Fast & Reliable Cash Loans Online: What You Need to Know

Imagine receiving an unexpected medical bill that exceeds your savings, causing immediate stress. Cash loans online can provide a timely solution for such unforeseen financial emergency situations. These loans offer quick access to funds, ensuring you can manage unexpected expenses without derailing your financial plans.

Understanding Online Cash Loans

Online cash loans offer a practical financing solution for urgent financial needs. By applying for cash loans online, you gain a convenient way to bridge short-term financial gaps, making life’s uncertainties more manageable.

These loans provide a straightforward application process with quick approval times, ensuring funds are available when needed most. For those facing unforeseen expenses, the accessibility and speed of online cash loans make them a viable option.

They cater to various financial situations and credit profiles. Unlike traditional bank loans with stringent approval processes, cash loans online typically have more flexible requirements, supporting more Filipinos in times of need.

Understanding the benefits of online cash loans empowers you to make informed financial decisions. By choosing secure and reliable online options, you can navigate life's challenges with confidence, knowing a safety net is available for unexpected expenses.

Benefits of Cash Loans Online

Accessing financial assistance quickly is crucial during urgent times. Online cash loans address this need with streamlined processes that eliminate lengthy paperwork. Since 2016, many financial institutions have offered user-friendly platforms for convenience.

You can secure funds from home, maintaining privacy, while advanced encryption technologies protect personal information. These loans cater to a broader audience, including those with varying credit histories, ensuring financial solutions are available even for those facing challenges with traditional lenders.

In summary, online cash loans provide a fast, secure, and efficient way to address immediate financial needs, promoting financial stability and peace of mind.

How to Apply for Online Cash Loans

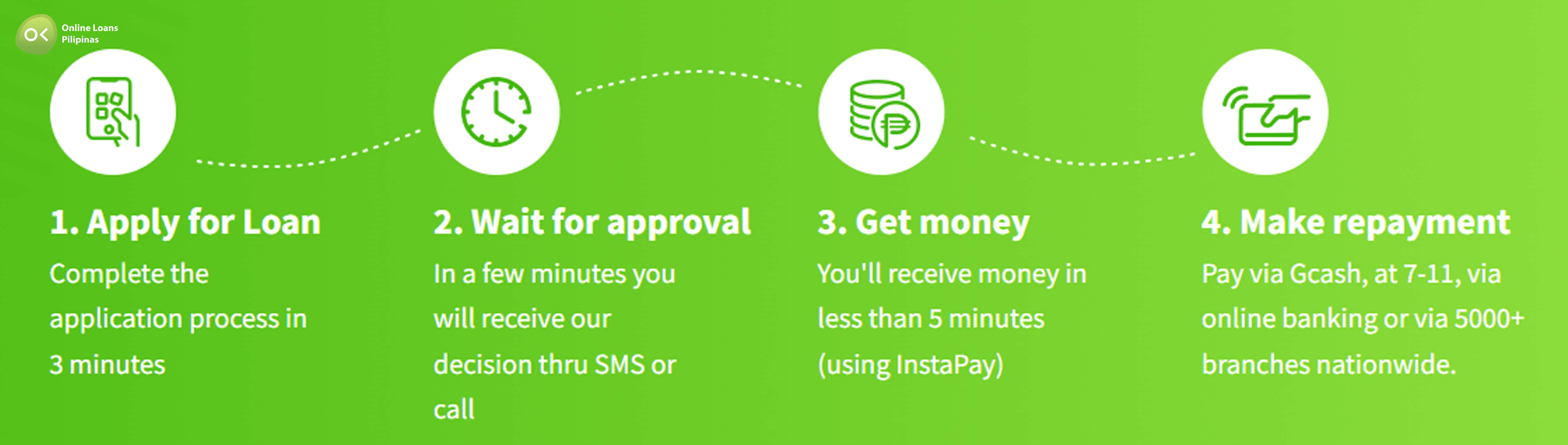

Applying for cash loans online is straightforward and convenient. Choose a reputable lender with positive reviews and strong encryption technologies. Visit their website, find the "Apply Now" section, and fill out a simple form. After submission, your application will be reviewed, and you could receive your funds as quickly as the same day, ensuring swift financial stability.

