Online Loan App Guide: Quick Cash Tips

In recent years, the popularity of online loan apps has surged exponentially in regions like the Philippines. Think of them as the modern-day equivalent of borrowing a book from the library, but much faster and more convenient.

They are transformative.

These savvy digital solutions offer quick and accessible financing options, empowering individuals to address their financial needs with unprecedented ease and efficiency.

1. Understanding Online Loan Apps

Online loan apps have revolutionized the finance landscape, providing unparalleled convenience, flexibility, and enhanced privacy for borrowers.

Emerging prominently in the market, these digital platforms cater to a diverse range of financial requirements. From personal loans to business financing, their reach is extensive.

The key advantage lies in their simplicity. Users can apply for a cash loan with just a few taps on their smartphones, avoiding lengthy paperwork and long waits.

Moreover, they have streamlined the approval process. Utilizing advanced algorithms, many online loan apps deliver instant decisions and fast fund disbursements.

Embracing this technology empowers consumers, offering them a seamless way to manage their finances.

2. Benefits of Using an Online Loan App

Online loan apps offer significant advantages to users across various demographics.

Firstly, they provide unmatched convenience, allowing individuals to apply for loans without leaving their homes. This accessibility is critical for those with busy schedules or limited mobility.

Additionally, these platforms offer speedy approval processes. Leveraging cutting-edge algorithms, many online loan apps can deliver loan decisions within minutes, significantly reducing waiting times.

Moreover, their user-friendly interfaces, often equipped with a loan calculator, make the application process straightforward and stress-free. Minimal documentation requirements further streamline the experience, enabling quicker access to needed funds.

In essence, online loan apps empower users to address their financial needs efficiently, fostering a sense of empowerment and financial independence.

3. How to Choose the Right Loan App

Selecting the right online loan app requires a blend of thorough research, keen attention to detail, and strategic deliberation. Evaluating factors such as interest rates, repayment terms, user reviews, and security measures is imperative. By meticulously considering these aspects, individuals can identify reliable platforms that align with their financial goals, ensuring a smooth and beneficial borrowing experience.

3.1. Comparing Interest Rates

Comparing interest rates and fees is crucial to finding the best online loan app.

Lower interest rates mean lower monthly payments, allowing more financial flexibility and peace of mind.

A comprehensive comparison of interest rates offers insight into the true cost of borrowing, avoiding unwelcome surprises.

Seek online loan apps that clearly display their interest rates, helping borrowers make informed decisions. Be thorough in your research, always comparing multiple options.

3.2. Evaluating User Reviews

Evaluating user reviews is essential in selecting the right online loan app.

By scrutinizing authentic reviews in a thoughtful manner, one gains valuable insights into the app’s reliability, customer service, and overall user satisfaction. Genuine testimonials often shed light on practical experiences, providing a glimpse into both the app’s strengths and potential pitfalls.

Moreover, these reviews serve as a testament to the app's credibility. An online loan app with consistently positive reviews suggests a trustworthy service, while numerous negative experiences can be a red flag for potential users.

Thus, paying meticulous attention to user feedback not only informs prospective borrowers about the quality of the app but also fosters a sense of confidence and reassurance. This evaluation process is a vital step toward a secure and rewarding borrowing journey.

