Online Loan Pilipinas: Secure Loan Options

When Maria faced an unexpected medical expense, she turned to online loans for quick financial relief.

Online loans Pilipinas provide middle-income Filipinos with easy access to funds, but the question of their safety and finance management often arises.

Comprehensive Online Loan Solutions

Online Loans Pilipinas offers quick and reliable financial solutions. Borrowers can access funds through a straightforward online process, providing a seamless experience without the need for extensive paperwork or long waiting periods.

Diverse Loan Offerings

Online Loans Pilipinas offers a myriad of loan options—personal, payday, and installment—each specifically tailored to meet diverse financial needs.

Personal loans can help cover medical expenses, home renovations, and even vacations with lower interest rates.

Flexible terms and competitive interest rates make these loans accessible and affordable, enabling you to manage your credit and finances effectively without undue stress or hidden fees.

Whether you need an emergency fund, want to consolidate debt, or invest in a new business venture, our varied loan offerings ensure that you find the perfect financial solution.

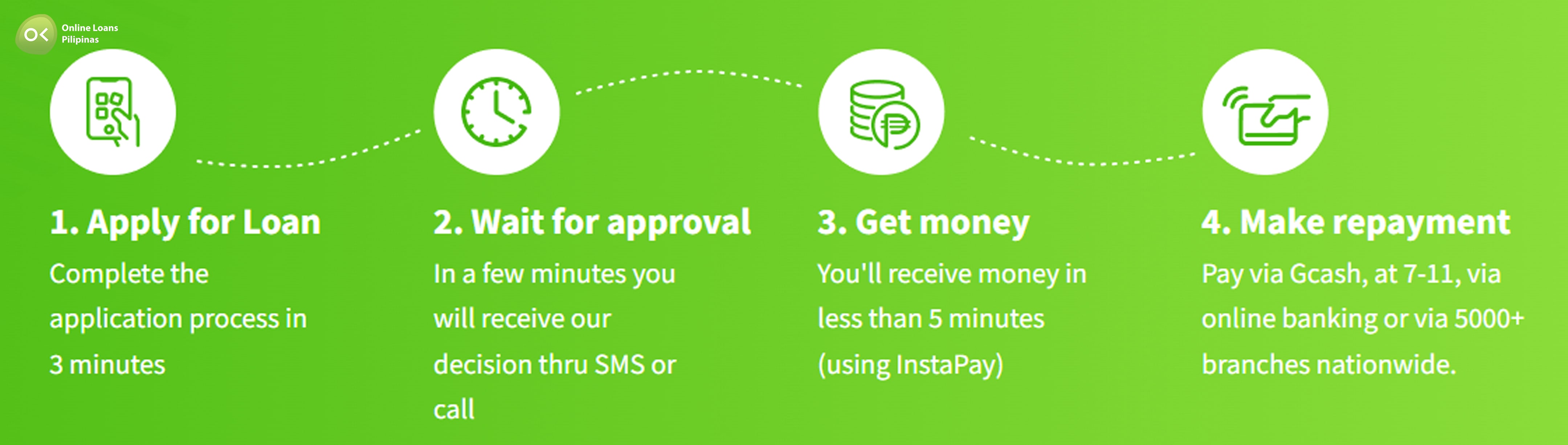

Easy Application Process

With Online Loans Pilipinas, we prioritize customer convenience by offering an easy application process.

First and foremost, our online platform is user-friendly and intuitive, allowing even those with minimal tech experience to navigate with ease. Applicants simply need to fill out a straightforward online form, upload the necessary documents, and submit their application in just a few minutes.

Furthermore, our streamlined process eliminates the need for extensive paperwork. This means you won't have to worry about printing, scanning, or faxing multiple documents, making your loan application experience smooth and hassle-free.

Most importantly, we expedite approval times to ensure you get the funds you need quickly. Once your application is submitted, our team promptly reviews it, and if all requirements are met, you can expect to receive the funds in your bank account within a short period. This efficiency ensures that your financial needs are addressed without delay.

Ensuring Security and Safety

Here at Online Loans Pilipinas, safeguarding your personal information is our topmost priority. We employ state-of-the-art encryption protocols, ensuring your data remains confidential and impenetrable.

Furthermore, we adhere to stringent verification processes, including validating our Securities and Exchange Commission (SEC) registration and confirming our physical office locations to ensure our credibility. These measures are in place to protect you from fraudulent activities and unscrupulous lenders.

