Loan Online PH Review 2024: Is It Worth It?

You're sitting at your desk, thinking about funding that dream project. What if you could access the funds instantly?

In the digital age, online loans have become a savior for many. Have you ever wondered if they are the right fit for you?

Loan Online PH emerges as a strong contender, offering reliable, legit, and speedy financial solutions. Let’s delve into this loan online PH review.

Understanding Online Loans in the Philippines

In the dynamic era of digital finance, online loans in the Philippines offer unparalleled convenience with rapid approvals and minimal paperwork. These platforms simplify securing funds compared to traditional banks, catering to personal emergencies and entrepreneurial ventures. Leveraging technology, they provide fast, secure, and accessible borrowing options with competitive interest rates and flexible repayment plans. This shift underscores the potential for growth and financial inclusion in every Filipino’s journey to achieve their dreams.

Benefits of Online Loans

Experience financial freedom right at your fingertips.

Access to online loans provides convenience and speed, making financial relief just a few clicks away. Unlike traditional banks, online lenders eliminate extensive paperwork and time-consuming processes, allowing Filipino borrowers to secure funds promptly for faster problem-solving or investment growth.

The user-friendly application process can be completed anywhere, crucial for remote areas with scarce banks. Online loan platforms offer 24/7 services, providing round-the-clock financial support.

Leveraging technology, these platforms ensure transparency and security with advanced protocols to safeguard personal details and reduce fraud risks. Data-driven decision-making allows for accurate risk assessments, offering fair and customized financial solutions to a wider audience.

Common Types of Online Loans

In today's fast-paced world, online loan options offer flexibility and cater to various financial needs, ensuring that everyone finds the perfect fit.

Personal loans are perhaps the most popular, allowing borrowers immense versatility in usage.

Another key category is business loans, which empower entrepreneurs to scale their ventures with ease and efficiency. These loans serve as a backbone for start-ups, enabling them to flourish in a competitive market by providing essential financial support.

Lastly, payday loans offer immediate financial relief for short-term needs. While they typically have higher interest rates, they are invaluable for pressing situations, making them a quick and accessible solution when faced with unexpected expenses. As technology advances, the scope and flexibility of online loans continue to expand, heralding a new era of financial empowerment for Filipinos.

Top Online Loan Providers in the Philippines

Invest in your future with trusted providers.

When it comes to accessing quick funds, the landscape of online loan providers in the Philippines is truly impressive. From seamless applications to swift disbursals, these companies are pivotal in addressing diverse financial needs efficiently. Let's explore some of the top online loan providers that epitomize reliability and innovation.

The top online loan providers in the Philippines include:

- Online Loans Pilipinas - Online Loans Pilipinas is the top online loan provider in the Philippines due to its quick approval process, user-friendly platform, and minimal documentation requirements. Offering 24/7 service, competitive interest rates, and advanced security measures, it ensures fast, secure, and convenient financial solutions for Filipino borrowers.

- Tala Philippines - Offers rapid approvals and a seamless app experience.

- Cashalo - Provides flexible loan options and competitive interest rates.

- Home Credit - Specializes in personal loans and consumer financing with easy repayment plans.

- Loan Ranger - Focuses on short-term loans with fast disbursement.

- MoneyCat - Offers instant loans with minimal requirements and quick processing.

- UnaCash - Provides accessible loans with a focus on transparency and customer service.

- Digido - Known for its straightforward application process and swift approval times.

These providers leverage technology to offer secure, fast, and convenient borrowing options tailored to various financial needs.

Criteria for Choosing an Online Loan Provider

Selecting the ideal online loan provider.

When it comes to financial stability, the choice of a reliable online loan provider can make all the difference. The foremost criterion to consider is the provider’s reputation for being legit, transparency, clear terms, and customer-centric policies. Additionally, understanding what fees may be involved is crucial as unforeseen charges can lead to complications.

Evaluate the loan criteria, eligibility, loan terms, the loan amount, and the interest rate.

Ensure the provider offers flexible repayment options. These could range from short-term to long-term loans, catering to different financial needs and capabilities.

Pay attention to customer service.

An accessible customer support team ensures that help is always at hand, whether you're facing technical difficulties or have queries about your loan terms.

Lastly, consider the security measures in place to protect your personal information. As online transactions increase, choosing a provider with robust cybersecurity measures guarantees peace of mind. By following these best practices, you elevate your chance of a fruitful and secure borrowing experience.