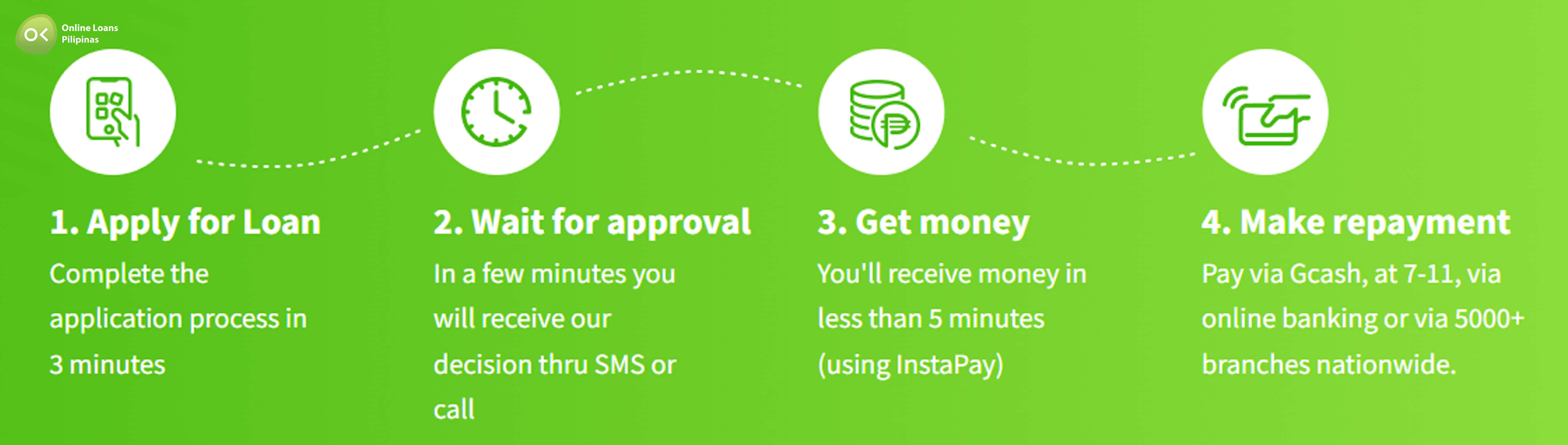

4. How to Apply for a Loan Online

To borrow a loan online, begin by selecting a trusted online loan app that suits your financial needs and preferences. If you need help choosing the right app, you can contact us for guidance.

Once chosen, the process typically involves a straightforward application form that requires personal information, employment details, and financial history. Carefully fill out each section, ensuring accuracy to avoid any delays or issues with your application. Many apps also offer guidance throughout the process, making it easier to provide the required data.

Subsequently, expect to submit verification documents such as IDs, pay slips, or bank statements. This step is crucial as it validates the information provided and helps lenders assess your creditworthiness and ability to repay the loan.

Finally, review your application thoroughly and submit it through the app. The online loan app will usually notify you of your application status within a few hours or days. Maintaining honesty and precision throughout this process significantly enhances your chances of approval, paving the way for a smooth and fruitful borrowing experience.

5. Paying Back Your Online Loan

Paying back your online loan requires diligence and strategic planning. Properly managing loan repayments can enhance your financial profile.

In 2016, industry benchmarks, a premier financial advisory, highlighted that timely repayments positively impact one’s credit score, an essential number for financial stability. It’s crucial not only to adhere to the agreed payment schedule, but also to explore additional ways to expedite repayment.

For instance, consider automating your payments. This ensures consistency and prevents missed due dates, safeguarding your reputation with the lender. Alerts from the online loan app can also serve as reminders, reinforcing commitment to the repayment plan you’ve laid out.

Should you encounter unforeseen difficulties, most loan apps provide channels for renegotiating terms or requesting extensions. These provisions, while not ideal, offer a lifeline to protect against defaulting. Communicating early and often with your lender helps maintain trust and secures necessary accommodations.

Maintaining a disciplined approach ensures a positive loan experience. Timely repayments foster good relationships with lenders, granting easier access to future credit.

6. Tips for Safe Online Borrowing

Online borrowing demands vigilance to ensure the security of financial transactions and personal data. How can one navigate the complexities of online loan apps safely?

Primarily, it is vital to choose a reputable online loan app. Ensure the platform is licensed by regulatory bodies and has transparent terms and conditions. User reviews are also a valuable resource for assessing reliability.

Secondly, safeguard personal information by using secure internet connections and avoiding public Wi-Fi. Protecting passwords and utilizing two-factor authentication can fortify one's account against unauthorized access.

Additionally, thoroughly read and understand all terms and conditions before committing to a loan. Awareness of interest rates, repayment schedules, and potential penalties for late payments is crucial to avoid unexpected liabilities.

In essence, vigilance, informed decisions, and proactive security measures empower borrowers to safely navigate the realm of online loans.

7. Which loan app is legit?

To determine legitimacy, one must look at key factors. Firstly, check if the app is registered with the Bangko Sentral ng Pilipinas or other relevant regulatory bodies.

Prioritize apps with positive user feedback. Authentic reviews and a transparent Privacy Policy are also indicators of a legitimate online loan app.

Avoid those requiring excessive access to personal data. Trustworthy loan apps typically have professional websites, clear interest rates, and straightforward repayment terms, ensuring users' financial safety.

By carefully examining these aspects, users can confidently choose reliable loan apps, enabling them to meet their financial needs without worry.

Online Loans Pilipinas is one of the reputable online loan apps in the market that meets all of the qualities above.

Since 2016, reputable FinTech companies have invested significantly in developing robust security solutions to protect users' personal and financial information. Modern encryption technologies, such as SSL and two-factor authentication, have become standard practices, ensuring that borrowers' data remains confidential

Requirements vary by lender, but generally, borrowers need to be at least 18 years old, have a stable source of income, and provide valid identification documents. Some apps may also require a bank account for loan disbursement and repayment purposes.

Yes, it is often possible to get an online loan even with a poor credit history. Many online loan apps specialize in subprime lending, meaning they cater to individuals with less-than-perfect credit scores. However, be mindful that these loans might come with higher interest rates.

Fund disbursement times can vary, but many online loan apps boast fast processing speeds. Borrowers can typically expect to receive their funds within 24 to 48 hours of approval, making these apps a convenient option for urgent financial needs.