Fast Loans Online: Everything You Need to Know

The digital age has transformed finance dramatically. Today, the convenience of fast loans online has become an indispensable resource for many.

Professionals find solace in knowing that fast access to funding through an online loan can fuel their aspirations and bridge gaps seamlessly, ensuring financial confidence.

1. Understanding Fast Loans Online

Fast loans online have transformed the financial landscape, offering quick access to funds through digital platforms. Utilizing advanced technologies, these loans provide swift solutions without traditional banking hassles, making financial maneuvering more agile.

Streamlined application processes allow borrowers to quickly determine loan amount and arrange prompt payment schedules, significantly reducing waiting times. Robust algorithms efficiently assess credibility, ensuring expedited approval for eligible individuals.

These loans empower individuals to seize timely opportunities, fostering growth and stability. Quick access to funds instills confidence to navigate unforeseen expenses, propelling individuals towards achieving their financial milestones seamlessly.

2. Benefits of Fast Loans

Fast loans offer significant advantages, including immediate access to funds, crucial during emergencies or unexpected expenses. They bridge financial gaps promptly, reducing stress.

The simplified process requires minimal paperwork, enhancing the borrowing experience. User-friendly applications allow for quick completion without extensive documentation.

Expedited approval processes provide crucial financial relief. Leveraging technology, lenders offer rapid decisions, often within hours, empowering individuals to manage financial challenges swiftly and efficiently.

3. Types of Fast Loans Online

In pursuing financial flexibility and immediate support, seekers of fast loans online encounter various options geared towards different needs. Each type offers distinct advantages suited to specific financial scenarios, empowering borrowers to select the most suitable product.

Payday loans stand out as the most recognizable of fast financial solutions.

Typically, these short-term loans cater to immediate cash flow needs until the borrower's next payday.

Personal loans, characterized by their versatility and higher borrowing limits, are another option.

Often unsecured, personal loans offer borrowers flexibility in terms of usage, whether for emergencies or planned expenditures.

Next, there are business loans specifically designed for entrepreneurs seeking quick capital injections to sustain or grow their enterprises.

Lastly, line of credit loans provide a revolving credit option, allowing borrowers to access funds as needed, repay, and borrow again within a set limit.

4. How to Apply for Fast Loans Online

Applying for fast loans online is now seamless, even for digital novices. Borrowers start by researching reputable lenders, comparing offers, and gathering necessary documents. After selecting a lender, they complete an online application form with personal, employment, and financial details. Swift feedback follows, often leading to loan approval and fund disbursement within a few business days, showcasing efficiency and customer-centric service in the digital age.

4.1. Eligibility Criteria

Determining one's eligibility for fast loans online is crucial to ensure a smooth application process. Lenders have specific criteria that must be met to qualify for a loan.

These criteria generally involve age restrictions, with applicants needing to be at least 18 years old. Proof of regular income is often required to demonstrate the capacity to repay the loan.

Lenders' primary concern is ensuring applicants have a reliable income source.

Other typical requirements include possessing a valid identification card and possibly maintaining a good credit score. Adhering to these guidelines enhances the chances of securing a fast loan swiftly, thereby easing financial pressures and facilitating prompt access to needed funds. Applicants should thoroughly review these criteria before applying to prevent potential delays in the loan approval process.

4.2. Required Documents

Applying for fast loans online requires the submission of several key documents to verify identity and financial stability.

- Proof of Identity: Valid passport, driver's license, or national ID

- Proof of Address: Utility bill, lease agreement, or bank statement with applicant’s address

- Proof of Income: Payslips, tax returns, or bank statements showing consistent income

- Bank Account Details: Statement or document containing bank account number and branch code

These documents help lenders assess the applicant's eligibility and ability to repay the loan.

Ensuring all documents are up-to-date and accurate can significantly expedite the loan application process.

