Online Loan Philippines: Best Tips & Tricks

Struggling to find reliable financial solutions online?

In an age dominated by technology, one might wonder where to turn for secure online loans in the Philippines.

Navigating this digital landscape can be overwhelming, yet hope and opportunity are just around the corner. Reputable online loan platforms offer transparent, efficient, and accessible solutions to those needing to borrow financial assistance.

1. Introduction to Online Loans in the Philippines

In recent years, the financial landscape of the Philippines has significantly evolved, with online loans becoming increasingly prominent and accessible to many seeking money.

With just a few clicks, borrowing has never been easier.

These advancements in digital finance have empowered Filipinos to explore various online loan options, each offering a unique blend of convenience, flexibility, and lower interest rates compared to traditional bank loans.

Furthermore, the rise of online lending platforms has democratized access to credit, enabling more individuals and businesses to achieve their goals. By leveraging technology, borrowers can now enjoy a seamless, secure, and transparent loan application process tailored to their specific needs.

2. Benefits of Online Loans

Online loans in the Philippines present numerous advantages, redefining how individuals and businesses access financial assistance.

One significant benefit is the unparalleled convenience they offer, along with transparent APR details. Users can apply for loans without needing to leave their homes, saving time and resources. This is particularly advantageous for those in remote areas, where traditional banking services may be limited or absent.

Additionally, online loans tend to have faster approval processes compared to conventional bank loans. Many platforms utilize automated systems, allowing for quick assessments and prompt disbursements, often within a few hours or days.

Moreover, these digital platforms usually provide a more transparent borrowing experience. Detailed loan terms, interest rates, and repayment schedules are clearly presented, allowing borrowers to make informed decisions. This accessibility ensures that users are well aware of their commitments and can plan their finances accordingly.

3. Top 5 Online Loan Providers in the Philippines

In the realm of online loans in the Philippines, several top-tier providers have garnered trust and recognition for their exceptional offerings. Among these are Online Loans Pilipinas, Tala, Cashalo, Digido, Atome, and JuanHand, each excelling in specific features tailored to diverse needs.

These providers ensure swift approval processes and transparent terms, setting them apart from traditional lending institutions. Their user-friendly platforms and strong customer support further enhance the borrowing experience.

3.1 Online Loans Pilipinas

Online Loans Pilipinas provides a comprehensive online loan solution specifically designed for the Filipino market.

Its innovative platform guarantees a quick and efficient approval process, reducing undue waiting. The system is developed to enhance user experience, ensuring a high level of security, transparency, and reliability.

This commitment to cutting-edge technology and customer-centric policies makes it a standout choice for those seeking online loans in the Philippines. Their dedication to ensuring user satisfaction through clear communication and a seamless digital interface is undeniable.

3.2 Tala Philippines

Tala Philippines stands as a trailblazer in the digital lending space, providing quick and accessible financial solutions. Their platform ensures users receive funds swiftly, often within minutes.

Tala's innovative app offers flexible loan amounts and repayment plans, tailored to meet individual needs. This adaptability makes it a favored choice among Filipino borrowers seeking convenience.

Tala's advanced analytics empower better financial decisions, enhancing user experience exponentially.

Furthermore, Tala prioritizes financial literacy, offering educational resources alongside its loan services. By empowering users with knowledge, Tala ensures that borrowers can manage their loans responsibly, fostering a cycle of financial well-being. Their transparency and dedication to customer satisfaction truly set them apart in the online loan Philippines landscape.

3.3 MoneyCat Philippines

MoneyCat Philippines offers a fast, simple, and reliable solution for Filipinos in need of quick financial assistance. Their straightforward application process ensures ease of access to funds.

- Competitive Interest Rates: Reasonable rates tailored to various financial situations.

- Flexible Repayment Terms: Options designed to accommodate the borrower’s payment capacity.

- Speedy Disbursement: Funds are typically released within 24 hours of approval.

- User-Friendly Platform: Intuitive interface for a seamless borrowing experience.

- Strong Customer Support: A dedicated team is available to address concerns and queries efficiently.

These features make MoneyCat a compelling option in the online loan Philippines sector. They are particularly suited for individuals seeking immediate financial relief.

Through its commitment to transparency and customer satisfaction, MoneyCat continues to gain the trust of Filipino borrowers.

3.4 Cashalo

Cashalo provides a convenient and secure platform for Filipinos looking for online loan solutions. Their innovative approach aims to enhance financial inclusion across the country.

- Instant Approval: Immediate loan approval decisions to address urgent financial needs.

- Transparent Terms: Clear and concise loan terms with no hidden fees.

- Multiple Loan Products: Diverse options tailored to different borrowing requirements.

- User-Centric App: Easy-to-navigate mobile application enhancing user experience.

- Reliable Customer Support: Professional support team available to assist with loan inquiries and issues.

These features position Cashalo as a leading choice in the online loan Philippines market. Their dedication to user-friendly, transparent, and quick solutions appeals to a wide range of borrowers.

Through its cutting-edge technology and commitment to financial empowerment, Cashalo stands out as a trusted financial partner for Filipinos.