Loan Online PH Review: Key Considerations

|

Aspect |

Details |

Importance |

|---|---|---|

|

Lender's Credibility |

Evaluate user reviews, regulatory compliance, and transparency of terms. |

Ensures secure transactions and builds trust and confidence in the borrowing process. |

|

Competitive Interest Rates |

Look for loan providers offering attractive interest rates. |

Helps in reducing the overall cost of borrowing. |

|

Flexible Repayment Terms |

Prioritize lenders with adaptable repayment plans. |

Provides ease in managing loan repayments according to your financial situation. |

|

Robust Customer Support |

Choose providers with strong customer service. |

Ensures assistance and support throughout the borrowing process. |

|

Comprehensive Research |

Conduct thorough research on potential lenders. |

Enhances financial empowerment and leads to a successful borrowing experience. |

How to Apply for an Loan Online PH

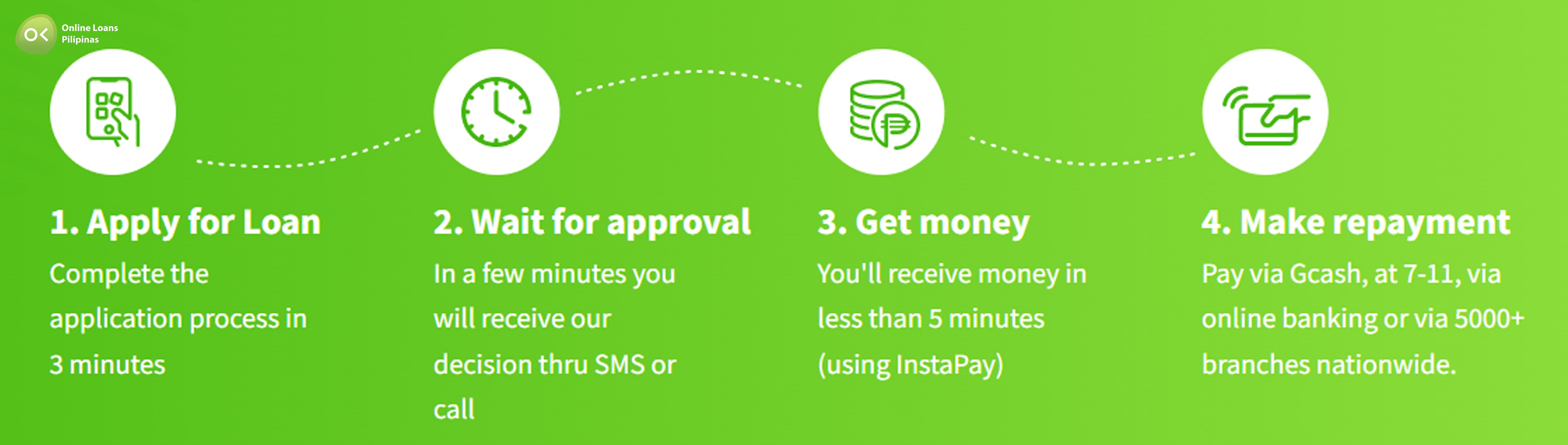

Applying for an online loan in the Philippines is a streamlined process that can be completed in just a few simple steps, thanks to modern technology.

Firstly, identify a reputable and legit loan provider.

Once you’ve chosen a credible lender, visit their official website and locate the loan application section. Typically, you will need to provide personal information, employment details, and proof of identity to initiate your application.

After submitting the necessary documents and information, the verification process begins. Most online lenders in the Philippines boast quick turnaround times, often approving applications within hours or days, depending on the loan amount. Once approved, the funds are transferred to your designated bank account, facilitating immediate access to the necessary funds, thus enriching your financial journey and enabling your goals.

Managing Your Online Loan Responsibly

Taking out a loan is a significant financial decision.

It's essential to approach this commitment with a clear strategy. By carefully considering your repayment capacity and maintaining a disciplined approach towards managing your finances, you can ensure that your loan serves as a beneficial tool rather than a financial burden. Prioritize understanding all the terms and conditions associated with your loan to avoid any unexpected surprises.

Stay on top of your scheduled payments.

Defaulting on loan repayments can lead to higher interest rates and may negatively affect your credit score. By setting up reminders or automatic payments, you can make sure you never miss a due date, thereby safeguarding your financial health.

Remember, borrowing should be seen as an opportunity to grow, not just a quick fix. When used responsibly, loans can enhance your ability to achieve financial stability and growth. Aim to utilize the borrowed funds for productive purposes that lead to greater returns or financial well-being, ultimately positioning you for long-term success.

Final Thoughts

In this comprehensive review of Loan Online PH for 2024, we explore whether this financial service is a worthwhile option for Filipinos seeking online loans. The review delves into the platform's user experience, interest rates, loan terms, and customer service. By examining both the advantages and potential drawbacks, we aim to provide a balanced perspective to help readers make informed decisions about using Loan Online PH.