Personal Loan Apply Online: Quick and Easy Steps

In today's fast-paced world, time is a valuable asset.

Gone are the days when one had to visit banks, filling out numerous forms for hours to secure a personal loan.

Modern technology has revolutionized the lending process, making it more accessible and straightforward than ever before by allowing borrowers to easily determine their loan amount. With just a few clicks, anyone can apply for a personal loan online, access funds swiftly, and realize their financial goals.

Experience the empowerment of quick financing.

Understanding Personal Loans

A personal loan provides financial assistance without requiring collateral, allowing individuals to borrow based on their creditworthiness. These loans are ideal for covering various expenses such as debt consolidation, home improvement, or emergency medical costs, offering fixed interest rates and predictable monthly payments.

In the digital age, applying for personal loans online is quick and easy. This streamlined process offers on-the-spot approvals and immediate access to funds, making financial empowerment accessible to everyone.

Why Choose an Online Personal Loan?

Applying for a personal loan online is incredibly convenient, eliminating long queues and physical documents. From application to approval, the process is fast and efficient, with quick feedback on loan status.

Online platforms offer competitive rates through partnerships with financial institutions, ensuring borrowers get the best offers. They also guarantee the security and confidentiality of personal information, making online personal loans an attractive choice for financial assistance.

Benefits of Applying Online

Convenience and Flexibility

- Apply anytime, anywhere.

- Intuitive platforms for easy navigation.

Time-Saving

- Complete the process in minutes.

- No need for queues or physical documents.

Transparent Communication

- Real-time assistance from customer support.

- Clear and transparent communication channels.

How to Prepare for Your Application

Before initiating a personal loan apply online, ensure your financial records and the desired loan amount are organized and accessible. Gather necessary documents like a government-issued ID, proof of income, and bank statements to streamline the process.

Check your credit score to anticipate loan approval chances and potential interest rates. Compare loan offers from different lenders using online calculators to find the most favorable terms. This preparation ensures a smoother and more informed application experience.

Choosing the Right Lender

Selecting a reputable lender is essential for a successful loan application process. Research and compare different lenders to find which one offers the best terms.

Using online reviews and ratings can provide insightful information, helping one to make an informed decision. Other factors to consider include "low-interest rates" and flexible repayment options.

Not all lenders are created equal; choosing wisely maximizes benefits and minimizes risks.

Checking for transparency in fee structures and how customer service handles inquiries can also be deciding factors. To ensure a good fit, applicants must align their financial goals with what the lender offers. Using these criteria, anyone can confidently choose the right lender.

Gathering Necessary Documents

Before applying for a personal loan online, it's crucial to gather the necessary documents to streamline the process.

- Valid ID: Government-issued identification (passport, driver's license)

- Proof of Income: Payslips, employment certificate, tax returns

- Bank Statements: Recent bank statements for the past three months

- Proof of Address: Utility bills, lease agreements

- Other Financial Documents: Credit card statements, existing loan details

Having these documents ready will ensure a smooth and efficient application experience.

Most lenders require these documents to verify identity, income, and financial stability.

This preparation not only speeds up approval but also demonstrates financial responsibility.

Filling Out the Application Form

Filling out the application form for a personal loan apply online is efficient and accurate. Provide accurate personal, employment, and financial details to boost approval chances. Include truthful information about credit history and existing debts to build credibility. Upload necessary documents directly within the form to accelerate processing. With preparation, anyone can confidently complete their online personal loan application, making financial dreams attainable.

Submitting Your Application

The process of submitting your loan application online can be straightforward and efficient when the necessary steps are followed attentively.

- Double-check all information: Ensure that every piece of information entered is accurate and complete.

- Prepare required documents: Have digital copies of required documents ready for upload.

- Review terms and conditions: Carefully read and understand the loan terms before submission.

- Submit the application: Confidently submit your application through the secure online portal.

- Await confirmation: Expect a confirmation email or message from the lender.

By taking the time to meticulously review each detail, applicants can avoid common pitfalls and expedite the approval process, setting the stage for financial empowerment.

FAQs on Personal Loan Apply Online

Frequently Asked Questions (FAQ)

- What are the eligibility criteria for an online personal loan?

- Minimum age, income, and credit score requirements set by the lender.

- What documents are required for the application?

- Proof of identity, residence, income, and employment.

- How can I prepare for the application process?

- Gather necessary documents in advance and review lender prerequisites.

- Is my personal information secure when applying online?

- Yes, reputable lenders use advanced encryption technology to protect personal information.

- How fast is the approval process for online personal loans?

- Online applications are designed to expedite the approval process, often delivering faster results compared to traditional methods.

Online Loans Pilipinas: The Best Choice for Personal Loans

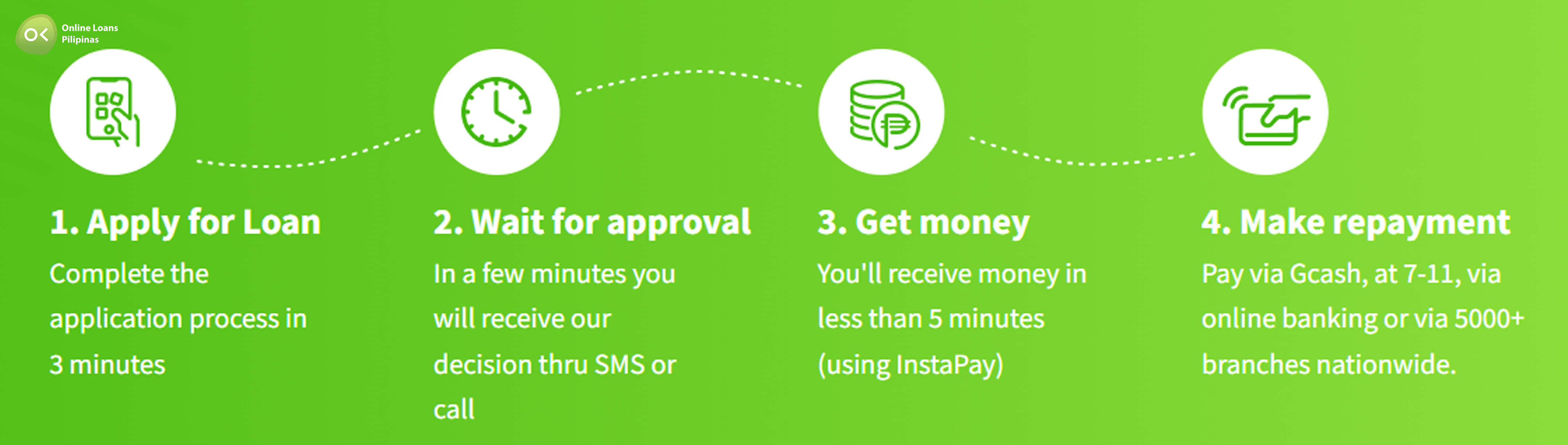

- Quick and Easy Application

- Streamlined online process for fast approval and disbursement.

- Competitive Interest Rates

- Offers attractive rates to make borrowing more affordable.

- Flexible Loan Terms

- Provides various repayment options to suit different financial needs.

- Secure Transactions

- Utilizes advanced encryption technology to protect personal information.

- Excellent Customer Support

- Dedicated representatives available to assist throughout the application process.