Your trust and peace of mind are paramount; that's why our security practices are designed to guarantee a safe and reliable borrowing experience.

SEC Registered Lender

Being an SEC-registered lender is paramount for ensuring the credibility and legitimacy of any financial institution. It signifies adherence to national regulations and standards, providing borrowers with an additional layer of security.

This registration creates a foundation of trust between the lender and the borrower. It also showcases the lender’s commitment to transparency and ethical lending practices. To verify if a lender is SEC-registered, you can check the SEC's online database or contact them directly. This step is crucial in avoiding fraudulent lenders. An SEC-registered lender is subject to regular audits and assessments. These audits help maintain high standards of operation and financial stability, reassuring borrowers of continued support and reliability.

Furthermore, SEC registration ensures that the lender's operations are transparent and lawful. Borrowers can be assured that they are dealing with a legitimate institution that adheres to the regulatory framework.

Ultimately, opting for an SEC-registered lender in the Philippines isn’t just about compliance; it’s about safeguarding your financial future. It provides peace of mind, knowing that your transaction is protected by the law.

Clarity in Terms and Conditions

Before you apply for any loan, ensure that you meticulously read and fully understand the terms and conditions. This includes the Annual Percentage Rate (APR), loan tenure, repayment schedule, and any additional fees or penalties. Authentic lenders will provide transparent and comprehensive details, aiding you in making an informed decision, thus safeguarding you from unexpected financial pitfalls.

Transparent Loan Terms

Understanding the terms of your loan is crucial to ensuring your financial health and security.

Reputable lenders like Online Loans Pilipinas emphasize transparency in their loan agreements, offering clear explanations and comprehensive details about the loan's Annual Percentage Rate (APR), tenure, and repayment schedules. This level of transparency ensures that you are fully aware of and agree to the costs and commitments involved.

For instance, lenders should clearly outline any additional fees or penalties associated with the loan. Knowing these details upfront helps in planning your finances better and avoiding unexpected charges, which could otherwise strain your budget.

Moreover, at Online Loans Pilipinas, we are committed to providing straightforward and honest loan terms. This commitment not only fosters trust but also ensures borrowers can confidently manage their loans without encountering hidden surprises. Always read the terms thoroughly and ask questions if anything is unclear; a genuine lender will gladly provide all necessary clarifications.

No Upfront Fees

When seeking a loan, it’s essential to be wary of lenders who require upfront fees.

- Reputable lenders do not demand any payment before processing your loan.

- Genuine costs are typically deducted from the loan amount.

- Lenders should not ask for wire transfers as part of the lending process.

- Application and processing should never have hidden or advance fees.

Paying in advance can be a sign of scam practices.

Genuine lenders like Online Loans Pilipinas ensure transparency without any upfront costs.

Verified Customer Satisfaction

Online Loans Pilipinas consistently prioritizes customer satisfaction, a testament to our commitment to excellence. Positive feedback from our clients highlights our reliable service, uncomplicated application process, and prompt customer support, reinforcing our reputation as a trustworthy financial partner in the Philippines. Our dedicated team ensures that every loan experience aligns with our high standards, fostering trust and credibility in our service.

Positive Online Reviews

Positive online reviews are a crucial factor to consider when evaluating the legitimacy and reliability of an online lender.

- Authenticity: Real reviews provide genuine feedback from actual customers.

- Customer Experience: Insights into the application process and customer service.

- Trustworthiness: High ratings can build confidence in the lender’s credibility.

- Transparency: Reviews can reveal the clarity and fairness of loan terms.

- Responsiveness: Assess the lender's efficiency in addressing customer concerns.

Reviews provide a snapshot of what you can expect from the lender. Happy customers often highlight quick approvals and excellent service. These reviews help new borrowers make informed decisions and avoid potential scams.

Reliable Customer Support

Reliable customer support is paramount for any financial service provider, ensuring seamless and positive experiences for all of the clients.

Since 2018, Online Loans Pilipinas has committed to delivering exceptional customer service, addressing queries, and resolving issues promptly. This dedication strengthens trust and satisfaction among borrowers.

When seeking financial assistance, it's crucial to have access to knowledgeable and responsive customer support. This ensures borrower queries are resolved swiftly and accurately, enhancing the overall borrowing experience.

Our support team is available 24/7, ready to assist with any loan-related inquiries. Whether it's about application status, repayment options, or general loan information, we are here to help.