Steps for a Quick Application

Start by gathering necessary documents, a crucial step toward expediting your application process. Ensure you have identification, proof of income, and bank details ready for submission.

Next, visit the lender’s website and locate the “Apply Now” button. Enter accurate information as requested on the form to avoid delays. Completion usually takes just minutes.

Leveraging technology, online loan applications boast approval rates as high as 80%.

After submission, wait for a confirmation email or SMS. Most lenders verify your details promptly, with funds potentially disbursed within hours. This swift process underscores the convenience of cash loans online.

Eligibility Criteria for Cash Loans

When seeking cash loans online, understanding eligibility criteria is crucial.

Applicants must be at least 18 years old to meet legal requirements for a cash loan. A stable source of income reassures lenders of your ability to repay, increasing approval chances. Additionally, having a valid residential address and some credit history can bolster credibility.

Meeting these requirements enhances the likelihood of securing swift and reliable cash loans online.

Comparing Online and Traditional Cash Loans

Online and traditional cash loans differ significantly.

Traditional bank loans involve lengthy processes and substantial documentation, often delaying approval. In contrast, cash loans online are efficient, with minimal paperwork and quicker processing times.

Online loans offer unmatched convenience, allowing applications anytime and from anywhere, unlike traditional banks with fixed hours. This flexibility ensures prompt and seamless financial assistance.

Additionally, online platforms employ sophisticated security measures to protect your information, making cash loans online both appealing and practical.

Interest Rates and Fees

When considering cash loans online, it is crucial to understand interest rates and fees, which can significantly impact the overall cost of your loan.

Online lenders typically offer competitive interest rates to attract those looking to borrow.

Comparing different offers allows you to find the best possible rate.

Transparent fee structures enhance trust and help avoid unexpected expenses.

Always review the terms carefully to understand any additional costs.

Ultimately, select a loan that aligns with your financial goals and capabilities. By doing so, you position yourself to achieve success responsibly.

Managing Your Loan Repayment

Managing loan repayment requires careful planning and disciplined budgeting. Focus on timely repayments to maintain a positive credit history.

First, understand your loan terms, including disbursement details, repayment dates, and amounts. Create a budget prioritizing loan repayments to allocate funds appropriately.

Set up automatic payments to avoid missing due dates and incurring penalties. Whenever possible, pay more than the minimum to reduce the principal and overall interest.

If you face financial difficulties, communicate with your lender immediately. Reputable providers often offer adjusted payment plans to help you manage through tough times.

Reliable Online Loan Providers

In the realm of cash loans online, selecting reliable providers is crucial for a secure borrowing experience. Trusted providers use robust security measures to protect your information.

Choose providers with a proven track record, positive reviews, and affiliations with recognized financial organizations. Transparency in terms and conditions is essential, ensuring you understand the loan process, fees, and repayment terms.

Exemplary customer service and multiple communication channels enhance borrower confidence. Reputable lenders also offer comprehensive online resources, empowering you to make informed decisions.

Ultimately, choosing the right provider ensures not just securing funding but also peace of mind, fostering a seamless and secure borrowing process.

Online Loans Pilipinas stands out as the best option for cash loans online due to several key factors:

- User-Friendly Platform: Their website is easy to navigate, making the application process quick and straightforward.

- Fast Approval: They offer rapid approval times, ensuring you get the funds you need promptly.

- Flexible Requirements: With more lenient eligibility criteria compared to traditional banks, they cater to a broader range of applicants.

- Secure Transactions: Advanced encryption technologies protect your personal information, ensuring secure and reliable transactions.

- Positive Customer Reviews: Numerous satisfied customers attest to their excellent service and reliability.

Choosing Online Loans Pilipinas means opting for a fast, secure, and efficient way to address your immediate financial needs.