3.5 Robocash Philippines

Robocash Philippines stands as an innovative player, offering efficient online loan solutions tailored to the needs of Filipino borrowers.

Launched with the vision of streamlining the lending process, Robocash delivers immediate loan approvals and disbursements, catering to urgent financial demands. Their fully automated system ensures a seamless experience, reducing the waiting time and paperwork typically associated with traditional loans.

Moreover, Robocash differentiates itself with a strong emphasis on security and transparency. Borrowers can access clear information on their loan terms, with no hidden charges or surprise fees, fostering trust and reliability.

Its user-focused design, paired with robust customer support, makes Robocash an appealing choice for those seeking swift and reliable online loans in the Philippines. This dedication to innovation and customer satisfaction positions Robocash as a significant contributor to the rapidly evolving financial landscape in the country.

4. Eligibility Criteria for Online Loans

Understanding the eligibility criteria is crucial when applying for an online loan in the Philippines.

Generally, an applicant must be a Filipino citizen between 21 and 60 years old, with a stable source of income. Verification of one's employment status, income, and identification documents is typically required by most lenders to ensure the applicant's capability to repay the loan.

Moreover, lenders often require a bank account under the applicant's name. This facilitates the smooth disbursement of the loan amount and simplifies the repayment process. Furthermore, having a good credit history, while not always mandatory, significantly increases the chances of loan approval.

Ultimately, comprehending and meeting these eligibility requirements enhances one’s chances of securing an online loan through financial services. It empowers borrowers to seek financial assistance confidently, knowing that their needs align with the lenders' criteria. This meticulous preparation can pave the way to a more seamless, efficient, and successful borrowing experience.

5. How to Apply for an Online Loan in the Philippines

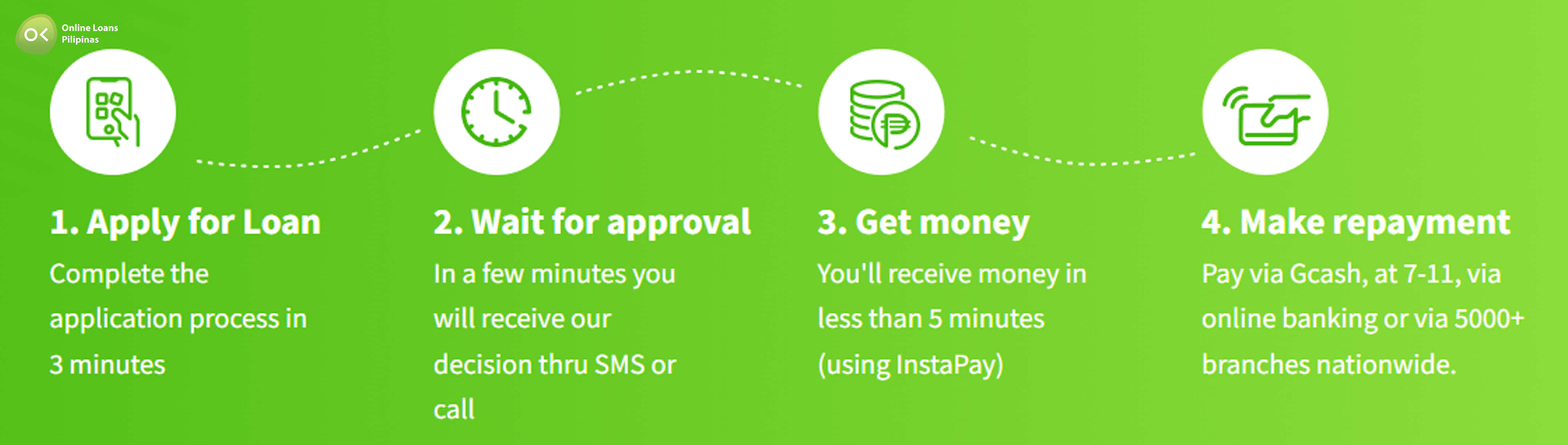

Applying for an online loan in the Philippines is a straightforward process designed for convenience. One must first research and identify reputable online lending platforms.

Next, they should gather essential documents typical for loan applications. These usually include proof of identity, income, and residence.

With documentation in place, the individual can proceed to fill out the lender’s online application form. It is crucial to ensure all information is accurate and complete to avoid processing delays and facilitate rapid approval.

Once the application is submitted, most lenders offer real-time application tracking. Applicants can expect swift communication via email or SMS regarding their loan status, heralding a new era of accessible financial solutions in the Philippines. By embracing technology, they unlock a gateway to financial empowerment and opportunity.

6. Tips for Choosing the Best Online Loan

When selecting the best online loan in the Philippines, one must consider several crucial factors for a seamless borrowing experience.

Firstly, understanding the terms and conditions is paramount, specifically interest rates and repayment schedules.

Furthermore, borrowers should investigate the lender's credibility, including customer reviews and any accreditations.

Evaluating the lender's customer service quality is also essential, ensuring they provide timely and helpful support.

Additionally, borrowers must assess the flexibility of the loan terms, checking for possibilities of early repayment or loan extension.

Lastly, keeping in mind one's financial capacity is key to ensure that the loan taken is manageable and aligns with their financial goals.