Apps to Apply for Loans

Leveraging technology for financial needs, like loan applications, is transformative. Mobile apps from leading financial institutions offer a convenient and efficient borrowing option.

These apps enable loan applications with a few taps, featuring secure document uploads, identity verification, and real-time status tracking. Loan calculators help borrowers assess the appropriate loan amount and repayment capabilities accurately.

This seamless process saves time and enhances the user experience, highlighting the importance of innovation in streamlining financial services.

Why Online Loans Pilipinas is the Best Mobile App for Loan Applications

- User-Friendly Interface: The app offers an intuitive and easy-to-navigate interface, making the loan application process simple and efficient.

- Quick Approvals: With automated checks and instant document uploads, applicants receive responses swiftly, often within hours.

- Secure Transactions: Advanced security features ensure that all personal and financial information is protected.

- Real-Time Tracking: Users can monitor their loan status in real-time, providing transparency and peace of mind.

- Comprehensive Tools: The app includes loan calculators and educational resources to help borrowers make informed decisions.

Tips for a Successful Loan Application

Successfully navigating the loan application process requires preparation, knowledge, and a strategic approach. These essential tips will significantly increase their chances of being approved.

First, they should thoroughly understand the loan requirements and their eligibility criteria.

Reading the terms and conditions is crucial.

Next, they must ensure all necessary documents for their personal loan are prepared in advance.

Incomplete applications often result in delays or rejections, so meticulous attention to detail is paramount.

Furthermore, highlighting their creditworthiness by maintaining a good credit score can immensely sway the lender's decision in their favor.

Lastly, an honest and accurate presentation of their financial situation will not only build trust but also facilitate a smoother approval process.