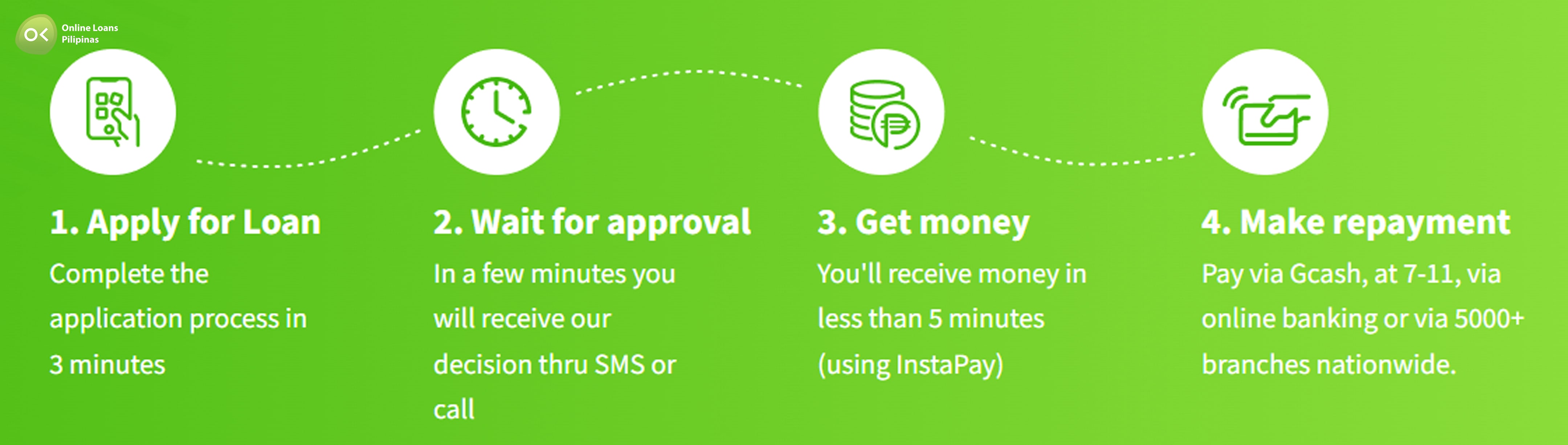

4.3. Application Process

Securing fast loans online begins with filling out an application form on the lender’s website. This streamlined process allows applicants to provide personal, employment, and financial details from home. Accurate information prevents approval delays.

Lenders offer user-friendly interfaces for easy document uploads. After submission, a preliminary assessment verifies the information and documents. The approval team then evaluates the application, often providing a decision within hours. This swift process enables prompt access to funds, alleviating financial stress and fostering timely opportunities for growth and success.

5. Tips for Getting Approved

Securing approval for a fast loan online is streamlined with the right approach. Ensure all personal and financial details in the application are accurate and up-to-date to expedite the assessment phase.

A stable, verifiable income enhances credibility, reassuring lenders of repayment capability. Promptly providing required documents, such as proof of identity and income verification, reduces approval times.

Following these guidelines improves chances of securing fast loans online, facilitating quick access to crucial funds.

6. Risks and Considerations

While fast loans online offer convenience and quick access to funds, they are not without risks. Borrowers must carefully consider their financial situation and the terms of the loan.

High interest rate and fees can quickly accumulate, leading to a significant financial burden.

Additionally, the ease of obtaining these loans may tempt individuals to borrow more than they need, or can repay, leading to potential long-term debt.

To navigate these risks, it is essential for borrowers to thoroughly read and understand the loan agreement, seek reputable lenders, and reflect on their ability to meet repayment obligations. By being well-informed, they can turn fast loans online into a beneficial financial tool rather than a source of stress.

7. Comparing Loan Providers

When seeking fast loans online, comparing loan providers is crucial for finding the best terms and interest rates. Each lender offers different rates, fees, and repayment terms, impacting the loan's overall cost.

Applicants should start by examining interest rates; lower rates mean less expensive loans. They should also consider hidden fees like origination fees or prepayment penalties. Transparent lenders provide clear cost breakdowns.

Comparing providers equips borrowers to select the most advantageous loan, ensuring necessary financial support without unnecessary expense.